Damion Smy

Chevrolet Corvette Z06 Bathurst edition revealed for Australia

15 Minutes Ago

The Federal Government’s ambitious aims to reduce emissions and fuel usage should take place across a greater time period, says the MTAA.

Contributor

Contributor

One of Australia’s largest automotive industry bodies has called for the Federal Government to provide a longer timeframe for carmakers to meet proposed emissions regulations, citing data that reveals many won’t meet targets.

The Motor Trades Association of Australia (MTAA) publicly released its New Vehicle Efficiency Standard (NVES) submission this week, detailing its recommendations to the Federal Government about how the upcoming emissions regulations should be rolled out.

Under the Federal Government’s preferred ‘Option B’ approach, the NVES would see Australia’s emissions targets match those of the US by 2028.

The US has had its own form of standards in place since the late 1970s, while no such scheme has ever been used here.

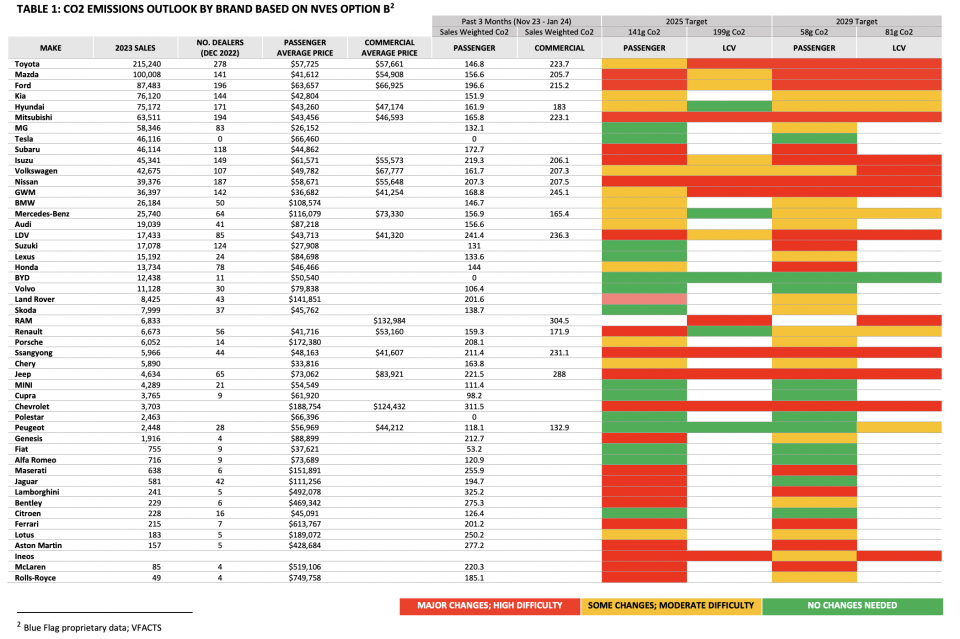

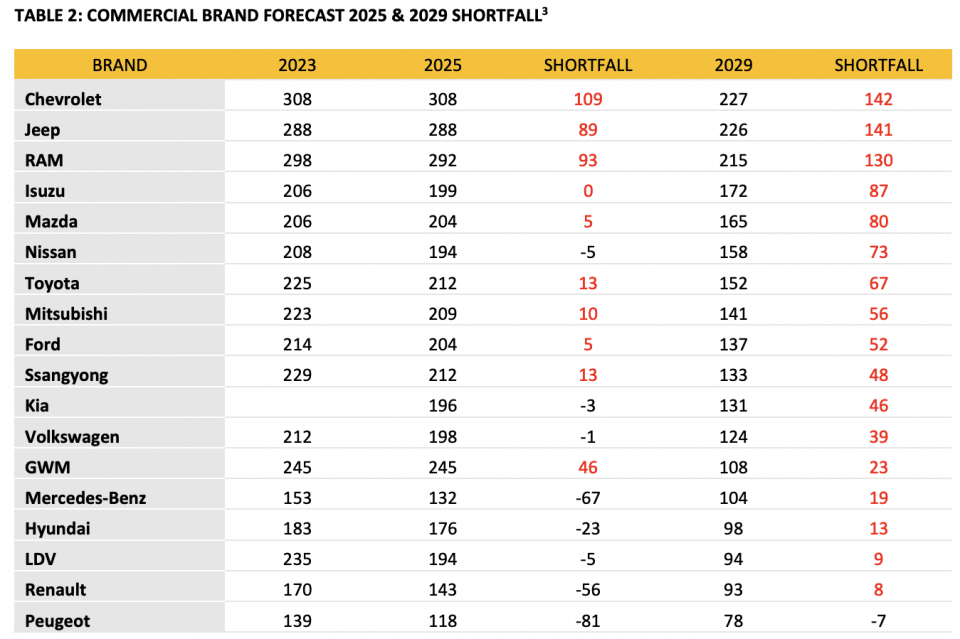

Citing data from analytics firm Blue Flag, the MTAA says 16 of 49 brands which sell cars, SUVs, utes or vans in Australia likely won’t be able to meet the proposed NVES target for both passenger and light commercial vehicles (LCVs) by 2025.

