Damion Smy

Nissan Australia replaces managing director

1 Hour Ago

No, it's not a new Christopher Nolan film. Stellantis, a merger of equals between Fiat Chrysler and Peugeot Citroen, will be official this time next week.

Journalist

Journalist

Starting on January 16 there will be a new automotive behemoth on the block. Stellantis is the coming together of the PSA Group and Fiat Chrysler Automobiles (FCA).

The new automaker brings together 14 brands of varying strength and depth. Coming from FCA are Fiat, Abarth, Lancia, Alfa Romeo, Maserati, Chrysler, Dodge, Jeep, and Ram, while PSA adds Peugeot, Citroen, DS, Opel, and Vauxhall to the party.

It should be noted Vauxhall exists to sell right-hand drive Opel cars in the UK, and Abarth tunes Fiat vehicles for more oomph.

At its conception, Stellantis will have around 400,000 employees across the world. When the two firms signalled their intent to merge in 2019, the combined company was going to be the fourth largest automaker behind Volkswagen, Toyota, and the Renault-Nissan-Mitsubishi Alliance.

Last year’s numbers will see the combined entity fall to sixth behind General Motors and the Hyundai Motor Group. This is primarily due to FCA and PSA’s small presence in China, the first major country to get the COVID-19 pandemic under control.

The combination is being billed as a “merger of equals”. This phrase was most infamously used when DaimlerChrysler was created in 1998 although Jurgen Schrempp, CEO of Daimler, later admitted it was a takeover pure and simple.

While this merger is certainly closer to its billing, the PSA Group does have the upper hand, at least initially, in the new company.

There will be an 11-member board, with FCA and PSA nominating five members each. Carlos Tavares, currently PSA CEO, will be the chief executive of Stellantis for at least the first five years.

He will also be the 11th member of the board, and is not counted in PSA’s quota.

John Elkann, current FCA chairman, will become the Stellantis chairman. FCA CEO Mike Manley will be made head of the merged automaker’s North American division, but is not a part of the new company’s board of directors.

It should be noted international accounting standards require the firms to nominate the company being taken over and the one doing the taking over, and these state PSA is taking over FCA.

Equity in the new automaker will be split 50/50 between FCA and PSA’s shareholders.

After the Stellantis is created, the largest shareholders will be Agnelli family — long-term controllers of the Fiat Group — with a 14.4 per cent stake through Exor, their holding company.

Next up is the Peugeot family who will have a 7.2 per cent share in the new company. The French government, through its stake in PSA, will own 6.2 per cent of the combined firm.

In order to appease US regulators, Chinese automaker Dongfeng has reduced its shareholding in PSA and will end up with a 4.5 per cent stake in Stellantis.

While all the major shareholders in Stellantis are bound by lockup agreements, which prevent them from selling down their stake for a certain period, the Peugeot family are allowed to buy from Dongfeng and the French government if either wants to sell down their holdings during the lockup period.

Companies and individuals who have held their PSA or FCA stock for more than three years are entitled to extra voting stock. This move is intended to shield Stellantis from a hostile takeover.

Stellantis will be listed on the New York, Milan, and Paris stock exchanges, while the company will be incorporated in the Netherlands.

Current PSA CEO Carlos Tavares — a keen rally car driver — will be the first chief executive of Stellantis.

As we noted in our noted in our feature on automotive CEOs, he joined PSA in 2014 after the firm notched €8 billion ($13.3 billion) in losses over the previous two years.

He has a closely held mantra of prioritising profit over volume, and managed to improve PSA’s margins to around the best in the industry by cutting costs and shedding jobs.

After turning PSA around, in 2017 he bought Opel and Vauxhall from GM. Although the General’s European patient had wallowed in red ink since the turn of the millennium, Tavares was able to bring them back to profitability within a year.

Integrating FCA’s operations will be orders of magnitude more difficult given its sheer size and complexity, as well as the potential for culture clashes.

While the merger is widely seen as complementary as PSA is strong in Europe, and FCA has a large and profitable presence in North America, Tavares will have his work cut out for him.

