Damion Smy

ANCAP calls for Australian ban on door handles used by Tesla, BYD and others

2 Hours Ago

Business purchases of light commercial vehicles were key, as the new car market recorded a notable uptick. Sales totalled 110,234 cars, down a comparatively modest 6.4 per cent after COVID-wracked May.

Senior Contributor

Senior Contributor

Australia’s new car market recorded a significant uptick in sales during June – historically the year’s biggest-volume month – due to end-of-financial-year incentives and clear signs of business recovery.

VFACTS data compiled by the Federal Chamber of Automotive Industries, submitted by the car brands and cross-checked, recorded 110,234 sales across the nation.

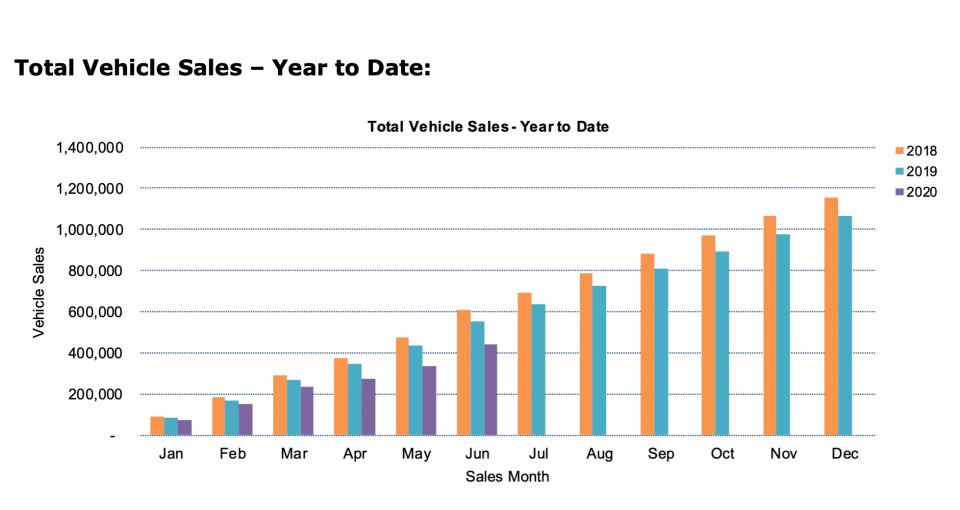

That’s 6.4 per cent down on June 2019, but it is the easily strongest result since the beginning of the COVID-19 crisis which saw March sales slide 17.9 per cent, April sales tumble 48.5 per cent, and May sales down 35.3 per cent.

Year-to-date, sales are down 20.2 per cent at 442,415 sales. Given it’s the half-way mark, we can assume that 2020 won’t pass a million units.

“Some states have seen the easing of COVID-19 restrictions, and this has increased floor traffic through dealerships,” said FCAI chief executive Tony Weber.

Sales in fact grew in the ACT (up 13.6 per cent), South Australia (up 3.6 per cent) and Western Australia (up 3.2 per cent) relative to June 2019. Unsurprisingly perhaps, Victoria was down 13.6 per cent (equal to 4622 units).

Weber noted that business fleet sales actually increased by 6.3 per cent over June 2019, reflecting pent-up demand, citing the government’s instant asset tax write-off scheme as a key factor.

“We [also] have seen a strong surge in marketing activity from both brands and dealerships, who are offering an array of attractive retail packages in a bid to recover from the impacts of the COVID-19 pandemic,” he added.

Toyota grew its sales by 7.9 per cent, and its market share from 18 per cent in June last year to 20.7 per cent this year.

Other notable brands that grew sales over June 2019 included Ford (by 6.6 per cent), MG (up 32.9 per cent), LDV (up 31 per cent), and Haval (up 99.5 per cent), Volvo Car (up 40 per cent), Jeep (up 7.2 per cent as it seeks a turnaround based on better customer care), Ram Trucks (up a huge 130.5 per cent), and Mini (up 49.5 per cent).

Luxury brands also did well. Mercedes-Benz Cars and Vans was up 25.5 per cent, and in fact posted an all-time record.

Fellow German luxury marques BMW (up 32 per cent) and Audi (up a whopping 84.6 per cent after a shocking supply-restricted June 2019) continued the trend.

