Dave Humphreys

2027 Skoda Epiq review: Quick drive

8 Hours Ago

Ten years ago, Australians loved their small hatchbacks and sedans. But sales have fallen of a cliff, as this story shows.

Senior Contributor

Senior Contributor

The rise of small and medium SUVs have completely changed the buying habits of Australians, who have fallen out of love with the humble small hatchback and sedan.

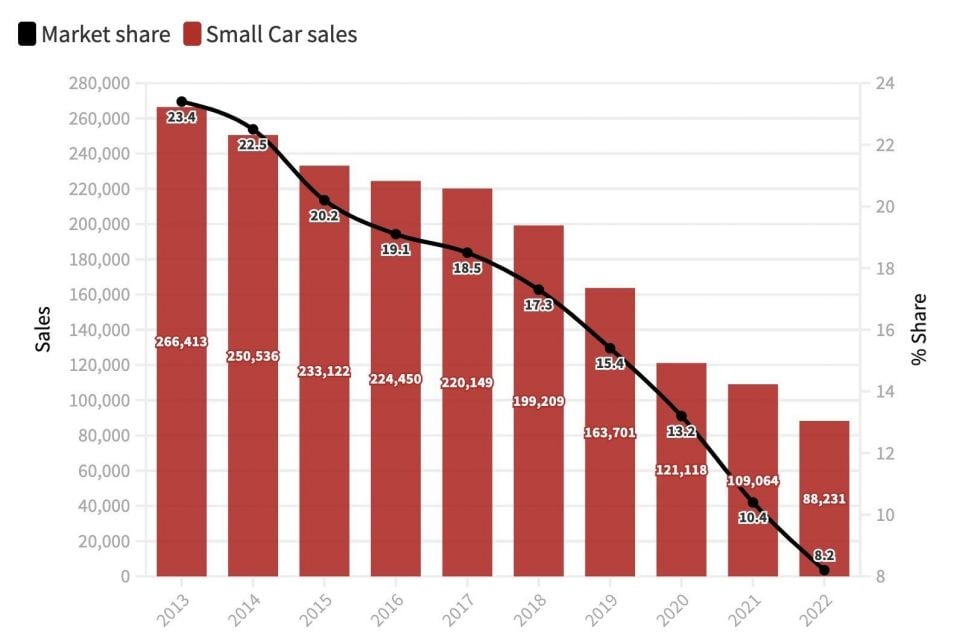

Sales of small cars have plummeted by 67 per cent in Australia over the past decade, while their overall market share has collapsed from 23.4 per cent to just 8.2 per cent.

The number of nameplates in the mix has halved to 22, and the number of brands competing there has reduced by a third to 17.

When we talk of small cars, what do we mean? Our definition is sourced from Australia’s VFACTS new car sales database, published by the car brands’ peak body, the FCAI.

Small cars sit between light cars and medium cars, and are separated from small and medium SUVs which offer greater ride height.

Everyone knows the leading small cars, which include staple nameplates such as the Toyota Corolla, Mazda 3, Hyundai i30, Honda Civic and Volkswagen Golf.

The VFACTS data splits the small car market into two pieces based on price point, with luxurious options like the Mercedes-Benz A-Class and Audi A3 in their own sub-segment.

We have included all small cars into one, to really demonstrate just how far these vehicles have fallen in a mere 10 years.