In addition to issues common to all automakers — devoloping hybrid and EVs, investing in autonomous vehicle technology, and dealing with the effects of the COVID-19 pandemic — Stellantis will also need to sort out and prioritise its model plans across its 14 brands.

If Tavares sticks to his earlier promise to not close factories or brands, wringing savings and achieving appropriate economies of scale out of the combined automaker will be even more heavily dependent on getting the automotive roadmap close to perfect.

Stellantis will also save money by streamlining backroom functions, such as finance, marketing, and IT.

Overcapacity in Europe

The new firm’s European plants have the ability to produce more cars than they current are. One solution is to shutter some factories or at very least close production lines, while the other is to boost production, preferably with new and desirable products.

Although Tavares has previously committed to keeping the company’s production footprint in place, the COVID-19 pandemic could provide some cover if the automaker decides to make this promise “non-core”.

Platforms and electrification

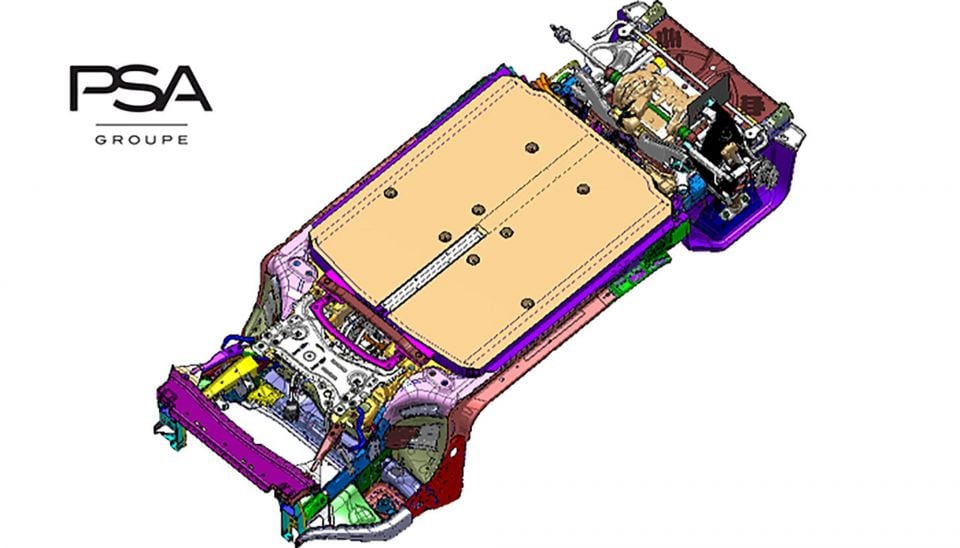

Over the past decade PSA has aggressively pursued a two-platform strategy: CMP for smaller vehicles, and EMP2 for larger cars.

CMP can be used with conventional and full electric drivetrains, while EMP2 supports plug-in hybrid setups.

From 2023 a new architecture, known as eVMP, will replace EMP2. Although designed with EV drivetrains in mind, it will still be able to accommodate internal combustion engines for markets without EV mandates, CO2 targets, or poor electric car infrastructure.

With the exception of Alfa Romeo’s Giorgio platform, the new Fiat 500 EV’s underpinnings, and Ram’s full-size ute architecture, all of FCA’s platforms are over a decade old.

It’s probably safe to assume the next generation of Jeep and Fiat products will be built atop PSA platforms.

With electrified drivetrains increasingly necessary to meet the EU’s tightening CO2 emissions targets, PSA has been busy adding EV and plug-in hybrid options to its range over the last few years as models have entered new generations.

FCA has been slower to join the party, and has only recently begun adding plug-in hybrid drivetrains to its Jeep Compass and Renegade models, as well as some mild hybrid options elsewhere.

Despite having a range heavily skewed towards light cars, FCA was unable to meet the EU’s CO2 target. In order to avoid hefty fines, it paid Tesla to join its fleet emissions pool.

Brand fragmentation

The new automaker has 14 active brands, although you could argue Opel and Vauxhall are essentially one brand and Abarth is a sub-brand. Regardless how you see those three marques, Stellantis has a lot of brands to juggle.

