Damion Smy

Australia's new vehicle emissions regulations delivering results, says Bowen

57 Minutes Ago

Chevy, GWM, MG, Genesis, LDV, Skoda, Jeep, Isuzu, and Volvo all among the fastest-growing brands by percentage.

Senior Contributor

Senior Contributor

Sales of new cars are flying over the first four months of 2021 as the market rebounds from last year’s COVID-driven downturn.

Industry data shows car sales are up 30.9 per cent for the January 1 to April 30 period, relative to the same period in 2020.

That’s despite stock shortages costing sales and forcing many customers to wait months for their cars to be delivered.

Here’s a breakdown of which brands are showing the strongest growth so far this year, based on percentage gains.

The fastest-growing brand in the VFACTS data is Chevrolet, with 412 locally re-engineered (for right-hand drive) Silverado 1500 pickups finding buyers through the GMSV dealership network.

Soon, the Silverado will be joined by the Corvette sports car.

The lack of a growth percentage figure comes from the fact that zero Chevrolets were counted as sold in the data over this period last year, even though they were available.

That’s because they were sold at HSV sites which didn’t report sales.

GWM (formerly Great Wall) and its Haval SUV brand are counted together now, and their combined sales with this taken into account are up a massive 247 per cent to 3995 units.

The GWM Ute dual-cab four-wheel drive is its hero with 1639 sales, ahead of the Haval H2 small SUV with 1413.

Next are the outdated and soon-to-be-axed GWM Steed (369), Haval H6 (320, mostly the old model with a few of the just-launched new model), Haval H9 (320), and new H2-supplanting Haval Jolion (73 in its first month on sale).

Genesis sales were up 246 per cent, albeit to a lowly 128 units, including 85 GV80 large SUVs, 28 G70 medium sedans, and 14 G80 large sedans.

With more studios and test-drive centres being built, the new GV70 medium SUV around the corner, and the ‘JV’ and G80 electric cars due inside 12 months, we’d imagine this Lexus rival’s growth trajectory is just beginning.

Another Chinese brand (like GWM) sits next in the list, in the form of MG.

This brand has stormed up the charts and now sits inside the top 10 overall brands by sales ahead of Honda, with 11,735 YTD sales and growth of 215 per cent.

The MG ZS is the nation’s second top-selling Small SUV this year (5415 sales), while the MG 3 has gone one better and tops the Light Car market overall with 4560 sales YTD and almost 30 per cent market share.

MG’s HS mid-sized SUV including the new PHEV option has found 1760 homes this year.

Next is LDV, which has the same parent company as MG (SAIC Motor from Shanghai) but which has a different, independent importer and distributor in Australia and is therefore counted separately.

It’s found 4236 customers, up 156 per cent.

Leading the charge is the LDV T60 four-wheel drive ute with 2186 sales, ahead of the G10 van and people-mover range with 1086 combined sales. The Deliver 9 large van did 388 units and the D90 SUV a further 386. The aged V80 workhorse van found 190 customers.

If MG Australia’s factory backed distributor had the LDV brand here, as a pure hypothetical, SAIC Motor would have managed 15,998 sales for the year that would have placed it in seventh spot, ahead of Nissan, Subaru, and Volkswagen.

Korea’s third-string brand has found 881 sales this year, up 140 per cent.

The soon-to-be-facelifted Musso ute accounts for 600 of these, ahead of the recently-upgraded Rexton large SUV (158), and Korando small SUV (123). The Tivoli remains off sale for now.

At the time of writing, SsangYong was seeking funding after majority stakeholder Mahindra signalled its plan to pull away. Therefore its future remains up in the air, though its Australian operation says things are “business as usual”.

Czech Volkswagen subsidiary Skoda is ensconced in the market’s top 20 now, and with every passing month become less of a niche player. Its sales of 3704 units YTD are up 124 per cent.

Its top-seller YTD is the new Kamiq light SUV with 824 sales, ahead of the larger Kodiaq seven-seater (775) and Karoq five-seater (590), while the Octavia is next with 530. The just-launched all-new model should bolster these numbers.

Next comes to also recently launched Scala small hatch on 480, ahead of the near-runout Fabia entry car (257) and Superb flagship hatch and wagon on 248.

Jeep Australia appears to be turning a corner after successive years of decline, with sales up a strong 90 per cent this year to 2452 units – its best result since the 2018 sales year.