Also up were Lexus (by 60.8 per cent) and Porsche (by 13.8 per cent).

| Brand | June 2020 sales | Change +/- % |

|---|---|---|

| Toyota | 22,867 | +7.9 |

| Mazda | 9420 | -12.8 |

| Hyundai | 7737 | -22.6 |

| Ford | 7624 | +6.6 |

| Mitsubishi | 7419 | -16.6 |

| Volkswagen | 5737 | -1.0 |

| Kia | 5727 | -20.5 |

| Mercedes-Benz | 5433 | +25.5 |

| Nissan | 4260 | -22.7 |

| Subaru | 3775 | -18.2 |

| Honda | 3423 | -45.1 |

| BMW | 3307 | +32.0 |

| Isuzu Ute | 3656 | -11.4 |

| Audi | 2027 | +84.6 |

| Holden | 1912 | -60.3 |

| Suzuki | 1588 | -17.0 |

| Lexus | 1560 | +60.8 |

| MG | 1348 | +32.9 |

| Land Rover | 1127 | -7.5 |

| Volvo Car | 1113 | +40.0 |

| LDV | 1052 | +31.0 |

| Renault | 794 | -9.8 |

| Skoda | 697 | -19.4 |

| Jeep | 694 | +7.1 |

| RAM | 604 | +130.5 |

| Porsche | 519 | +13.8 |

| Mini | 450 | +49.5 |

| Haval | 371 | +99.5 |

| Peugeot | 285 | -25.6 |

| Jaguar | 256 | -6.2 |

Smaller-scale brands not listed above included Great Wall (243, up 33.5 per cent), SsangYong (213, no comparison to June 2019 as it’s a newly-returned brand), Fiat (166, down 8.4 per cent), Maserati (61, down 10.3 per cent), Alfa Romeo (58, down 22.7 per cent), Chrysler (34, down 30.6 per cent), Bentley (25, up by 2 units), Citroen (22, down 56.9 per cent), and Genesis (21).

The Toyota HiLux and Ford Ranger utes had monster months, topping the charts with 6537 sales (up 21.1 per cent) and 5329 sales (up 9.9 per cent) respectively.

The Toyota Corolla was the number-one passenger car with 3008 sales (down 4.1 per cent), ahead of the Mitsubishi Triton ute (2721, up 1.0 per cent). The top SUV was the Toyota RAV4 (2632, up 7.5 per cent), edging out the Mazda CX-5 (2530, down 13.1 per cent).

Next were the Toyota Prado (2374, up 16.1 per cent as ‘grey nomads’ gear up to travel again), Hyundai i30 (2368, down 29.2 per cent), Hyundai Tucson (2206, down 5.9 per cent), and Kia Cerato (2016).

| Model | June 2020 sales |

|---|---|

| Toyota HiLux | 6537 |

| Ford Ranger | 5329 |

| Toyota Corolla | 3008 |

| Mitsubishi Triton | 2721 |

| Toyota RAV4 | 2632 |

| Mazda CX-5 | 2530 |

| Toyota Prado | 2374 |

| Hyundai i30 | 2368 |

| Hyundai Tucson | 2206 |

| Kia Cerato | 2016 |

| Mazda BT-50 | 1768 |

| Mazda 3 | 1722 |

| Isuzu D-Max | 1642 |

| Toyota LandCruiser Wagon | 1521 |

| Mitsubishi ASX | 1475 |

| Nissan Navara | 1465 |

| Subaru Forester | 1464 |

| Volkswagen Golf /Golf Alltrack | 1458 |

| Toyota LandCruiser PU/CC | 1388 |

| Nissan X-Trail | 1387 |

| Hyundai Kona | 1385 |

| Honda CR-V | 1381 |

| Mitsubishi Outlander | 1306 |

| Toyota Kluger | 1243 |

| Volkswagen Amarok | 1229 |

| Toyota HiAce Van/Bus | 1228 |

| Kia Sportage | 1213 |

| Toyota C-HR | 1199 |

| Mazda CX-3 | 1157 |

| Subaru XV | 1124 |

As you can see from the top 30 list above, the breakdown included five passenger vehicles, 16 SUVs or 4×4 wagon, and nine commercial vehicles.