When FCA and PSA went public with their intention to merge, Tavares also promised to keep all of the brands from both automakers.

Under the leadership of Sergio Marchionne, FCA concentrated on eliminating its debt burden and finding a long-term partner — GM openly rejected its overtures, while a merger with Renault was called off when Nissan refused to give the marriage its blessing.

Thanks to an edict to keep its brands from fighting over the same market space, as well as a string of broken product promises, many of FCA’s marques have thin and aging ranges that will take significant investment to renew and grow.

The pandemic may provide a convenient excuse if there is to be some marque pruning.

Europe

Thanks to Carlos Tavares’ focus on keeping profit margins above six per cent, PSA has been able to make money in its core geography despite being reliant on the mass market Peugeot, Citroen and Opel/Vauxhall brands.

He will look to apply the same rigour to FCA’s brands after the merger.

Based on 2019 figures, the combined automaker will be the second biggest automaker in Europe after the Volkswagen Group.

France

According to industry analyst Felipe Munoz, PSA remains the dominant force in its home market, France, with a market share of around 32 per cent — Peugeot was the second most popular brand just behind Renault, while Citroen placed third.

The company’s share will grow after the merger with FCA’s brands adding just a tick of 3 per cent to the overall figure.

The podium places are rounded out by Renault Nissan Mitsubishi (27 per cent) and the Volkswagen Group (12 per cent).

Italy

Fiat Chrysler is still the number one automaker in Italy with a 24 per cent share in 2020, but the company’s dominance has been waning. Back in 2010 the Fiat Group controlled 30 per cent of its home market.

As well as rapidly declining sales, Fiat’s model mix is skewed ever more in favour of light vehicles such as the 500 and Panda, where margins are thinner.

The addition of the third-placed PSA Group will boost the automaker’s share in Italy back up to 39 per cent and pushing the company well clear of the second-placed Volkswagen Group (17 per cent).

US and North America

Although FCA only had a 13.1 per cent market share — behind GM (18.2 per cent), Ford Motor Company (14.6 per cent) and Toyota/Lexus (15.2 per cent) — in 2020, the vast majority of its sales came from the highly profitable Ram and Jeep brands.

With most of FCA’s dealers selling Chrysler, Dodge, Jeep and Ram under one roof, the company has pretty good market coverage.

It was the first of the Big Three US automakers to abandon traditional body styles when the Dodge Dart and Chrysler 200 were axed in 2016. This leaves the company vulnerable if tastes change or customers shift to more affordable vehicles.

Although Peugeot left the USA in 1991, PSA has been selling cars in Mexico since the late 1990s. Prior to the conception of the FCA/PSA merger there were plans for Peugeot to return to the US during the late 2020s.

Latin America

Thanks to its market-leading position in Brazil, FCA has a strong presence in Latin America with its Fiat and Jeep brands.

Fiat has a wide selection of affordable locally developed models covering the light and small car segments, as well as a selection of unibody utes.

Peugeot and Citroen also frequently appear on the top 10 lists across Latin America.

China, India, and Asia

The PSA Group was once a major player in the growing Chinese market. As recently as 2014 the company had two joint ventures — one each for Peugeot and Citroen — and was selling 700,000 cars annually in the Middle Kingdom.

In 2020 sales slipped beneath 100,000 and one of the joint ventures has been dissolved. Complicating matters further, the DS line was split off from Citroen in order to give the company a player in the luxury market, but the move has yet to prove a sales success.

FCA manages to sell vehicles in the low six-figure range thanks its local Jeep joint venture.

Both companies have fallen far behind the Volkswagen Group, GM, Toyota, Honda, and domestic brands for the hearts and minds of customers in the world’s most populous nation.

The other key growth markets are nearby India and Asia, and in both these regions both FCA and PSA are poorly represented.

Fiat

Models (Europe): 500, New 500 (EV), 500X, 500L, Panda, Tipo/Egea Models (Latin America): Mobi, Argo, Cronos, Grand Siena, Uno, Strada, Toro,

As far as passenger vehicles are concerned, there are essentially two Fiat ranges: one for Europe, and one for Latin America.