This is based on the NVES ‘Option B’, which proposes a penalty to carmakers of $100 per gram of CO2 emitted per kilometre (g/km) above its targets – 141g/km for passenger cars, and 199g/km for LCVs.

This will drop annually until 2029, when it will reach 58g/km for passenger cars and 81g/km for LCVs. It’s worth noting the Blue Flag data doesn’t denote whether SUVs are counted towards passenger vehicle or LCV sales.

Blue Flag’s data shows Chevrolet would be the worst-affected brand if the NVES Option B 2025 target was implemented against its current model lineup, which would result in it being 108g/km above the proposed regulations.

By contrast, brands which only sell electric vehicles (EVs) – such as Tesla and BYD – would be 141g/km under the target given their cars emit no CO2.

These credits can then be sold to other carmakers, which the MTAA recommends doing rather than brands paying the fixed-rate penalty.

The MTAA has warned that if carmakers don’t purchase credits from their rivals, the penalty costs will be passed on to franchise dealer owners and then new vehicle buyers.

It claims this would result in more motorists shying away from buying new vehicles, essentially reducing the number of newer and more efficient cars on the road, as well as reducing jobs in the industry it’s attempting to protect.

To prevent this, it has recommended the government provide more time for the NVES to be implemented to ensure carmakers aren’t rushing to bring in new models, given product plans are usually set years in advance.

“We fully support the introduction of an ambitious, but achievable NVES designed and implemented with a focus on Australian consumers’ needs,” the MTAA said in its submission.

“While we support the introduction of the NVES in principle, a fair transition is essential including the very real issue of regional Australia and the impacts of a fuel efficiency standard.

“The current and mid-term new vehicle fleet mix and dealer inventory also needs to be factored into the implementation of any NVES.”

Blue Flag says 14 brands don’t need to make any changes to avoid penalties based on the 2025 target, while seven require ‘moderately difficult’ changes to meet the requirements.

The remaining 12 companies have mixed results in terms of whether the emissions figure is achievable in either their passenger or LCV ranges.

However, this increases to 20 carmakers missing the proposed 2029 target across their model lineups, with 17 requiring work and 10 not needing to make changes.

Unsurprisingly, brands which have been the most publicly critical of the NVES – such as Toyota, Mazda and Mitsubishi – are among the biggest players in the market with the most work to do to reach the hypothetical target.

The data shows Toyota needs major changes to reach the 2025 LCV target, and both 2029 requirements. While Mazda’s LCVs only require ‘some changes’ to meet the 2025 figures, its passenger lineup could completely miss the mark.

Meanwhile, Mitsubishi and fellow Alliance partner Nissan are both projected to need extensive changes to reach either the 2025 or 2027 targets.

General Motors Specialty Vehicles (GMSV) – the local distributor for Chevrolet, which exclusively sells V8-powered cars and pickups in Australia – came out in support of the NVES, despite the Chevrolet brand being likely to miss the emissions target by the largest margin.

MORE: What Australia’s biggest car brands have to say about tough new emissions standards MORE: Car industry cautious about Australia’s proposed vehicle efficiency standards MORE: Tesla quits carmaker lobby group, slams it on the way out MORE: ‘Aggressive’ emissions standards will mean price hikes, hurt ‘middle Australia’ – Toyota MORE: Mitsubishi: Emissions standards can’t forget about ‘middle Australia’ MORE: Mazda pumps the brakes on Australian efficiency standards, calls for subsidies MORE: Nissan backs new emissions laws but calls for incentives, regulatory reform MORE: Carmakers, lobby groups go to war over cost of emissions standards to new car buyers MORE: Volkswagen’s wish list for Australian emissions standards revealed

Born and raised in Canberra, Jordan has worked as a full-time automotive journalist since 2021, being one of the most-published automotive news writers in Australia before joining CarExpert in 2024.

Damion Smy

15 Minutes Ago

William Stopford

23 Minutes Ago

CarExpert

1 Hour Ago

Damion Smy

2 Hours Ago

William Stopford

3 Hours Ago

Derek Fung

7 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.