Ben Zachariah

2027 Cupra Raval EV hot hatch caught on camera ahead of reveal

2 Hours Ago

News Editor

Australian company Magnis Energy Technologies has signed a deal with Tesla to supply the automaker with raw materials for its batteries.

Under the terms of the binding agreement, Magnis will supply Tesla with a minimum of 17,500 tonnes per annum (tpa) of anode active materials (AAM) beginning in February 2025.

The agreement will run for a minimum term of three years and at a fixed price, and Tesla reserves the right to increase its supply to 35,000tpa.

It’s conditional on Magnis securing a final location for its commercial AAM facility by June 30, 2023, producing it from a pilot plant by March 31, 2024, and then starting production from the commercial AAM facility by February 1, 2025.

Magnis says it will start large-scale pilot plant development for both AAM and Nachu graphite concentrate immediately.

It’s in the process of selecting a US location for an AAM facility, and it has started development of pilot plant facilities for both materials by appointing new hires and commencing equipment orders.

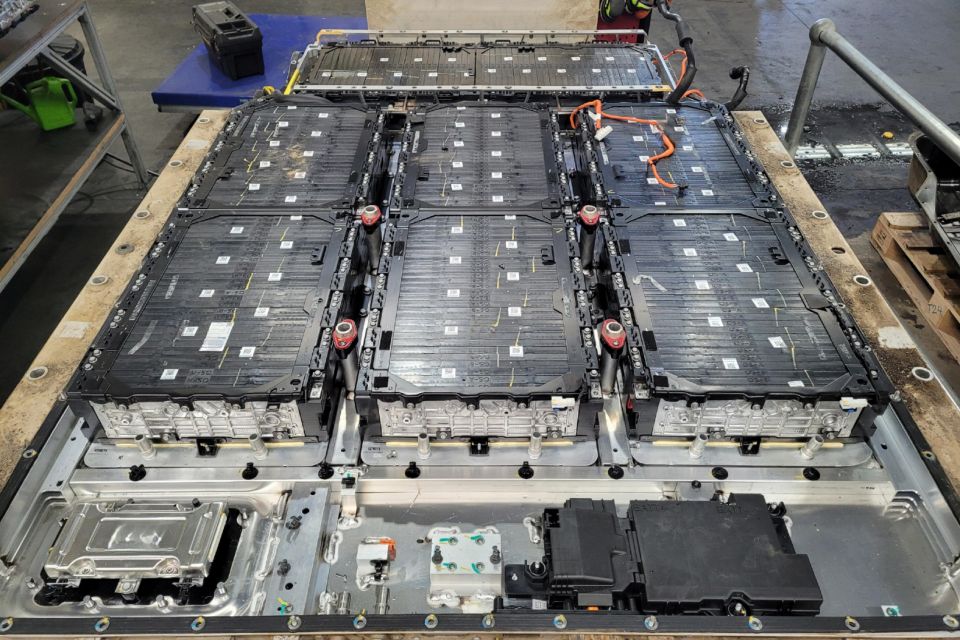

Magnis calls itself a vertically integrated lithium-ion battery technology and materials company, and through its subsidiary Imperium3 New York, Inc (iM3NY), operates a gigawatt-scale lithium-ion battery manufacturing plant in Endicott, New York.

Over a seven-year period, it has been working on producing AAM using Nachu graphite concentrate sourced from Tanzania at its New York facilities.

“We are really excited to bring our high performing AAM to market that requires no chemical or thermal purification throughout the whole process, which differentiates this sustainable material in the market and provides great value to all parties,” said Magnis chairman Frank Poullas.

Magnis isn’t the only Australian company Tesla has made such an agreement with.

It has a recently amended its agreement with Piedmont Lithium, for a binding three-year term for the Australian company to deliver approximately 125,000 metric tons of spodumene concentrate to Tesla from the second half of this year through the end of 2025.

It also sources minerals from BHP, Syrah Resources and Liontown Resources.

Other companies have also tapped Australian companies for raw materials, with General Motors signing a deal last year with Queensland Pacific Metals to source nickel and cobalt from the Sunshine State. Ford also sources materials from Australia.

Where we currently supply the materials for batteries, the Tesla chair Robyn Denholm has previously called on Australia to start refining raw minerals before shipping them offshore.

“Tesla estimates that last year, Australia supplied approximately 49 per cent of the world’s lithium ore – spodumene – but zero per cent of the refined product suitable for battery cells,” Ms Denholm told the Minerals Council.

“That lithium sold for about $US100 million, but if it was processed onshore in Australia the value would have been more like $US1.7 billion. So that’s a $US1.6 billion annual opportunity and growing.”

Ms Denholm said the nation is faced with an “extraordinary” opportunity to cash in on growing demand for lithium, nickel, and cobalt to build electric vehicles.

Go deeper on the cars in our Showroom, compare your options, or see what a great deal looks like with help from our New Car Specialists.

William Stopford is an automotive journalist with a passion for mainstream cars, automotive history and overseas auto markets.

Ben Zachariah

2 Hours Ago

James Wong

4 Hours Ago

Damion Smy

6 Hours Ago

Damion Smy

6 Hours Ago

James Wong

7 Hours Ago

James Wong

7 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.