William Stopford

2026 GWM Tank 300 Hi4-T PHEV priced, significantly undercuts Denza B5

7 Hours Ago

Contributor

In the automotive industry, South Korea is best known for two brands, namely Hyundai and Kia. Starting small, both of these have become well-renowned brands building world-class cars like the Ioniq 5 and EV6.

Perhaps less well known is Korea’s third car brand, SsangYong. Founded in 1954, SsangYong splits the difference between its Korean counterparts with regard to age, being older than Hyundai but younger than its Kia counterpart.

Nevertheless, with under 3000 sales last year in Australia – where it has a subsidiary operation – the brand is dwarfed by both its compatriots in popularity, and this figure is arguably reflective of its chaotic history and an uncertain future.

With the nation partitioned and its infrastructure devastated in the aftermath of the brutal Korean War, the 1950s were a particularly difficult decade for the Korean people.

The company now known as SsangYong was first established as Ha Dong-Hwan Motor Workshop shortly after the end of this conflict. With materials and resources scarce, the firm entered business by making buses and other commercial vehicles with scrap metal from old oil drums, powered by engines from abandoned US military vehicles.

The company gradually grew over the next decade. 1966 gave the company the distinction of being the first South Korean vehicle manufacturer to export vehicles overseas when one of its buses, the HDH R-66, now making use of a Nissan chassis, was sold in Brunei, before also being exported to Vietnam.

The rest of the 1960s and 1970s saw the firm consolidate its position, continuing to build buses and tractors whilst also dipping its toes into passenger vehicles by locally assembling Jeep vehicles in partnership with US carmaker American Motors Corporation (AMC).

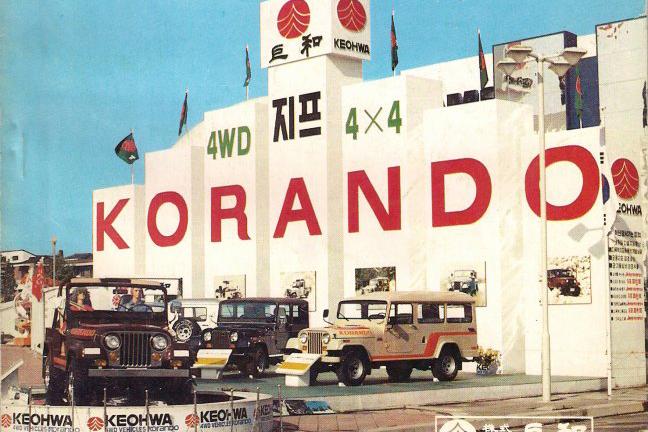

Further investment into the passenger vehicle market followed, with the development of the Jeep-derived Korando SUV and the export of vehicles to Japan.

However, the company had over-invested in its model lineup and, running out of funds, was bought by cement manufacturer SsangYong Group in 1986, with all models being produced thereafter sold under the SsangYong brand.

Newly rebranded and with increased funds, the company now known as SsangYong had ambitions for a global presence. But rather than developing the required sales channels, dealerships and technology to be competitive in-house, the firm instead agreed to a technical partnership with Mercedes-Benz in 1991.

At first glance, this appeared to be a win-win scenario for both firms, with the Korean brand gaining access to Mercedes-Benz powertrains and associated technology, as well as their global distribution network. Mercedes-Benz, in turn, would enjoy additional revenue from licensing and selling its technology to its Korean partner, and having the option of using SsangYong products to plug any holes in its existing lineup.

The first fruit of this partnership was the SsangYong Musso, an SUV offered through Mercedes-Benz dealerships locally from 1996 (but not branded as such), and available with either a 3.2-litre petrol engine with 161kW of power, or a 2.9-litre diesel engine with just 70kW of power. Both engines were able to be mated with a four-speed automatic transmission borrowed from the Mercedes S-Class of the time.

Other cars using Mercedes technology followed, including the Rexton and perhaps most notably the Chairman sedan, which was based on W124 Mercedes-Benz E-Class underpinnings but sized (and styled) to resemble the larger S-Class.

Despite the technical partnership, the firm’s finances failed to improve, and successive takeovers took place. First came fellow Korean brand Daewoo in 1997, which subsequently sold it in 2000 when its own financial situation deteriorated.

It was subsequently acquired by Chinese giant SAIC in 2004. With a dated and still uninspiring lineup, sales continued to flatline. Coupled with the onset of the Global Financial Crisis, SAIC went on a cost-cutting drive and attempted to reduce the firm’s wage bill.

