Ben Zachariah

2026 BYD Sealion 5 Essential review

6 Hours Ago

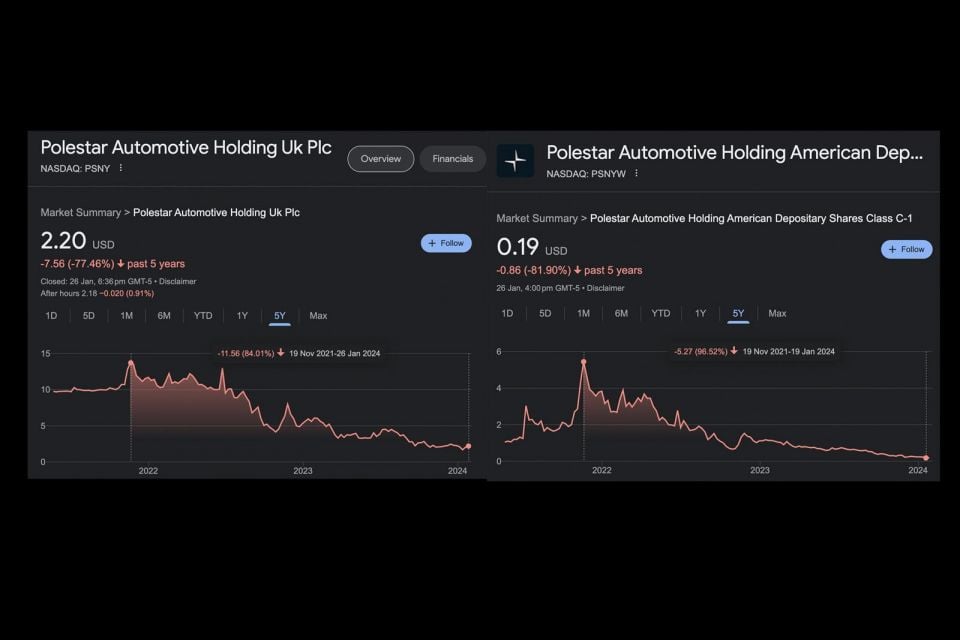

No matter how you look at the figures, Polestar as a brand is under incredible market pressures and, so far, it's failing to deliver.

Publisher

Publisher

You may have seen “Swedish” brand Polestar announce it’s cutting 450 jobs globally as it continues to struggle to sell its range of electric vehicles (EVs) in the face of increased competition from the likes of Tesla and Chinese manufacturers.

Polestar, which was once the AMG of Volvo and had absolutely nothing to do with EVs, was turned into its own brand in 2017 with the aim of selling plug-in hybrids (now gone) and EVs.

It was positioned as a sporty alternative to the likes of Tesla, and was listed on the NASDAQ.

No doubt parent company Geely was taking some inspiration from Tesla and hoping to realise some serious market valuations in taking the brand public – but fast-forward to today and the Chinese-owned brand delivered just 54,600 vehicles globally in 2023.

To make matters worse, fourth quarter deliveries fell nearly eight per cent compared to the preceding quarter, with just 12,800 sales.

To put that in perspective, MG sold more cars in Australia last year (58,346) than Polestar sold globally.

If you’re wondering how a brand survives with such low volumes, you’re asking the right questions because Polestar is in serious financial trouble.

From its peak after going public in 2021, Polestar’s share price (PSNY or PSNYW) has crashed by more than 80 per cent (90 percent for PSNYW).

It’s at a point now that its reliance on Volvo and parent company Geely for funding its losses ($640 million cash injection in late 2023) puts a big spotlight on the brand’s future potential.

The company has already said it needs around US$1.3 billion (A$2 billion) in debt and equity financing just to break even, and only if things go to plan. This is on top of its promise to double down on its cost-cutting efforts.

In the trailing twelve months of doing business, Polestar managed to lose around US$1.2 billion (A$1.8 billion in normalised EBITDA), up from US$740 million (A$1.1 billion) in 2022. In other words, the sales are going down and the losses are mounting up.

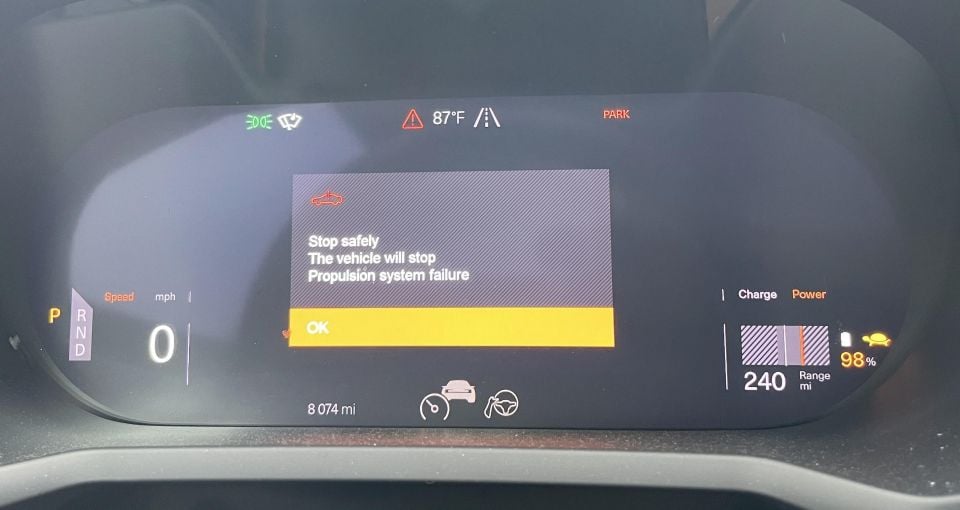

At some point, something has to give and it won’t just be the dreaded propulsion system failure errors owners are reporting.

