Damion Smy

Chevrolet Corvette Z06 Bathurst edition revealed for Australia

39 Minutes Ago

The market tumbles again, down 29 per cent to the worst August tally in 23 years. If the 'Toyota RAV4' was a standalone brand, it would've outsold Hyundai, Kia and Ford.

Senior Contributor

Senior Contributor

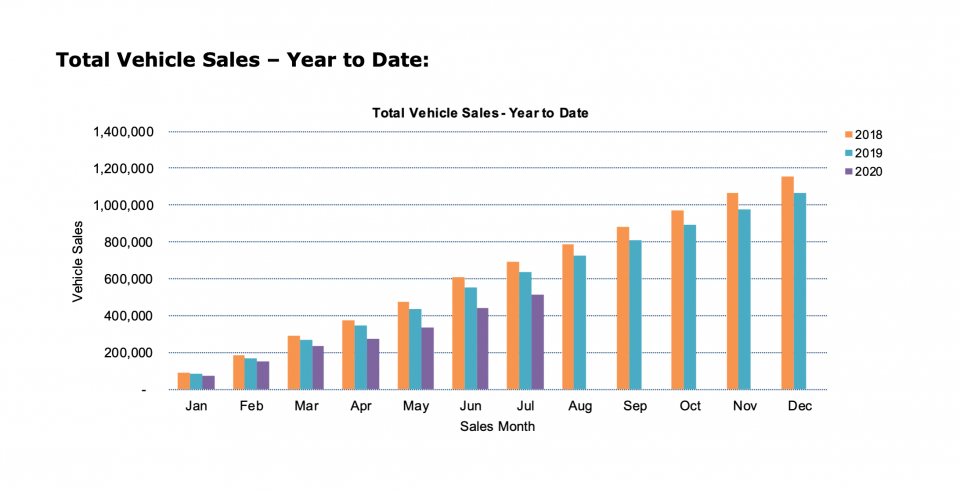

New car sales tumbled 28.8 per cent in Australia during a grim August, to 60,986. Year-to-date (YTD) sales are now down 20.4 per cent on 2019’s underwhelming tally.

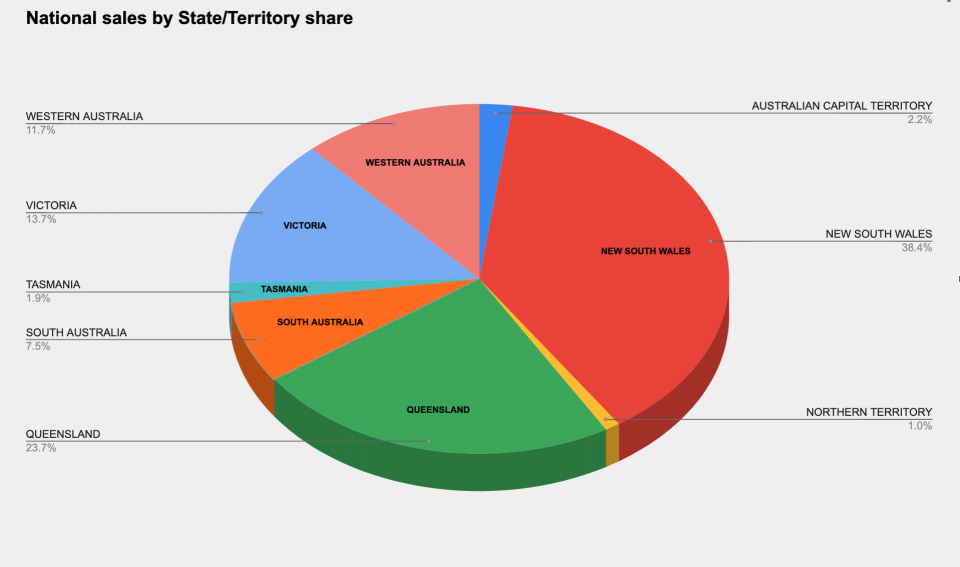

The precipitous sales decline was driven by Victoria, which is no surprise given the Melbourne population hub spent the month in Stage 4 COVID-19 restrictions, meaning the closure of metro showrooms.