In terms of segment breakdowns, the most popular type of vehicles were 4×4 Utes (19.2 per cent market share), ahead of Medium SUVs (18.8), Small Cars (13.2), Large SUVs (12.5), and Small SUVs (17.6).

| Segment | 1 | 2 | 3 |

|---|---|---|---|

| Micro | Kia Picanto – 346 | Mitsubishi Mirage – 102 | Fiat 500 – 65 |

| Light | MG 3 – 643 | Suzuki Swift – 537 | Kia Rio – 491 |

| Light Lux | Mini – 215 | Audi A1 – 65 | Citroen C3 – 6 |

| Small | Toyota Corolla – 3008 | Hyundai i30 – 2368 | Kia Cerato – 2016 |

| Small Lux | Mercedes A-Class – 901 | BMW 1 Series – 397 | Audi A3 – 358 |

| Medium | Toyota Camry – 1123 | Mazda 6 – 177 | Skoda Octavia – 152 |

| Medium Lux | BMW 3 Series – 561 | Mercedes C-Class – 492 | Mercedes CLA – 315 |

| Large | Kia Stinger – 247 | Holden Commodore – 43 | Skoda Superb – 25 |

| Large Lux | BMW 5 Series – 130 | Mercedes E-Class- 127 | Audi A6 – 27 |

| Upper | Chrysler 300 – 34 | BMW 7 Series – 22 | Mercedes S-Class – 17 |

| MPVs | Kia Carnival – 465 | Honda Odyssey – 125 | LDV G10 – 74 |

| Sports | Ford Mustang – 419 | Mercedes C-Class 2-dr – 196 | BMW 4 Series – 74 |

| Segment | 1 | 2 | 3 |

|---|---|---|---|

| Light | Mazda CX-3 – 1157 | Hyundai Venue – 344 | Volkswagen T-Cross – 449 |

| Small | Mitsubishi ASX – 1475 | Hyundai Kona – 1385 | Toyota C-HR – 1199 |

| Small Lux | Volvo XC40 – 490 | Audi Q3 – 479 | BMW X1 – 392 |

| Medium | Toyota RAV4 – 2632 | Mazda CX-5 – 2530 | Hyundai Tucson – 2206 |

| Medium Lux | Mercedes GLC/Coupe – 1029 | Lexus NX – 698 | BMW X3/X4 – 604 |

| Large | Toyota Prado – 2374 | Toyota Kluger – 1243 | Isuzu MU-X – 1014 |

| Large Lux | Mercedes GLE/Coupe 453 | BMW X5/X6 – 435 | Lexus RX – 337 |

| Upper | Toyota LandCruiser – 1521 | Nissan Patrol – 211 | |

| Upper Lux | Land Rover Discovery – 164 | Mercedes GLS – 153 | BMW X7 – 143 |

| Segment | 1 | 2 | 3 |

|---|---|---|---|

| Small Vans | Volkswagen Caddy – 265 | Renault Kangoo – 83 | Peugeot Partner – 26 |

| Mid Vans | Toyota HiAce – 1014 | Hyundai iLoad – 542 | Ford Transit Custom – 403 |

| Large Vans | Mercedes Sprinter – 354 | Volkswagen Crafter – 238 | Ford Transit Heavy – 210 |

| 4×2 Utes | Toyota HiLux – 1726 | Isuzu D-Max – 505 | Mazda BT-50 – 453 |

| 4×4 Utes | Ford Ranger – 5092 | Toyota HiLux – 4811 | Mitsubishi Triton – 2292 |

Sales of utes and vans grew 8.6 per cent, and their volume of 28,645 units meant 26 per cent overall market share. SUVs had 47.1 per cent share and passenger vehicles a paltry 22.7 per cent.

Business sales climbed 6.3 per cent over June 2019 to 48,517, private sales fell 7.9 per cent to 52,641, rentals plummeted 75.7 per cent to 1918, and government department sales dipped 16 per cent to 2536.

Mild-hybrid sales totalled 4243 units, almost double June 2019’s tally. Electric and plug-in hybrid sales excluding market-leader Tesla (which refuses to disclose data) totalled 384 units, up 47.1 per cent.

The top sources of imports included Japan (32,469), Thailand (28,070), Korea (13,657), Germany (8680), the USA (4824), and China (3029).

Damion Smy

2 Hours Ago

Ben Zachariah

2 Hours Ago

Damion Smy

3 Hours Ago

William Stopford

3 Hours Ago

William Stopford

4 Hours Ago

William Stopford

6 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.