Damion Smy

Ford posts its biggest loss since the Global Financial Crisis

3 Hours Ago

New car sales were down 22 per cent in September, with Victoria the site of predominant reductions. Ranger and HiLux topped the charts again, but annual overall sales are at their lowest point since 2002.

Senior Contributor

Senior Contributor

Sales of new cars in Australia fell by 21.8 per cent in September this year, compared to the same month in 2019.

VFACTS data supplied by car brands and cross-checked by the Federal Chamber of Automotive Industries claims that 68,985 new cars, SUVs and commercials found homes last month.

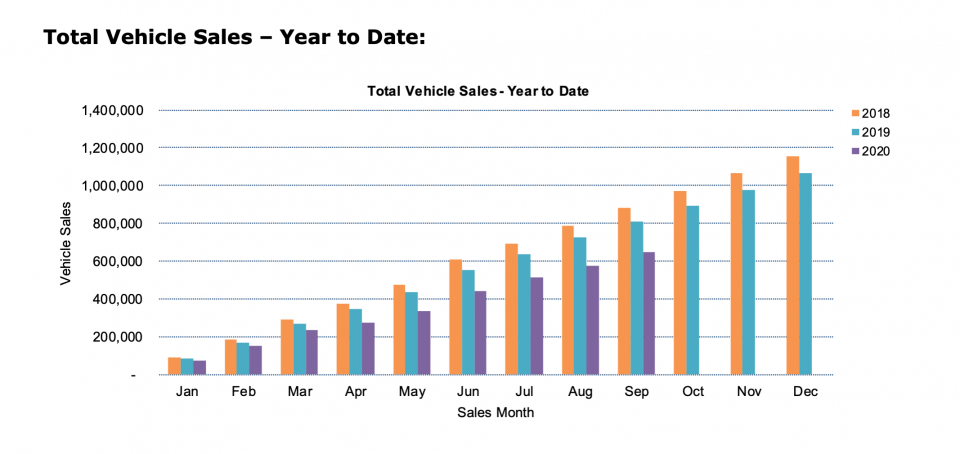

This brings the year-to-date (YTD) tally for 2020 to 644,891 sales, down 20.5 per cent on last year. The last time cumulative YTD sales were this low at the end of September was way back in 2002.

We have also seen 30 consecutive months of decreasing sales.

It was business as usual on the top-selling brand front, with Toyota, Mazda and Hyundai occupying the podium – though Kia was not far off.

Normality also resumed in terms of models, with the Ford Ranger and Toyota HiLux ute returning to the top of the table after some upgrades.

Victoria accounted for the majority of the sales drop, on account of COVID-19 restrictions across the metro area that saw dealerships shuttered. Sales in the second-most populous state totalled 10,447 units, down 57.7 per cent (equivalent to 14,239 cars).

Sales also declined in New South Wales (down 6.0 per cent, equivalent to 1668 cars), South Australia (down 22.1 per cent or 1468 cars), Queensland (down 7.9 per cent or 1386 cars), and Tasmania (down 34.2 per cent or 659 cars).

On a more positive note, sales grew in September 2020 over the same month last year in Western Australia (up 1.5 per cent, equivalent to 115 cars), Northern Territory (up 10.6 per cent or 64 cars), and the ACT (up 3.4 per cent or 45 cars).

Toyota topped the charts, and grew its market share to 18.8 per cent, because the percentage by which its September sales declined was lower than the market’s average. It also sold four of the top 10 models.

Mazda finished a clear second, ahead of Hyundai which held onto third despite sales falling by 27.2 per cent. Sister brand Kia nipped at its heels, losing just 0.7 per cent in volume and thereby taking its market share from 5.8 per cent in September 2019 to 7.4 per cent in September 2020.

Ford finished fifth and actually increased its sales by 0.7 per cent, Mitsubishi finished sixth despite sales falling 53.5 per cent (we suspect cuts in fleet sales across the board, particularly in rental cars, played a big role here), and Volkswagen managed seventh.

Mercedes-Benz, Nissan and Subaru rounded out the top 10, edging out BMW, Honda, and China’s MG, up a remarkable 86 per cent to finish 13th.