Victorian sales fell 66 per cent to 8347, which in numerical terms meant a decline of 16,129 units over August 2019. New South Wales declined by 16 per cent (equal to 4568 units) while Queensland’s tally fell 14 per cent (2386 sales).

On a year to date basis, VFACTS data cited here reported 575,906 sales for the eight months ending August 31, 2020, down 20.4 per cent on the same period in 2019 when 723,283 sales were reported.

The automotive industry figures were released one day after the Australian Bureau of Statistics announced a 7 per cent drop in Gross Domestic Product for the June quarter – the largest drop ever recorded in a single three-month block.

Speaking in response to today’s “alarming” Victorian figures, the head of the AADA peak body for new-car dealers, James Voortman, said businesses were “under severe stress and people are losing their jobs”.

“Dealerships are well placed to observe COVID-safe plans and already have measures in place, in preparation for when restrictions are eased.

“We will be asking the Victorian Government to allow us to reopen responsibly so we can start servicing our customers,” he said.

Market leader Toyota declined 25.5 per cent to 12,449 sales, but its market share stayed north of 20 per cent.

Behind sat Mazda (6921, down just 5.1 per cent thanks to strong months from the CX-30, CX-5, and CX-8 SUVs), Hyundai (4525, down 38.2 per cent), and fellow Korean contender Kia (4521, down just 3.0 per cent on the back of a great month from the new Seltos SUV).

Mitsubishi held onto fifth despite dipping 31 per cent to 4308, edging Ford (down 20.7 per cent to 3898). Rounding out the top 10 were Volkswagen (2788, down 32.1 per cent), Mercedes-Benz (2539, down 12.9 per cent), Nissan (2380, down 47.6 per cent), and Subaru (2052, down 42.2 per cent).

Next came Honda (1471, down 52 per cent), BMW (1414, down 24 per cent), and a rampaging MG (up 69 per cent to 1217, making it to a record-high ladder position of 13th. The Chinese brand even outsold Suzuki (1148, down 12.3 per cent) and Audi (1008, down 26.2 per cent).

If we want to find other brands that recorded positive sales months, that list is limited to MG’s fellow SAIC subsidiary LDV (654, up 16 per cent), a recovering Jeep (476, up 1.5 per cent), another Chinese marque in the form of Haval (246, up 46.4 per cent), and niche players McLaren and Lamborghini, that each sold 7 cars.

| Brand | August 2020 | Change % |

|---|---|---|

| Toyota | 12,446 | -25.5 |

| Mazda | 6921 | -5.1 |

| Hyundai | 4525 | -38.2 |

| Kia | 4521 | -3.0 |

| Mitsubishi | 4308 | -31.0 |

| Ford | 3898 | -20.7 |

| Volkswagen | 2785 | -32.1 |

| Mercedes-Benz | 2539 | -12.9 |

| Nissan | 2380 | -47.6 |

| Subaru | 2052 | -42.2 |

| Honda | 1471 | -52.0 |

| BMW | 1414 | -24.0 |

| MG | 1217 | +69.0 |

| Suzuki | 1148 | -12.3 |

| Audi | 1008 | -26.2 |

| Isuzu Ute | 794 | -58.5 |

| LDV | 654 | +16.0 |

| Volvo Car | 568 | -17.9 |

| Holden | 555 | -84.4 |

| Renault | 504 | -31.9 |

| Skoda | 504 | -17.5 |

| Jeep | 476 | +1.5 |

| Lexus | 358 | -56.2 |

| Land Rover | 248 | -62.3 |

| Haval | 246 | +46.4 |

| RAM | 245 | -19.1 |

| Mini | 175 | -36.1 |

| Porsche | 174 | -55.2 |

| Peugeot | 147 | -56.1 |

| SsangYong | 124 | -47.2 |

| Fiat | 116 | 41.4 |

| Great Wall | 115 | -2.5 |

| Alfa Romeo | 76 | -11.6 |

| Jaguar | 60 | -69.7 |

| Maserati | 30 | -16.7 |

| Chrysler | 20 | -23.1 |

| Genesis | 14 | -26.3 |

| Ferrari | 11 | -68.6 |

| Aston Martin | 10 | 0 |

| Bentley | 8 | -50.0 |

| Lamborghini | 7 | +16.7 |

| McLaren | 7 | +75.0 |

| Citroen | 6 | -83.3 |

| Rolls–Royce | 3 | -50.0 |

| Lotus | 2 | -33.3 |

| Morgan | 2 | +100.0 |

For the second month in succession, the Toyota RAV4 was the top-selling vehicle, thanks to Toyota’s coup to secure greater supply of the hybrid models announced earlier this year.