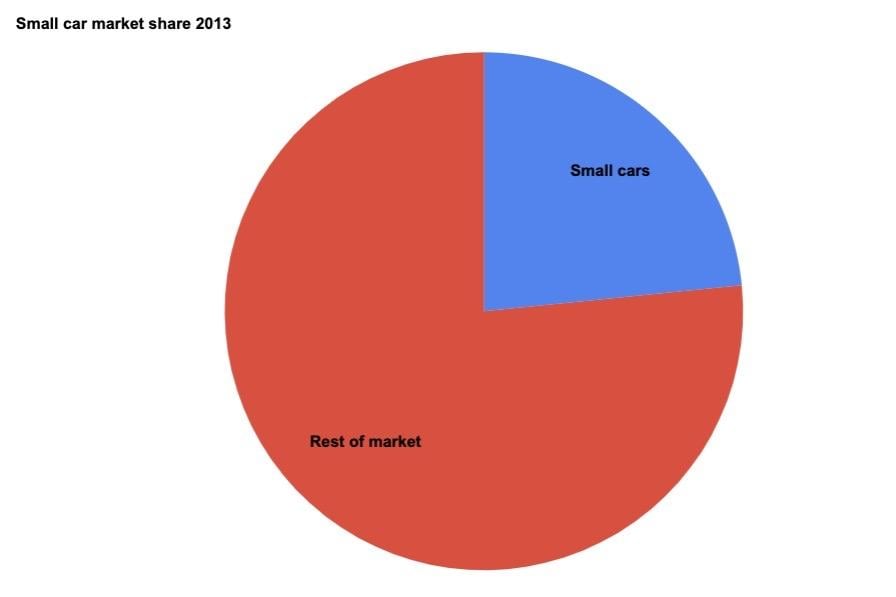

In 2013 small cars were the most popular type of car, owning a massive 23.4 per cent of the of overall new vehicle market (comprising cars, SUVs and commercials).

Seven of the top 20 nameplates that year were small cars, being the Toyota Corolla (1st), Mazda 3 (2nd), Hyundai i30 (4th), Holden Cruze (8th), Ford Focus (12th), Volkswagen Golf (14th), and Honda Civic (20th).

2013 Top 20 models:

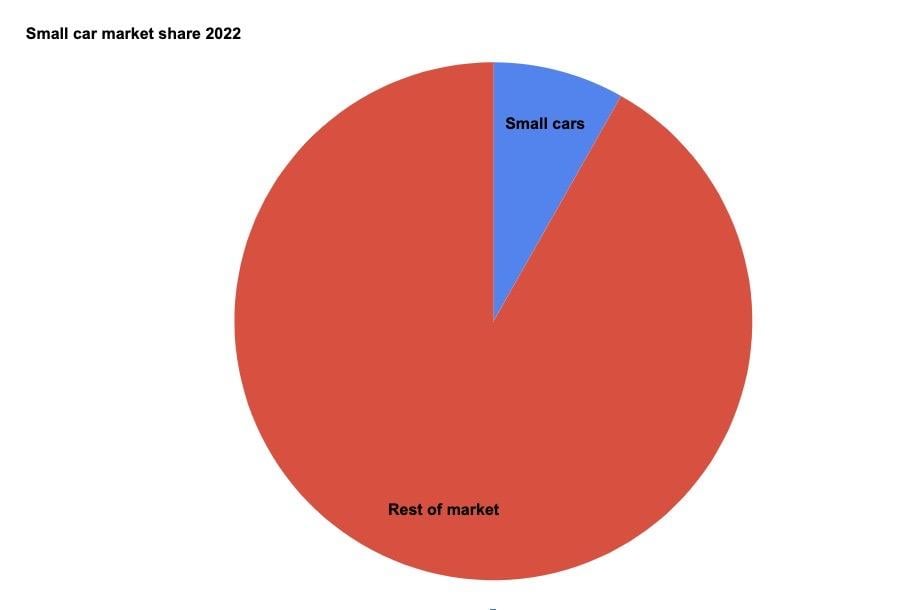

Pull forward to 2022 with the last full year of data and the market share of small cars has tumbled to a meagre 8.2 per cent. What was the number one segment a decade previous is now the number five segment – behind 4×4 utes, medium SUVs, small SUVs and large SUVs.

Only three small cars finished in the top 20 for 2022: the Toyota Corolla (6th), Hyundai i30 (9th), and Kia Cerato (19th).

2022 Top 20 models:

This table shows the steady decline in small cars both in terms of sales and market share.

Dave Humphreys

8 Hours Ago

Damion Smy

9 Hours Ago

William Stopford

9 Hours Ago

CarExpert

11 Hours Ago

William Stopford

11 Hours Ago

Damion Smy

12 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.