There were other brands that defied the odds and grew sales in September, principally: LDV (up 36 per cent), Skoda (up 29.3 per cent), Porsche (up 32.9 per cent), Haval (up 70.5 per cent), Mini (up 13.5 per cent), Great Wall (up 74.1 per cent), and Alfa Romeo (up 61 per cent).

| Brand | Sales | % Change +/- |

|---|---|---|

| Toyota | 12,936 | -14.7 |

| Mazda | 7000 | -14.3 |

| Hyundai | 5273 | -27.2 |

| Kia | 5092 | -0.7 |

| Ford | 4816 | +0.7 |

| Mitsubishi | 4179 | -53.5 |

| Volkswagen | 3493 | -8.5 |

| Mercedes-Benz | 2966 | -8.5 |

| Nissan | 2588 | -44.4 |

| Subaru | 2121 | -39.4 |

| BMW | 2007 | -9.6 |

| Honda | 1678 | -50.7 |

| MG | 1554 | +86.1 |

| Isuzu Ute | 1546 | -24.5 |

| Audi | 1280 | -14.7 |

| Suzuki | 1269 | -12.2 |

| LDV | 910 | +36.0 |

| Volvo Car | 661 | -6.5 |

| Renault | 638 | -7.7 |

| Skoda | 627 | +29.3 |

| Holden | 522 | -81.8 |

| Jeep | 481 | -9.2 |

| Porsche | 456 | +32.9 |

| Lexus | 362 | -50.7 |

| Haval | 358 | +70.5 |

| Land Rover | 339 | -50.4 |

| Mini | 295 | +13.5 |

| Ram | 286 | +2.5 |

| Great Wall | 249 | +74.1 |

| Peugeot | 163 | -6.9 |

| Fiat | 126 | -31.1 |

| SsangYong | 98 | -35.9 |

| Alfa Romeo | 95 | +61.0 |

| Jaguar | 61 | -66.7 |

| Maserati | 53 | +103.8 |

| Genesis | 28 | +833.3 |

| Citroen | 25 | -19.4 |

| Ferrari | 25 | +8.7 |

| Bentley | 15 | +34.8 |

| Chrysler | 14 | No change |

| Aston Martin | 9 | -25.0 |

| Lamborghini | 6 | -25.0 |

| Lotus | 6 | +200.0 |

| McLaren | 3 | -66.7 |

| Alpine | 1 | – |

The Ford Ranger topped the charts, ahead of the HiLux. As stocks of the updated models build up, we’d expect this to become an entrenched reality once again.

The Toyota RAV4 was again the nation’s favourite SUV, while the Hyundai i30 was the number one passenger car as the current model gears up for runout ahead of the arrival of an update in a few months time.

The leading model segments by market share were Medium SUV (17.8 per cent), 4×4 Utes (17.6), Small Cars (13.8), Small SUV (12.7), Large SUV (11.1).

| Model | Sales | % Change +/- |

|---|---|---|

| Ford Ranger | 3726 | +19.6 |

| Toyota HiLux | 3610 | +7.3 |

| Toyota RAV4 | 2433 | +41.8 |

| Hyundai i30 | 1786 | -27.0 |

| Mazda CX-5 | 1765 | -25.1 |

| Kia Cerato | 1599 | -20.9 |

| Toyota Corolla | 1462 | -34.1 |

| Mitsubishi Triton | 1446 | -51.8 |

| Hyundai Tucson | 1199 | -19.4 |

| Toyota Camry | 1192 | +0.5 |

| Mazda CX-3 | 1188 | -9.8 |

| Mazda 3 | 1134 | -33.1 |

| Isuzu D-Max | 1118 | -16.9 |

| Kia Seltos | 1089 | New model |

| Nissan Navara | 1072 | -3.8 |

| Hyundai Kona | 1036 | -17.4 |

| Toyota LandCruiser Wagons | 990 | +3.1 |

| Mitsubishi ASX | 940 | -61.1 |

| Volkswagen Golf | 924 | -17.4 |

| Nissan X-Trail | 888 | -49.8 |

If we look at the main vehicle segments, we find the top three models in each looks like this:

