Ben Zachariah

2027 Toyota Corolla: What we know about the next-generation small car

22 Hours Ago

News Editor

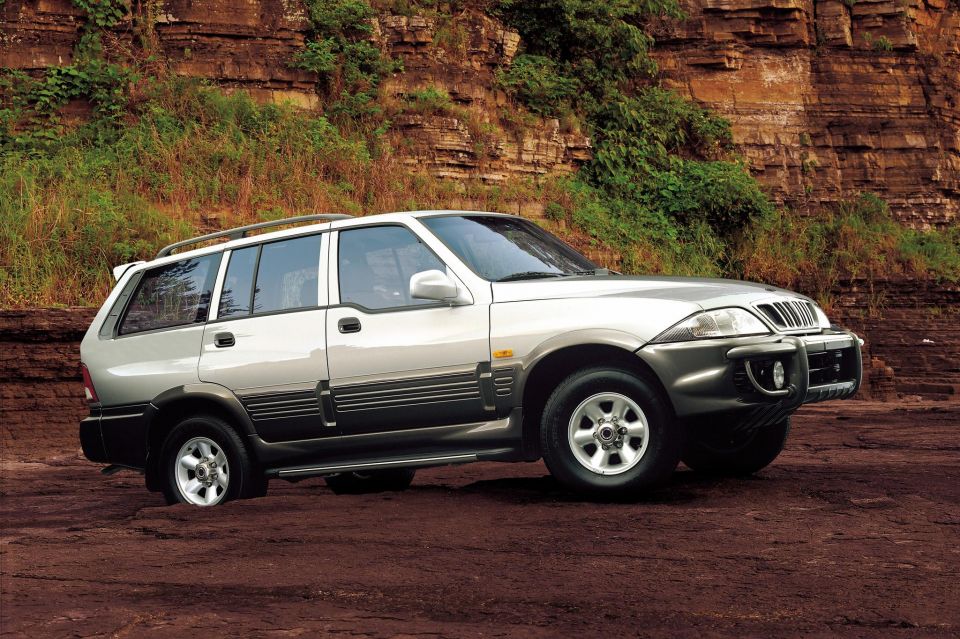

Four bidders have filed letters of intent to bid for ailing SsangYong Motor Co, but none of them are car companies.

Pulse News reports the four companies include chemical and steel conglomerate KG Group, Pavilion Private Equity, electric vehicle parts manufacturer EL B&T, and underwear company Ssangbangwool Group.

EL B&T and Pavilion PE both bid last year for SsangYong, before the Seoul Bankruptcy Court approved the sale of the beleaguered automaker to a consortium led by electric bus manufacturer Edison Motors.

SsangYong remains in court receivership after walking away from an acquisition deal by Edison Motors, which was unable to make its final payment by a March 25 deadline.

Though Edison Motors is asking the Seoul Bankruptcy Court to uphold the deal, SsangYong is looking for a new buyer.

Pulse News reports these preliminary bidders will now conduct due diligence for two weeks until May 4, when they join the tender.

SsangYong then reportedly expects to receive its final offer by mid-May.

KG Group is reportedly shaping up to be the strongest contender in terms of financing, with additional funds of around 500 billion won (A$549 million) expected from the sale of waste treatment subsidiary KG Eco Technology Services.

Pavilion PE reportedly plans to partner not only with a financial institution, but also an unspecified automotive company, while Ssangbangwool Group is sticking it out despite losing a financial backer.

Edison Motors has filed a stay against the court’s decision to nullify its acquisition deal and remove the company’s exclusive status for a controlling stake.

In effect, the court ruled the deal was dead. SsangYong has reportedly already confirmed it’s looking for a new buyer, but remains in court receivership.

Should an appropriate buyer not be found and should the court reject a rehabilitation plan submitted by the ailing automaker, the company could face liquidation.

The Edison-led consortium had offered to buy the beleaguered automaker for 304.8 billion won (A$331 million) and had paid 10 per cent.

“Whatever Edison says cannot justify its failure to meet payment obligation. We will strongly argue who is to be blamed for the collapse in the deal,” said a SsangYong official, per the Pulse News report.

It was already looking shaky for Edison’s deal, with its creditors rejecting it in objection to the proposed debt restructuring and payment scheme and its labour union opposing it due to concerns about Edison’s viability.

The union reportedly raised concerns Edison Motors didn’t have sufficient electrification technology for use in passenger vehicles and SUVs, despite Edison’s claims it could leverage its technology to shift production of petrol- and diesel-powered models to EVs within months.

SsangYong and Edison had also reportedly been in disagreement about key acquisition issues, such as management rights and the scope of technology sharing.

Yonhap reported SsangYong’s annual financial report has already been rejected by external auditor Samjong KPMJ following the collapse of Edison’s takeover deal.

“We have doubt over SsangYong Motor’s ability to continue its business,” Samjong reportedly said in its report.

The company has posted losses every year since 2017, recording an operating loss of 260.6 billion won in 2021.

It entered court receivership in April last year, when Mahindra & Mahindra said it would no longer fund it and confirmed it wanted to sell its 74.65 per cent stake in it.

That meant SsangYong had to go into court receivership once again in its life, having gone through this process a decade earlier.

SsangYong’s home life has been troubled for years, and it never seems to have a stable parent for long.

Daewoo bought a controlling stake in the company in 1997, only to offload it in 2000 as it experienced perilous financial woes of its own.

It endured a tumultuous few years under Chinese ownership, with SAIC Motor acquiring 51 per cent in 2004 but walking away in 2009 and leaving it in receivership.

Mahindra was the next parent to adopt SsangYong, acquiring a controlling stake of 70 per cent for 523 billion won in 2011.

MORE: SsangYong: The history of a brand with an uncertain future

Go deeper on the cars in our Showroom, compare your options, or see what a great deal looks like with help from our New Car Specialists.

William Stopford is an automotive journalist with a passion for mainstream cars, automotive history and overseas auto markets.

Ben Zachariah

22 Hours Ago

Max Davies

22 Hours Ago

James Wong

22 Hours Ago

Derek Fung

24 Hours Ago

Josh Nevett

1 Day Ago

Josh Nevett

2 Days Ago