In Europe and other developed markets the brand now focuses primarily on light cars with 500, 500X, 500L and Panda. Fiat’s only larger vehicle is the Tipo/Egea, which plays at the economy end of the Golf class.

Electrification has only just begun with the launch of the all-electric New 500, and the introduction of mild hybrid drivetrains on some models.

Thanks to its market-leading presence in the heavily protected Brazilian market, Fiat has a strong position across Latin America with a broad range of range of locally-developed hatches, sedans, and utes.

It’s unknown if Stellantis CEO Tavares will push the Fiat brand into larger and more profitable vehicle segments.

Chrysler

Models: 300, Pacifica/Voyager

FCA’s other titular brand is a shadow of its former self. The Camry-class second-generation 200 barely lasted two years before being axed in 2016, and since then promises for crossovers based on its large people mover have failed to materialise.

The modern Pacifica/Voyager people mover makes up the vast majority sales with around 100,000 units shifted every year.

Chrysler’s only other model is the 300. Launched in 2011, the large rear-wheel drive sedan is getting on and there are no plans to renew it when its Dodge Charger and Challenger siblings are redesigned.

Dodge

Models: Charger, Challenger, Durango

With the Journey crossover and the ancient (but highly affordable) Grand Caravan people soon to ride off into the sunset, Dodge will complete its transformation from a mass-market brand to one focused exclusively large rear- and all-wheel drive muscle cars and crossovers with a rear-wheel drive platform dating back to 2005.

With Ford/Lincoln and GM having effectively vacated the space for this nostalgic throwback to the halcyon days when US automakers seemingly ruled the world, Dodge has successfully claimed this niche for itself.

With tightening emissions standards in many parts of the world, it’s hard to see a future for the brand beyond its homeland unless it makes a pivot towards electrification.

Jeep

Models: Renegade, Compass, Cherokee, Grand Commander (China), Grand Cherokee, Grand Wagoneer (upcoming)

When Fiat took control of Chrysler, one of Sergio Marchionne’s first acts was to centre the American automaker around Jeep as it had global brand recognition and buyers were increasingly favouring high-riding body styles to traditional sedans, hatches, and wagons.

Under Marchionne’s control, Jeep utilised Fiat’s platforms for new crossovers that allowed it to compete in classes more comfortable for buyers outside of North America.

Today it is the combined automaker’s only truly global brand, although quality issues and some aging models have seen sales plateau.

Ram

Models: 700 (Latin America), 1500/2500/3500, ProMaster, ProMaster City

Split off from Dodge in 2010, Ram houses of all FCA’s pickup trucks and vans in North America. The healthy profit margins on Ram’s utes has ensured North America is FCA’s main profit centre.

In the US and Canada, Ram sells federalised versions of the Fiat Ducato and Fiat Doblo vans as the Ram ProMaster and Ram ProMaster City.

The brand is also establishing itself in Latin America, where it rebrands the Fiat Strada ute as the Ram 700.

There have been plenty of rumours of a new “mid-size” Dakota ute, which would be give Ram a competitor for the Toyota Tacoma, Ford Ranger, and Chevrolet Colorado.

It would also match up against the Toyota HiLux, Nissan Navara, and Isuzu D-Max if it were to make its way outside North America.

Lancia

Model: Ypsilon

This iconic and revered brand is a textbook case of what continual underinvestment in product can do.

After brief explosion in the product range with a bunch of rebranded Chrysler product in 2011 with the Flavia (200 convertible), Voyager, and Thema (300), the company has been reduced to just one vehicle — the third-generation Ypsilon — that’s sold exclusively in Italy.

Despite now being a one-trick pony, the Ypsilon has consistently been selling well. In 2020 it was the second best-selling vehicle in Italy behind the Fiat Panda, but ahead of the Fiat 500X.

Given the time and investment that will be required to expand and regrow the Lancia range, and all the other items on the Stellantis plate, it’s easy to see why many think this brand could be one of the casualties of the merger.

Alfa Romeo

Models: Giulia, Stelvio, Tonale (upcoming)

If Sergio Marchionne’s plans had come true, Alfa Romeo would have eight-strong range of rear- and all-wheel drive vehicles based on the Giorgio platform.