With 4825 sales, it owned a remarkable 38 per cent share of its segment. If ‘Toyota RAV4’ was a standalone brand, it would have finished third in August behind only Toyota and Mazda.

Second place on the brand charts belonged to Ford’s Ranger with 2935 sales, which had very little competition given two of its biggest competitors (Toyota HiLux and Isuzu D-Max) had nowhere months on account of limited dealer stock. The HiLux got a major upgrade while the D-Max entered a whole new generation.

Third spot on the podium was occupied by the RAV4’s main rival, the Mazda CX-5, with 1884 units sold. Because of this rivalry, the Medium SUV segment cornered a massive 23.3 per cent share of the entire new vehicle market.

Rivals the Toyota Corolla (1464) and Hyundai i30 (1429) sat fourth and fifth respectively and were the top two passenger cars. You can read our recent comparison test on this pair if you like.

Rounding out the top 10 were the Mitsubishi Triton (1406), Kia Cerato (1264), Toyota HiLux (1217, in what is surely a brief lull from the top), Mazda CX-3 (1136), and the Kia Seltos (1046).

| Model | Sales |

|---|---|

| Toyota RAV4 | 4825 |

| Ford Ranger | 2935 |

| Mazda CX-5 | 1884 |

| Toyota Corolla | 1464 |

| Hyundai i30 | 1429 |

| Mitsubishi Triton | 1406 |

| Kia Cerato | 1264 |

| Toyota HiLux | 1217 |

| Mazda CX-3 | 1136 |

| Kia Seltos | 1046 |

| Mazda 3 | 984 |

| Mitsubishi ASX | 929 |

| Nissan X-Trail | 924 |

| Toyota Camry | 910 |

| Hyundai Tucson | 903 |

| Toyota LandCruiser wagon | 893 |

| Mitsubishi Outlander | 885 |

| Nissan Navara | 868 |

| Hyundai Kona | 846 |

| Mazda CX-30 | 753 |

Of course, the top 20 models list only tells us so much. It’s equally important to see which cars and brands performed well in each vehicle segment.

Top 3 passenger vehicles by segment table:

Top 3 SUVs and commercial vehicles by segment table:

Tony Weber, chief executive of the FCAI, said that while the overall industry was “showing some response” to stimulus packages, the story for Victoria was less than promising.

“The industry has moved swiftly to implement robust COVIDSafe protocols to ensure the health and wellbeing of employees and customers is preserved,” he contended.

“However, it is particularly difficult for our members and their Victorian dealer networks under the current Stage 4 Restrictions, and this is reflected in the reduced sales figures.

“While we have the utmost respect for essential health priorities, the automotive industry supports the re-opening of our economy under appropriate COVIDSafe protocols.

“We’ve seen 29 consecutive months of diminishing sales in this industry, and there’s no doubt our members are feeling the pinch. The move to commence the reopening of industry and markets, especially in Victoria, needs to start as soon as possible.”

AADA CEO James Voortman added that: “Yesterday Australia entered its first recession in nearly 30 years, but the new car industry has been in recession for nearly 30 months”.

“The AADA is urging the Federal Government to provide assistance through measures such as adjusting responsible lending laws to free up much needed finance, extending the instant asset write-off scheme and totally reviewing the automotive taxation scheme which is a legacy of a bygone era designed to protect a local manufacturing industry that no longer exists.”

If you have any questions – perhaps you want to know how your car did – ask in the comments and a member of the CarExpert team will respond.

MORE: July sales MORE: Jan-Jun sales MORE: June sales MORE: May sales MORE: April sales

Damion Smy

39 Minutes Ago

William Stopford

47 Minutes Ago

CarExpert

2 Hours Ago

Damion Smy

2 Hours Ago

William Stopford

3 Hours Ago

Derek Fung

7 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.