Damion Smy

BYD sues US government over Trump tariffs blocking Chinese EVs – report

1 Hour Ago

More new cars in stock and a fall in household borrowing power are exerting downward pressure on what were recently record used car prices.

Senior Contributor

Senior Contributor

Sky high used car prices are gradually returning to earth as production of new vehicles improves, but they’re still far more expensive than before the COVID-19 pandemic.

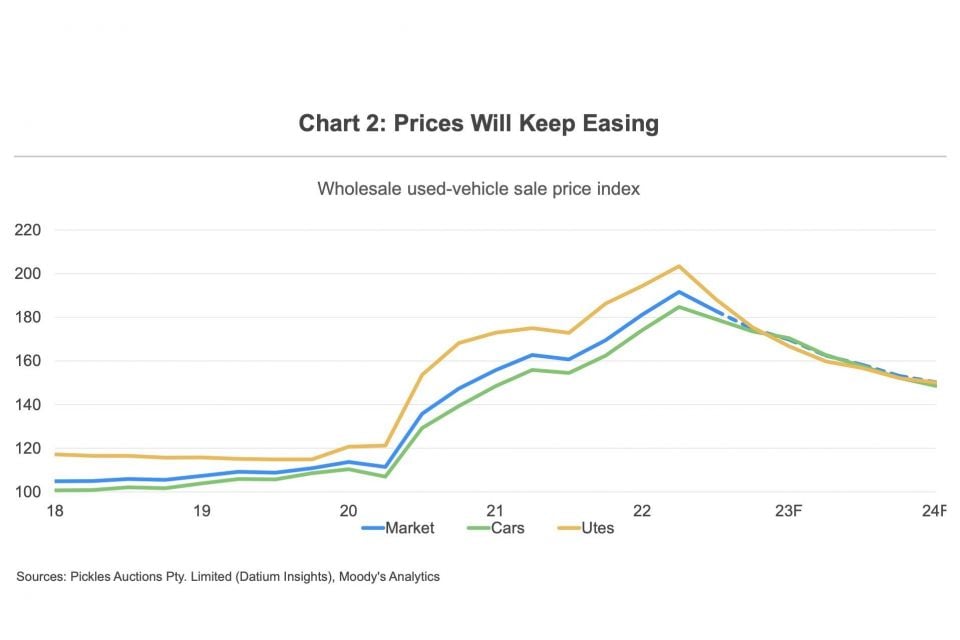

This is the latest from Moody’s Analytics, which this week published its Q1 used vehicle price report stating average used car prices across Australia were 13.2 per cent lower than they were at their May 2022 peak, and down 9.8 per cent year-on-year (to end of March).

The bad news is, used car prices are still 51 per cent higher than pre-pandemic levels. The temporary and seasonal backlog of new vehicles clearing quarantine in Australia as reported here has further subdued used-vehicle price declines in the short term.

The better news is that the average cost is projected to keep falling this year, as new car supply improves after years of COVID and semiconductor-related production snags.

Moody’s Analytics expects used car prices to fall 12 per cent across 2023 and a further 7.6 per cent in 2024 before stabilising in 2025.

Interestingly, the research firm tips second-hand ute prices will fall more rapidly than prices for passenger cars. Why? Manufacturers are cutting production of new passenger cars and prioritising the output of bigger vehicles with higher profit margins.

“While monthly price declines will feature through this year, prices are still relatively elevated at 51 per cent above pre-pandemic levels,” the report states.

“Increased new-vehicle supply is pushing prices for used vehicles lower. Although global vehicle production has not returned to pre-pandemic levels in Europe and Asia, there has been a decent improvement. For instance, vehicle production in Japan has improved over the past year but remains 21 per cent below 2019 levels.”

An additional lift to global new vehicle supplies during 2023 is expected as China walks away from its zero-COVID policy and opens up, and ramps up its exports as part of a wider geopolitical push.

Moody’s also expects inflation and higher borrowing costs due to interest rate increases will further exert downward pressure on vehicle prices, as households ditch discretionary spending.

This should be tempered to some extent due to Australia’s current near-record low unemployment levels, and expectations that the Reserve Bank will slow the cadence of rate increases as inflation eases.

A further possibility cited in the Moody’s report is the spectre of a global recession, which is “uncomfortably high” in the EU, UK and US. Any pronounced slowdown in global or local conditions would naturally hurt demand for new and used vehicles, leading prices to actually fall faster.

Australia’s GDP growth meanwhile is forecast to cool to 1.3 per cent in 2023 from 3.7 per cent in 2022, with weaker household consumption cited as “an important influence”. Still, a full-blown recession is seen as a lower-risk outcome here.

MORE: Australian used car prices are falling (slowly) back to Earth

Damion Smy

1 Hour Ago

William Stopford

2 Hours Ago

Damion Smy

3 Hours Ago

Damion Smy

4 Hours Ago

William Stopford

4 Hours Ago

Derek Fung

8 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.