In reality only the Giulia sedan and Stelvio crossover made it to market. The Jeep Compass-based Tonale crossover is nearing production, while a larger crossover is also said to be in the works.

Despite strong affection for the brand among enthusiasts, Alfa has failed to make a dent in the dominance of the German luxury marques.

If the experience of Lexus, Jaguar, Infiniti, Acura and Genesis is anything to go by, it will take sustained investment in products over a long period to make significant inroads into the affordable luxury segment.

The brand will also need to invest in plug-in hybrid and EV drivetrains if it is to stay relevant in Europe.

Maserati

Models: Ghibli, Quattroporte, Levante, MC20

Further up the luxury chain, FCA has attempted to revive Maserati several times. The last push saw the renewal of the Ghibli and Quattroporte sedans, as well as the addition of its first ever crossover, the Levante.

While these products pushed annual global sales beyond 75,000 momentum has stalled, black ink has turned red, and the brand’s volume will probably be around 10,000 in 2020.

The latest revival plan, unveiled in 2018, set Maserati on the path of becoming FCA’s electrification leader.

By 2025 the brand says it will offer at least one electrified drivetrain option in every model.

Peugeot

Models: 108, 208, 308, 408 (China), 508, 2008, 3008/4008, 5008

With a range of vehicles stretching from the tiny 108 to the family-sized 508, as well as three crossovers, and full complement of van models, Peugeot has most mass-market segments covered.

The brand — along with the rest of Stellantis — is missing a five-metre-long ute to compete globally with the likes of the Ford Ranger and Toyota HiLux, although it offers the Landtrek in emerging markets.

Prior to starting the merger process with FCA, Peugeot was looking to relaunch itself after 2026 in North America. It’s unclear whether this is still on the table given Stellantis already has a significant presence in the US.

Citroen

Models (Europe): Ami, C1, C3, C4, C3 Aircross, C4 Cactus, C4 Spacetourer, C5 Aircross Models (China): C-Elysee, C3L, C4L, C5, C6, C3-XR, C4 Aircross, C4 Picasso, C5 Aircross

Pitched downmarket from Peugeot, and with a history of ground-breaking innovations and designs, Citroen has been given more freedom in recent generations to experiment.

While the European range is quite modern, a number of older models remain on sale in China and Latin America.

DS

Models: DS3, DS7, DS9

From 2009 onwards, Citroen began selling more luxurious and avant garde versions of its main range under the DS sub-brand.

To capitalise on the early success of these models, as well as give PSA a premium marque, DS became its own standalone brand with grand ambitions, especially in China.

With Alfa Romeo and Maserati joining the family, it will be interesting to see how much effort Stellantis puts into the startup luxury brand compared to its more established siblings.

Opel/Vauxhall

Models: Corsa, Astra, Insignia, Mokka, Crossland, Grandland, Combo, Zafira/Vivaro, Ampera-e

Since the turn of the millennium Opel and Vauxhall have been the sick marques of Europe, unable to turn a profit despite repeated attempts by GM to right the ship.

In 2017 the companion brands were sold off to PSA, which was able to bring the operation back into profit within a year.

Opel’s stronger presence in northern Europe has helped to provide a bit more geographic balance to PSA’s sales.

Like Peugeot, Opel has a fairly full range of cars with three mainstream and three crossover models providing plenty of coverage. The Astra, Insignia and Ampera-e (a rebadged Chevrolet Bolt) are the last vehicles to use GM platforms and technology.

Opel has begun expanding into new markets, such as Russia, where it can only sell vehicles not based on GM architectures.

Derek Fung would love to tell you about his multiple degrees, but he's too busy writing up some news right now. In his spare time Derek loves chasing automotive rabbits down the hole. Based in New York, New York, Derek loves to travel and is very much a window not an aisle person.

Damion Smy

1 Hour Ago

Damion Smy

3 Hours Ago

Damion Smy

5 Hours Ago

William Stopford

6 Hours Ago

William Stopford

7 Hours Ago

Damion Smy

8 Hours Ago