Matt Campbell

2026 Kia Picanto review

5 Hours Ago

The semiconductor shortage is crunching supply of new cars and forcing manufacturers to sell models with a pared-back feature set. Renesas is one of the companies hit hardest by the ongoing crisis.

Contributor

Contributor

With interiors featuring large displays, and increasingly advanced autonomous driving and active safety technologies, the cars of today (and the future) are not far from being supercomputers on wheels.

Modern cars use semiconductors to enable not only advanced technologies like those described above, but also everything from air-conditioning to scrolling indicators.

This reliance on semiconductors, combined with a global shortage borne of COVID and war in Ukraine, is why some cars are being sold with a stripped-back feature set, or face lengthy delays to arrive locally.

Japanese company Renesas is one of the largest semiconductor suppliers for the global automotive industry, and consequently one of the companies at the centre of the current semiconductor pinch.

While Renesas is a relatively young company that was established in April 2003, it can trace its heritage back to Mitsubishi and Hitachi.

In 2002, Mitsubishi Electric and Hitachi decided to consolidate their semiconductor businesses (excluding their DRAM, or dynamic random access memory business, which was merged separately) into a company called Renesas.

Hitachi would initially have a 55 per cent stake in the new firm, with Mitsubishi controlling the remaining 45 per cent of shares.

Renesas is a portmanteau of RenaissanceSemiconductor for Advanced Solutions, which doesn’t say much about the rationale for its existence – to generate economies of scale by combining similar operations, improving profitability in the process.

With an annual sales revenue of approximately $US7 billion in the 2003 fiscal year, Renesas immediately became one of the largest semiconductor companies in the world. In 2010, Renesas merged with the semiconductor operations of fellow Japanese company NEC Electronics to further expand its footprint, which brought about a minor name change to Renesas Electronics Corporation (from the former Renesas Technology Corporation).

As with many other Japanese carmakers and suppliers, the Japanese earthquakes in 2011 hit Renesas hard. Although the company’s factory in Naka (Ibaraki Prefecture) was designed to be earthquake resistant, several pieces of valuable equipment were damaged, and estimates suggested it would take six months before the factory could be restored to its pre-earthquake output.

However, with the assistance of Toyota engineers who devised a ‘big room method’ that made it clear how recovery efforts were progressing, and other outside help, the company was able to restart production ahead of schedule.

More importantly, Renesas claimed it developed an improved business continuity plan that allowed it to better weather natural disasters (such as earthquakes in 2016), and set it up to manage its business during the COVID-19 pandemic.

Renesas has been at the heart of the global semiconductor shortage. CEO Hidetoshi Shibata has claimed while there is adequate production capacity to build enough semiconductors, one of the reasons for the pinch are shortages in the mining and supply of raw materials.

This has caused a flow-on effect in the production of certain types of semiconductors, especially those that use 40 nanometre transistors (processors in modern smartphones generally use 5nm) such as power management chips, and chips that process mixed digital and analogue signals.

Renesas is a publicly listed company on the Tokyo Stock Exchange, with a market capitalisation of approximately US$17.8 billion.

Renesas’ business extends beyond the automotive industry, reaching consumer electronics, along with the industrial and healthcare sectors. In the automotive space, however, Renesas primarily makes automotive microcontroller units (MCUs) and system-on-chip (SoC) products.

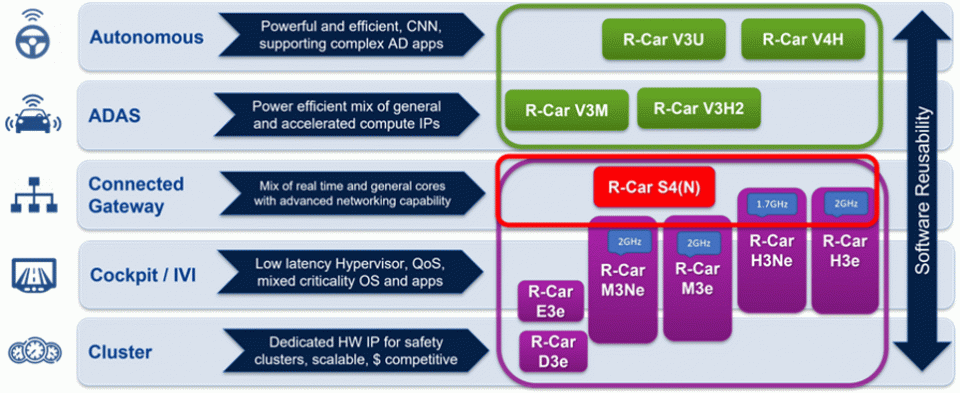

Renesas claims its ‘R-Car’ automotive SoC is designed for the ‘next generation of automotive computing for the age of autonomous vehicles’, and can power everything from advanced driver assistance systems to digital instrument clusters.

For example, Renesas claims its R-Car V4H SoC is suitable for cars equipped with Level 3 autonomous driving features, and its maximum performance of 34 trillion operations per second facilitates activities such as high-speed image recognition and processing of objects that have been identified by surround-view cameras, radar and LiDAR systems.

Renesas claims the V4H family of SoCs will also enable customers (car manufacturers) to develop cars that meet predicted Euro NCAP requirements until 2025.

Other applications for its MCUs and SoCs include controlling everything from electric power windows and HVAC (heating, ventilation and air-conditioning) systems, to LED headlight units, and electric power steering and tyre pressure monitoring systems.

Apart from MCUs and SoCs, Renesas produces electronic oscillators (devices that generate a clock signal) such as the VersaClock automotive clock generator, used to synchronise signals from various automotive systems, as well as other power management devices and automotive display processors.

The prevalence of semiconductors in a modern car, combined with Renesas’ portfolio of automotive products, means countless cars sold today use at least one Renesas semiconductor, with many vehicles likely using multiple chips.

Renesas counts major OEMs including everyone from Toyota to Tesla as key customers, with the former also being a shareholder in the company

Matt Campbell

5 Hours Ago

Ben Zachariah

21 Hours Ago

James Wong

21 Hours Ago

William Stopford

21 Hours Ago

Josh Nevett

1 Day Ago

Derek Fung

2 Days Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.