CarExpert

How to make CarExpert your preferred source on Google

32 Minutes Ago

One firm says not enough attention is being paid to encouraging Australians in outer suburban areas to purchase electric vehicles.

News Editor

News Editor

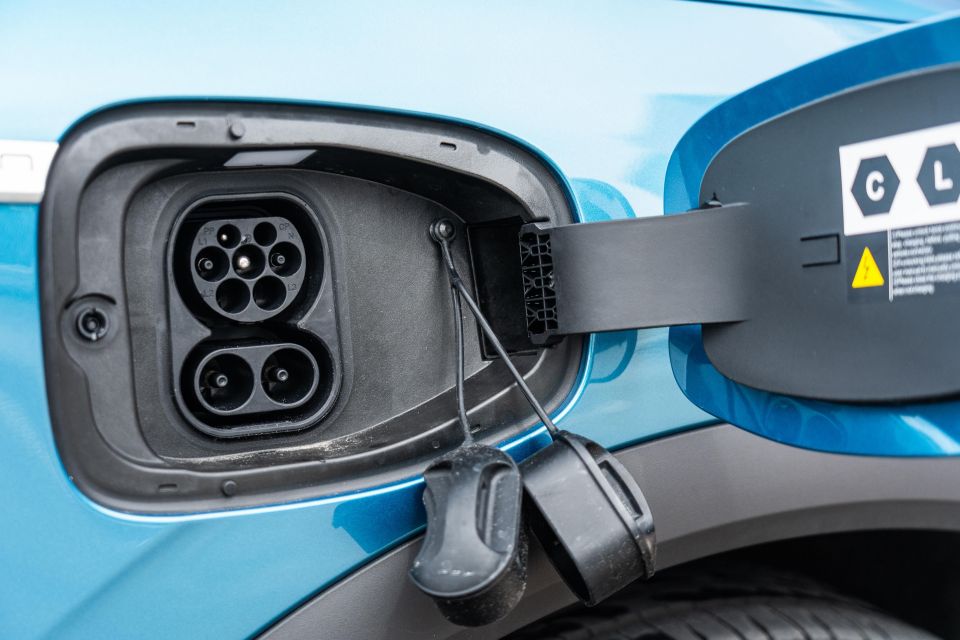

Electric vehicles will reach price parity with combustion-powered vehicles in Australia by 2031 but those who live in our nation’s outer suburbs risk being left behind.

That’s the word from professional services firm KPMG, which also predicts the average electric vehicle range will increase from 340km to 480km in that time.

It has compiled a report called Accelerating local electric vehicle uptake where it matters, and has developed a platform that tracks EV volumes at a postcode level and the ensuing emissions reductions, as well as changes in electricity demand.

KPMG is not only calling for better supply of EVs and stricter emissions standards, as other bodies have, but also purchase incentives for lower-priced EVs and/or lower-income households to better increase uptake in areas where they’ll have the largest impact on emissions.

It also suggests EVs should be subsidised for those who live in areas with longer commuting distances, such as those in the outer suburbs of our nation’s major cities.

It noted a model in Austria where there’s a fixed income tax exemption which increases based on a person’s distance to their workplace and the absence of public transport.

In this model, each kilometre exceeding an initial preset distance could be made deductible for EV owners.

KPMG says that, based on registration data, people living in the outer suburbs of Brisbane, Melbourne and Sydney are more likely to drive larger, less efficient vehicles, while those in inner-city suburbs prefer smaller and more economical vehicles.

It warns the theoretical taxing of emissions could further jeopardise car affordability in areas where zero-emissions vehicles are needed the most.

“If they exceed lower income households’ ability to pay, emission taxes could jeopardise car affordability for this group [and] would result in socially undesirable outcomes such as low-income households being forced to revert to the marginal conventional vehicles [i.e. the lowest priced vehicles with maximum allowed emissions],” the report notes.

“This could even slow down emissions savings rather than accelerate them.”

The car parc in outer suburban areas in Australia skews towards older vehicles, while residents of these suburbs naturally have a longer commute.

In Brisbane, for example, inner-city postcodes have an average vehicle fleet age of below eight years, while this is typically in excess of 12 years in fringe suburbs.

KPMG predicts Sydney will adopt EVs at a faster rate than Melbourne and Brisbane, to a total of 11 per cent of the total passenger fleet by 2031, though it notes that based on current trends, EV uptake, government incentives and vehicle turnover, this will have “little impact” on overall emissions reduction.

That’s because KPMG predicts inner-city residents will transition to EVs first, leaving their outer suburban counterparts as the laggards.

It predicts the share of EVs in Melbourne City will grow from 0.6 per cent to 22.6 per cent by 2031, for a total share of 56.4 per cent of all new cars in that post code.