Passenger segments

| Vehicle type | First | Second | Third |

|---|---|---|---|

| Micro | Kia Picanto – 357 | Fiat 500 – 34 | Mitsubishi Mirage – 34 |

| Light < $25k | MG 3 – 809 | Mazda 2 – 471 | Kia Rio – 388 |

| Light > $25k | Mini – 146 | Audi A1 – 30 | Renault Zoe – 9 |

| Small < $40k | Hyundai i30 – 1786 | Kia Cerato – 1599 | Toyota Corolla – 1462 |

| Small > $40k | MB A-Class – 460 | Audi A3 – 262 | BMW 1 Series – 235 |

| Medium < $60k | Toyota Camry – 1192 | Skoda Octavia – 227 | Mazda 6 – 152 |

| Medium > $60k | MB C-Class – 283 | BMW 3 Series – 241 | MB CLA – 213 |

| Large < $70k | Kia Stinger – 179 | Skoda Superb – 28 | Chrysler 300 – 14 |

| Large > $70k | MB E-Class – 93 | BMW 5 Series – 51 | Audi A6 – 23 |

| Upper Large | BMW 7 Series – 11 | MB S-Class – 9 | BMW 8 Series GC – 8 |

| People Movers | Kia Carnival – 237 | Honda Odyssey – 69 | LDV G10 – 67 |

| Sports < $80k | Ford Mustang – 145 | Mazda MX-5 – 54 | Hyundai Veloster – 49 |

| Sports > $80k | MB E-Class 2-dr – 97 | MB C-Class 2-dr – 94 | BMW 4 Series – 23 |

| Sports > $200k | Porsche 911 – 62 | Ferrari range – 25 | Astin Martin 2-dr – 9 |

SUV and Light Commercial segments:

| Vehicle type | First | Second | Third |

|---|---|---|---|

| Light | Mazda CX-3 – 1188 | Hyundai Venue – 365 | VW T-Cross – 364 |

| Small < $40k | Kia Seltos – 1089 | Hyundai Kona – 1036 | Mitsubishi ASX – 940 |

| Small > $40k | Audi Q3 – 362 | BMW X1 – 351 | Volvo XC40 – 293 |

| Medium < $60k | Toyota RAV4 – 2433 | Mazda CX-5 – 1765 | Hyundai Tucson – 1199 |

| Medium > $60k | BMW X3 – 407 | MB GLC – 295 | Volvo XC60 – 273 |

| Large < $70k | Toyota Prado – 820 | Mazda CX-9 – 624 | Kia Sorento – 569 |

| Large > $70k | BMW X5 – 212 | MB GLE – 190 | Audi Q7 – 137 |

| Upper Large < $100k | Toyota L’Cruiser – 990 | Nissan Patrol – 190 | |

| Upper Large > $100k | Audi Q8 – 71 | BMW X7 – 67 | Land Rover Disco – 50 |

| Vans <= 2.5t | VW Caddy – 128 | Renault Kangoo – 50 | Peugeot Partner – 24 |

| Vans 2.5t – 3.5t | Toyota HiAce – 442 | Hyundai iLoad – 249 | LDV G10 – 143 |

| Vans 3.5t – 8t | MB Sprinter – 195 | Renault Master – 177 | VW Crafter – 96 |

| Utes 4×2 | Toyota HiLux – 820 | Ford Ranger – 272 | Isuzu D-Max – 262 |

| Ute 4×4 | Ford Ranger – 3454 | Toyota HiLux – 2790 | Mitsu Triton – 1234 |

FCAI CEO Tony Weber

“First of all, we are seeing COVID-19 health restrictions across Australia, and particularly in metropolitan Melbourne, continue to ease.

“Another sign that the market may improve is the announcement by the Federal Government last week of an easing of lending conditions for private buyers and small business in Australia.

“Freeing up restrictions around financial lending will act as a stimulus for Australian industry.”

MORE: Check our our archive of VFACTS and industry sales content

If you have any questions – perhaps you want to know how your car did – ask in the comments and a member of the CarExpert team will respond.

Damion Smy

3 Hours Ago

Damion Smy

4 Hours Ago

Ben Zachariah

6 Hours Ago

William Stopford

7 Hours Ago

Damion Smy

9 Hours Ago

William Stopford

10 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.