The ageing Grand Cherokee will be replaced by an Australian-tested new model by the end of 2021, but the outgoing model is still its sales leader with 958 units finding homes over the January to April period.

Next is the supply-restricted Wrangler (579), then its Gladiator ute spinoff (399). The soon-to-be-updated Compass yielded 382 sales, while the Cherokee did 134 units.

Isuzu Ute managed 85 per cent sales growth over the period in large part because of the highly regarded new D-Max 4×4 (5610 sales, despite six-month wait lists for the luxury variant). The D-Max 4×2 found a further 1970 buyers.

The D-Max range sits fourth in overall light commercial sales behind the Toyota HiLux, Ford Ranger, and Mitsubishi Triton.

The MU-X SUV is also riding a wave of buyers seeking adventure machines in lieu of international travel, with 3315 sales, up 72 per cent. We’re still expecting to see the brand new MU-X arrive by the end of 2021.

The Swede’s sales are up 84 per cent to 3411 units this year, putting it ahead of Lexus. Driving this are the XC40 (1424), XC60 (1374), and XC90 (569) SUVs, while the S60 and V60 passenger cars (30 and 14 sales respectively) are niche at best.

There are some good things coming for Volvo, including the new V60 Cross Country crossover wagon (quarter three of this year), XC40 Recharge EV by year’s end, and the C40 Recharge EV in 2022.

The Polestar electric sub-brand also launches this year.

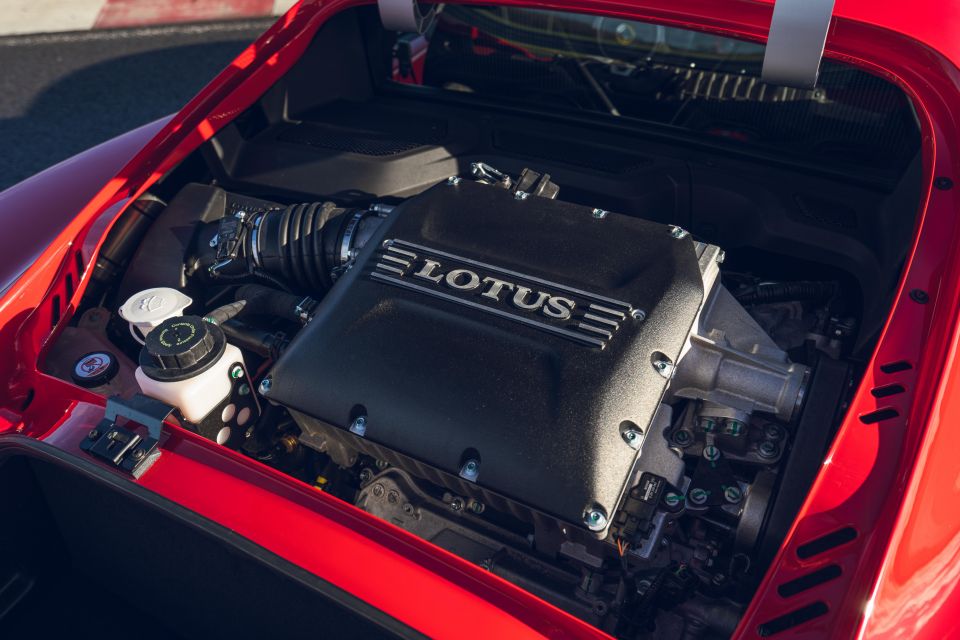

Aston (up 86 per cent to 52 units) and Lotus (up 91 per cent to 21 units) were both rapid growers, but they’re also so niche that I listed them separately.

| Brand | Jan-April sales | Growth % |

|---|---|---|

| Chevrolet | 412 | – |

| GWM/Haval | 3995 | 246.5% |

| Genesis | 128 | 245.9% |

| MG | 11,735 | 214.6% |

| LDV | 4236 | 155.6% |

| SsangYong | 881 | 140.1% |

| Skoda | 3704 | 124.1% |

| Jeep | 2452 | 90.1% |

| Isuzu Ute | 10,895 | 85.2% |

| Volvo Car | 3411 | 83.7% |

Got any questions about car sales? Ask away in the comments and I’ll jump in!

Damion Smy

57 Minutes Ago

William Stopford

1 Hour Ago

Damion Smy

2 Hours Ago

Ben Zachariah

3 Hours Ago

Derek Fung

6 Hours Ago

William Stopford

12 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.