Josh Nevett

2026 Mercedes-Benz E-Class review

3 Hours Ago

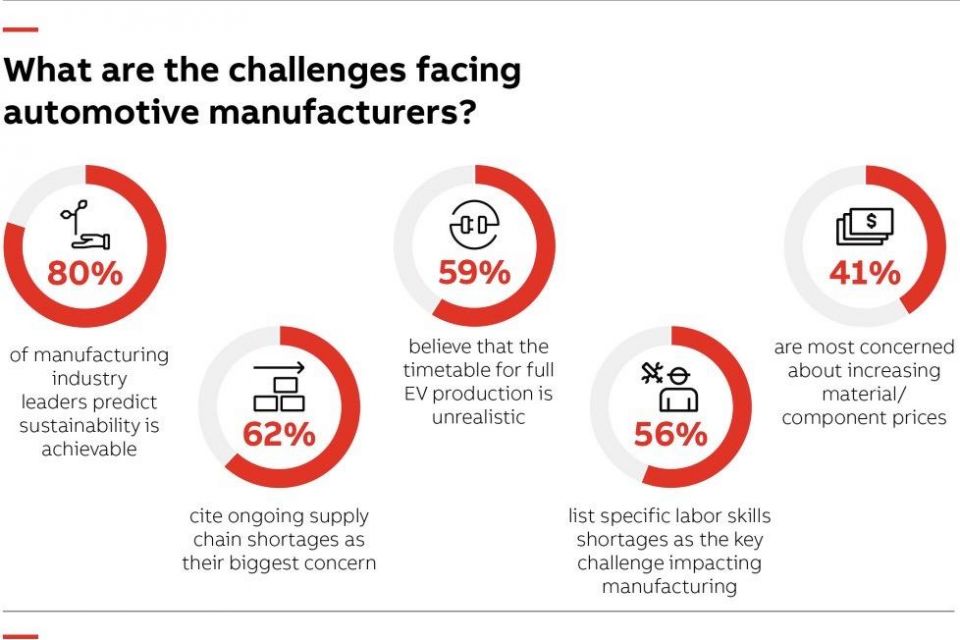

A new survey of car company and supply chain insiders found 59 per cent see current 2030-2040 EV targets as unrealistic.

Senior Contributor

Senior Contributor

A startling proportion of the car industry is skeptical that current government-led electric vehicle targets across much of the globe, are unrealistic in the current context.

This is one finding from the latest global Automotive Manufacturing Outlook Survey commissioned by ABB Robotics and industry publication Automotive Manufacturing Solutions.

From a survey of around 600 value-chain workers, 59 per cent responded that the shift to zero-tailpipe-emission (largely EV) production required by governments in Europe and the US “is not achievable within current legislative timelines”.

The European Union wants to phase-out new cars with combustion engines by 2035, with fights over allowing e-fuels still a roadblock to legislation. The same timeline has been put forward for US states California and New York.

Although 28 per cent of survey responders expressed the opinion that these sort of deadlines were achievable, they also indicated there would be “significant challenges”, while 18 per cent believed the present targets “would never be met”.

Only 11 per cent believed that all regional targets for EV adoption by 2030-2040 were realistic, the survey summary added.

The respondents flagged major challenges involved with adapting to a battery supply chain, the intense levels of capital investment required, current shortages of raw materials, suitable infrastructure, and even grid capacity.

The survey ended up with 590 respondents – a high proportion being managerial – tasked with examining current trends in automotive manufacturing, from most major car-making regions. Respondents work for OEMs, design and engineering firms, and key parts and services suppliers.

When questioned about delivering sustainable (net zero) manufacturing plants, industry leaders were far more positive, with 80 per cent predicting sustainability was achievable in this area.

Another fascinating take-away from the latest survey was a growing view that supply chain disruptions and ever-rising material costs were causing the global automotive industry to re-evaluate core manufacturing principles.

This might even mean shifting from the well-known ‘just-in-time’ ethos to ‘just in case’ tactics, with manufacturers holding more component stock to protect against unplanned disruptions.

Nearly two thirds (62 per cent) of respondents cited ongoing supply chain concerns when asked to select their top three challenges to automotive manufacturing, 41 per cent cited the impacts of material and component price increases, and 31 per cent pointed to growing labor costs and shortages.

The survey also revealed how manufacturers were turning to “increased stock-holding and bulk material purchasing to limit their exposure to disruption elsewhere in the supply chain, while working with a wider network of suppliers to ensure sufficient availability of parts”.

Josh Nevett

3 Hours Ago

William Stopford

19 Hours Ago

Josh Nevett

19 Hours Ago

Max Davies

19 Hours Ago

Shane O'Donoghue

1 Day Ago

Derek Fung

1 Day Ago