Looking at the Australian market, Polestar is seemingly (albeit incredibly slowly) moving in the right direction, with 2023 sales totalling 2463 units, up from 1524 in 2022. But, as is always the case, the devil is in the detail.

Of the 2463 deliveries last year for Polestar in Australia, only 741 of them were to private buyers according to VFACTS industry sales reports. The rest were business purchases for the likes of Splend (Uber), and other rental companies such as Hertz.

Now you know why you are seeing so many Polestar 2s in busy areas ferrying people around. It’s not because they’re loved, it’s because they’re offered to the likes of Uber drivers.

That means on average, Polestar Australia sold just over two cars per day to private buyers in 2023.

As a comparison, Tesla sold 13,109 Model 3s to private customers, with only 4238 going to fleet or business buyers in the same period – a very different, much healthier ratio of private-to-fleet sales.

Those who decided to part with their hard-earned money for one should pay close attention to what happens to their vehicle’s residual values when those thousands of fleet purchases come back on the market.

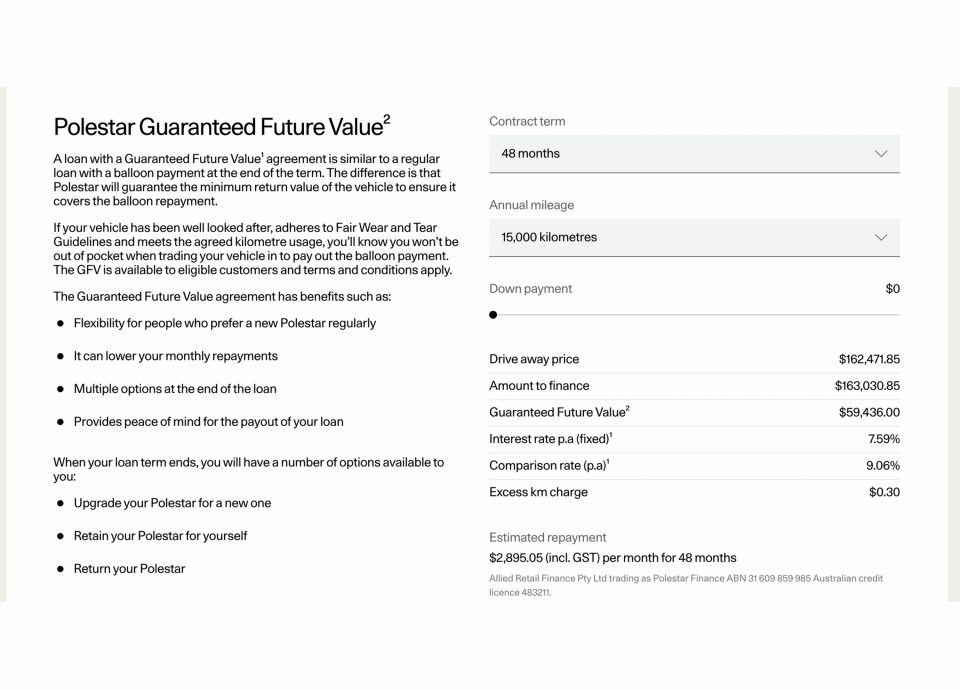

The next Chinese-made car from the brand, the Polestar 3 SUV, will start from around $132,000 and top out at close to $160,000 before on-road costs.

Polestar (on its own website) previously gave a guaranteed future value of just $59,436.00 after four years and 60,000km on the top-spec Polestar 3. That’s just 36.5 percent of the original purchase price.

Since we last reported on this, Polestar has seemingly removed its future value program calculator from its website.

If you’re looking to choose between a Polestar 2 or a updated Tesla Model 3, consider the cheapest facelifted Model 3 you can buy in Australia is $65,734 drive-away (using a Queensland postcode), while the cheapest Polestar 2 we could specify came in at $71,998. That’s a massive premium for a brand that has struggled to attract private buyers while giving fleets the nod.

Will Polestar survive long-term? The current numbers aren’t very promising, but if the company can change strategies to meet demand where it’s at, rather than trying to be an upmarket brand it certainly is not, it may have a resurgence.

As it stands today though, Polestar as a company is operated similarly to running a drop-shipping business.

The brand doesn’t manufacture its own cars – they are built by Volvo on a contract manufacturing basis in Taizhou and Chengdu (China) – and yet it has positioned itself well above the likes of other Chinese-made electric cars from Tesla, BYD, MG, and GWM by relying on its Swedish heritage and apparent luxury and sporty characteristics.

Going by the facts and figures the market isn’t buying it, and nor should you.

Go deeper on the cars in our Showroom, compare your options, or see what a great deal looks like with help from our New Car Specialists.

Alborz Fallah is a CarExpert co-founder and industry leader shaping digital automotive media with a unique mix of tech and car expertise.

Ben Zachariah

6 Hours Ago

Ben Zachariah

6 Hours Ago

William Stopford

11 Hours Ago

William Stopford

12 Hours Ago

Damion Smy

15 Hours Ago

Damion Smy

16 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.