Derek Fung

Next Mercedes-Benz A-Class to channel some of the spirit of the original - report

2 Hours Ago

Electric vehicle startup Faraday Future’s “biggest hurdle” to securing the funding it requires to survive has been removed.

A Californian judge has approved a bankruptcy plan for its founder seven months after it was filed in court.

The decision means controversial entrepreneur Jia Yueting can begin a Chapter 11 reorganisation plan to pay off his US$3.6 billion ($5.5 billion) debt.

The majority of people to whom Yueting owes money have agreed to switch their debt claims for pieces of the founder’s ownership stake in Faraday Future.

Much of the debt comes from Yueting’s failed aspirational “Netflix in China” technology business, LeEco. He was put on the official debtor blacklist in China and the government ordered him to face his creditors.

He fled China in 2017 to escape billions of dollars in debt after LeEco’s demise.

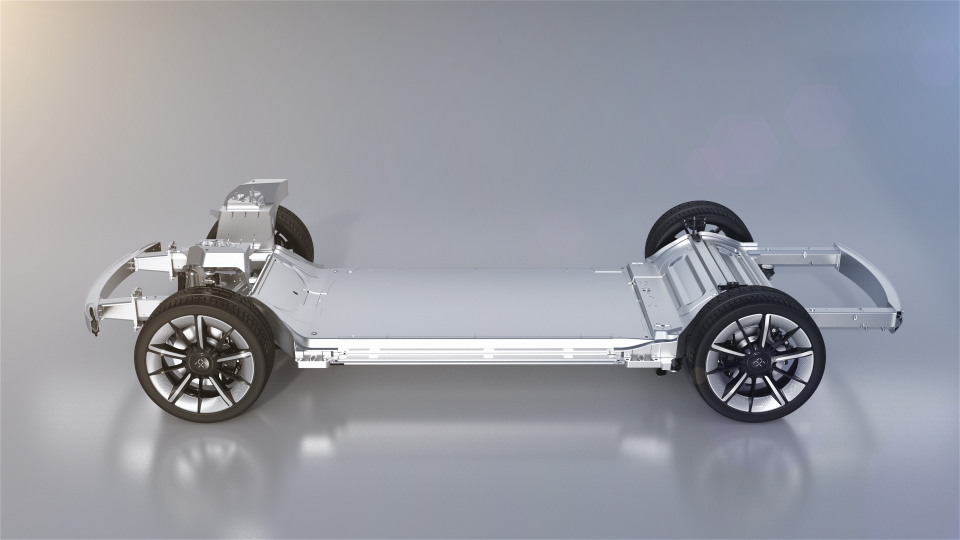

Faraday Future has spent more than US$1.7 billion – US$900 million from former founder Yueting’s personal bank account – developing its first car, but hasn’t yet started manufacturing the much-hyped FF91 luxury SUV.

With more certainty about its founder’s finances following the court decision, Faraday Future says the “biggest hurdle” in its attempts to raise capital and continue developing its cars has been removed.

When the FF91 debuted at the Consumer Electronics Show (CES) in 2017, the company was already struggling with unpaid bills, and was rapidly losing key senior employees.

Since its inception in 2014, Faraday Future has made headlines for poaching talent from SpaceX, Tesla, Apple, Ford, Ferrari, and BMW with its bold vision.

On the other hand, Yueting’s reportedly self-absorbed personality, poor financial skills, and abrasive managerial style have caused problems.

Today, Faraday Future is run by CEO Carsten Breitfeld, who was responsible for the BMW i8 plug-in hybrid sports car and helped found Chinese EV startups Byton and Iconiq Motors.

Breitfeld wants the brand to return to CES in 2021 with a new, smaller vehicle on a second-generation platform tailored for ride-sharing rather than private buyers – but it needs another US$850 million to make it happen.

Despite Faraday Future’s woes, Breitfeld believes the company will disrupt the transportation industry with its in-house battery technologies, electric drivetrains, intellectual property, and other assets.

Yueting still has a role in Faraday Future as a “chief product and user officer”, but supposedly has less control of the company’s operations.

If the FF91 launches by its target at the end of this year, it will be made in California and priced between US$150,000 ($230,000) and US$200,000 ($307,000). It will primarily focus on the affluent Chinese market.

The company got a short-term cash injection by selling land in Nevada where it planned to build its own factory, along with leasing its Los Angeles headquarters.

It continues to borrow money from restructuring firm partner Birch Lake, and recently received a US$9 million loan from the US government’s small business package due to the COVID-19 pandemic.

Speaking with Bloomberg, Breitfeld says funding is “a bit delayed” from investors due to Coronavirus.

Derek Fung

2 Hours Ago

James Wong

8 Hours Ago

Damion Smy

13 Hours Ago

Damion Smy

14 Hours Ago

Ben Zachariah

16 Hours Ago

William Stopford

17 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.