Likewise, Neutral Bay in Sydney will see its EV share grow from 0.31 per cent to 23.4 per cent, for a 70.8 per cent share of new car sales.

But in suburbs further afield, it paints a different picture. Fairfield in Sydney, for example, had an EV share of 0.04 per cent last year, and KPMG says it will only grow to 1.9 per cent by 2031 for a total new car market share of 7.3 per cent.

As another example, the report says the emissions savings potential per vehicle in Craigieburn in Melbourne is almost 10 times that of inner-city Melbourne – 1074kg of CO2 per annum, against 165kg pa – due to the heavy presence of older, more heavily polluting vehicles there with longer commutes.

The firm also notes the lack of EVs suitable for off-roading will likely impede the speed of EV uptake.

In collecting this data on vehicle registrations, KPMG has been able to identify the most popular vehicles in the Brisbane, Melbourne and Sydney metropolitan areas.

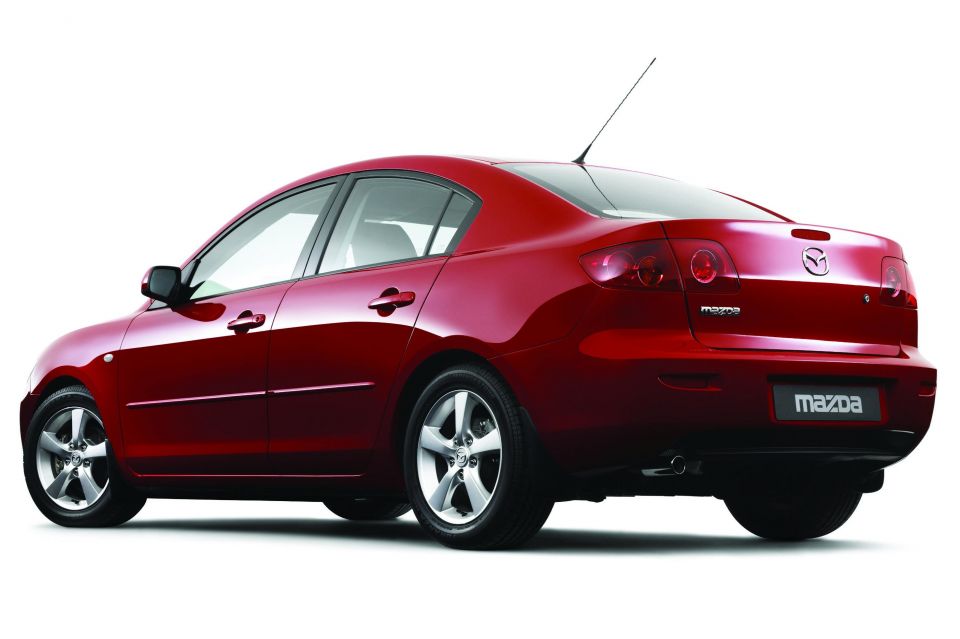

The Holden Commodore and Toyota LandCruiser dominate in the outer suburbs of each city, though the Toyota Corolla and Mazda 3 are also popular in some of Sydney’s outer suburbs.

Moving closer to each city’s CBD, the Corolla is king with a smattering of Mazda 3 and Hyundai i30 strongholds.

The Volkswagen Golf is also the most commonly registered passenger car in a sizeable number of Sydney and Melbourne post codes, but isn’t the favourite in any Brisbane post code.

One unusual outlier: the Subaru Outback leads in a small pocket of Sydney that includes prestigious Scotland Island.

While the report discusses the most commonly registered passenger cars, its data appears to include utes as well – though notably, neither the Toyota HiLux nor Ford Ranger, currently Australia’s top two best-selling vehicles, appear to be the most popular vehicle in any suburb in these three cities.

KPMG isn’t the only firm to compile a report on EV adoption in Australia.

S&P Global Research released a report this year that said EVs would account for 18 per cent of total industry volume in 2030 in Australia, ahead of plug-in hybrids (four per cent) but still behind hybrids (23 per cent), internal-combustion vehicles (24 per cent) and mild-hybrids (31 per cent).

It projects the average price of an entry-level mid-sized electric car will decrease by $17,400 between 2021 and 2030, while the average price of an entry-level electric mid-sized SUV will decrease by $8490.

William Stopford is an automotive journalist with a passion for mainstream cars, automotive history and overseas auto markets.

CarExpert

32 Minutes Ago

William Stopford

47 Minutes Ago

Damion Smy

2 Hours Ago

William Stopford

3 Hours Ago

CarExpert

4 Hours Ago

Damion Smy

6 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.