Ben Zachariah

Chery targets long-range driving with new plug-in hybrid powertrains

2 Hours Ago

Volvo is officially handing off financial responsibility for its Polestar offshoot to parent Geely.

Journalist

Journalist

Volvo Cars has detailed how it will largely divest its interest in Polestar, its former tuner turned standalone electric car brand.

Late last week Volvo Cars announced it plans to distribute 62.7 per cent of its current Polestar stake to existing Volvo Cars shareholders.

If this measure is approved by Volvo shareholders at its upcoming annual general meeting it will see Volvo’s shareholding in Polestar reduced from 48 per cent to 18 per cent.

Volvo values the 30 per cent stake in Polestar it is disbursing to be worth 9.5 billion Swedish krona (A$1.4 billion).

Although Polestar has been listed on tech-focussed Nasdaq stock exchange since 2022, at the time of writing almost 95 per cent of its shares are owned by Geely, its founder Li Shufu, and Volvo.

According to Jim Rowan, Volvo’s CEO, once the move is complete the Swedish-Chinese carmaker “will not provide further funding to Polestar”. This means Geely will assume full responsibility for funding Polestar as it struggles to ramp up production, and start turning a profit.

In a statement Volvo said it was keeping a 18.0 per cent stake in order to retain “influence over Polestar” as Volvo has already given the off-shoot automaker a US$1 billion (A$1.5 billion) convertible loan, and the two brands continue to have “strong operational collaboration across R&D, manufacturing, after sales and commercial”.

Starting life in the late 1990s as a racing outfit, the company began tuning Volvo cars in the mid-2000s, and was bought out by Volvo in 2015. Two years later, Volvo and Geely announced Polestar would become a standalone brand focussing on electrified – later fully electric – vehicles.

After merging with a special purpose acquisition company (SPAC) in June 2022, Polestar has been listed on the tech-focussed Nasdaq stock exchange. Its share price has fallen by around 85 per cent since then.

The company delivered 54,600 cars in 2023, a small six per cent increase over its 2022 sales, and well below the initial target of 80,000, which was later revised down to 60,000. Polestar blamed a “challenging market” for missing its 2023 targets.

In January Polestar announced it was retrenching 450 workers, or about 15 per cent of its workforce, as part of efforts were focussed on “reducing external spend” in order to meet its target of being cash flow break-even in 2025.

Polestar’s overall headcount is low because it uses an “asset light” approach, with manufacturing done by Volvo and Geely.

All of its current and future lineup are being on architectures developed by Volvo and Geely.

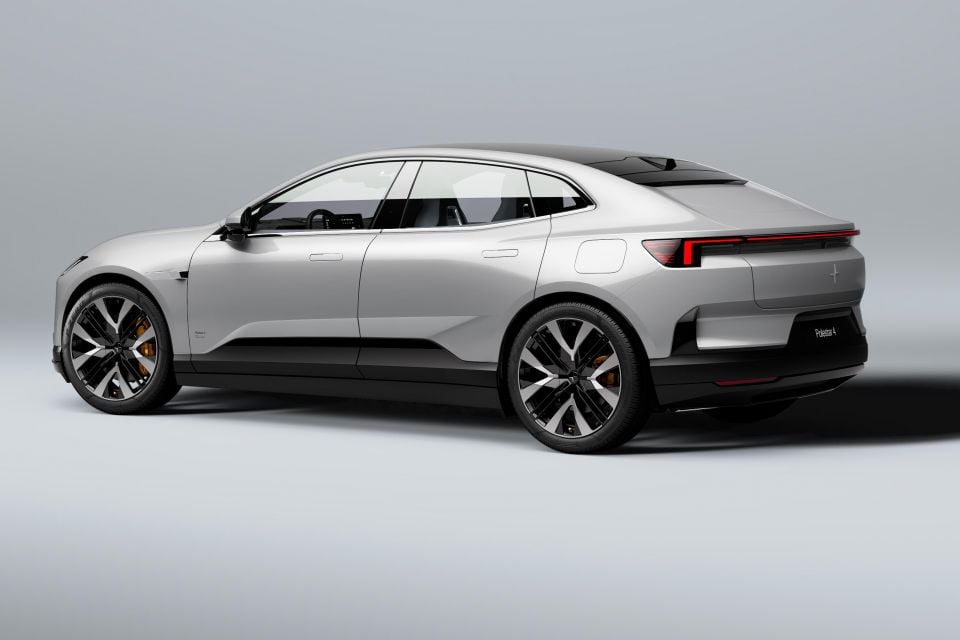

Polestar currently offers two vehicles: the Volvo XC40-based Polestar 2 high-riding sedan, and the larger Polestar 4 crossover coupe. Orders for the latter recently opened in Australia ahead of arrivals in August.

The first deliveries of the Volvo EX90-based Polestar 3 are expected to start around the middle of 2024.

While Polestar is currently an all-electric brand, Volvo is aiming to join the EV-only club by 2030, with the Australian division looking to ditch internal combustion engines as soon as 2026.

MORE: Volvo pulls plug on Polestar funding as electric car brand struggles

Derek Fung would love to tell you about his multiple degrees, but he's too busy writing up some news right now. In his spare time Derek loves chasing automotive rabbits down the hole. Based in New York, New York, Derek loves to travel and is very much a window not an aisle person.

Ben Zachariah

2 Hours Ago

William Stopford

2 Hours Ago

William Stopford

3 Hours Ago

James Wong

5 Hours Ago

CarExpert

6 Hours Ago

Derek Fung

8 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.