Tragically, this led to the death of an employee from a cerebral haemorrhage in 2009 after workers went on strike by barricading themselves inside SsangYong’s main factory, and were subsequently denied food, water and other medicines. SAIC finally decided to sell its SsangYong business to Indian firm Mahindra & Mahindra.

SsangYong and Indian carmaker Mahindra & Mahindra may hail from different countries, but they both share a history of producing commercial vehicles, 4x4s and SUVs as their core products.

It was this experience and expertise that the Indian brand thought would pair well with its existing model portfolio when it purchased the Korean brand in 2011 for 523 billion won (approximately $500 million at current exchange rates).

Unlike the Mercedes-Benz partnership, however, it was Mahindra that sought to utilise the Korean brand’s technology to its benefit, with an initial desire to replicate some of the same success that rival Tata Motors had with its purchase of Jaguar Land Rover (JLR).

Tata had invested in JLR to increase sales compared to German rivals, and Mahindra attempted to form an analogue by transforming SsangYong into a successful Hyundai rival, both in India and abroad. Of course, ownership also meant that SsangYong platforms and technologies could form the basis for the next generation of vehicles sold directly under the Mahindra brand.

The problem with this approach was two-fold. In image-conscious India, brand reputation is everything. While Hyundai was a globally recognised name that had steadily built an Indian reputation as a manufacturer of quality, ‘affordable premium’ vehicles, SsangYong had limited recognition in Korea and virtually none outside of it.

This was compounded by Mahindra’s retail strategy for SsangYong in India. Rather than separating it into its own distinct brand with unique dealerships and upmarket sales channels, SsangYong vehicles were relegated to a Mahindra sub-brand, with new models such as the Tivoli being sold as the Mahindra SsangYong Tivoli.

Thus, Indian consumers didn’t understand how Mahindra, a marque best known for agricultural vehicles, basic SUVs and three-wheeled auto-rickshaws (tuk-tuks), could suddenly offer a lineup of more expensive ‘premium’ vehicles within the same dealership.

Making matters worse was that SsangYong products in India were sold alongside the next generation of Mahindra products (such as the XUV300) which themselves were based on SsangYong underpinnings, creating further confusion.

With a burgeoning motorcycle business and other interests, Mahindra’s management and company resources were both stretched thin, and this led to other poor decisions such as no serious attempt to enter the American market, plus an incomplete product portfolio.

While models such as the new Tivoli sold reasonably well in other markets such as Europe (and enabled the Korean firm to return a net profit in 2016, the first in nine years), the rest of the range continued to underperform. Nevertheless, global sales during 2016 were able to reach 155,844 units.

Although these figures may seem reasonable in isolation, parent company Mahindra remained dissatisfied with its Korean subsidiary’s overall performance. Hampered further by the COVID pandemic, it decided to put SsangYong up for sale towards the end of 2020.

In late 2021, SsangYong claimed it had found a new buyer, namely a consortium led by electric bus manufacturer Edison Motors, for A$331 million. However, the deal collapsed after the consortium was unable to complete its payment for the company by a March 25, 2022 deadline.

Edison Motors had previously claimed that its electric vehicle technology and know-how would allow SsangYong to quickly pivot from making combustion-engined SUVs to a range of electric vehicles.

As a result, the company currently remains mired in court receivership. While SsangYong has claimed that its intention now is to seek another buyer, it may decide to declare bankruptcy instead; doing so, however, would mean that company vendors and suppliers would remain unpaid, thereby potentially causing a ripple effect to the wider Korean automotive industry.

Alternatively, the South Korean government may elect to step in and nationalise the company through the injection of public funds.

Whichever path the company chooses will, of course, have a substantial impact on its future model lineup. Currently, SsangYong says it has largely completed development of its J100 electric SUV, potentially a spiritual successor to the original Musso SUV and slated for a June 2022 reveal.

It also intends to develop another electric vehicle, the U100, by Q2 2023. The latter will use BYD’s blade batteries under licence from the Chinese carmaker. The company has also teased a rugged-looking SUV codenamed KR10.

The company previously also had plans to build an electric Musso ute with more than 500km of range, but it’s unclear whether such a model will be produced in light of the failed takeover by Edison Motors.

Where expert car reviews meet expert car buying – CarExpert gives you trusted advice, personalised service and real savings on your next new car.

William Stopford

7 Hours Ago

Damion Smy

7 Hours Ago

William Stopford

8 Hours Ago

Damion Smy

8 Hours Ago

CarExpert

10 Hours Ago

Damion Smy

11 Hours Ago