Ben Zachariah

2026 BYD Sealion 5 Essential review

1 Hour Ago

The Japanese and the Koreans have come to dominate the Australian new car market, but they’re not infallible.

News Editor

News Editor

Hyundai and Kia are top 10 brands today, but another Korean up-and-comer came and went.

Lexus continues to put the fight to the German big three, but another Japanese luxury brand found its time in Australia to be finite.

And Toyota appears to be finding success with its GR and GR Sport-branded cars, but locally-engineered, blown V6 models proved a bust.

Let’s look at three more brands that left the Australian market in the past 25 years.

This is the third instalment in a feature series. You can read Part 1 here and Part 2 here.

Years sold: 1994-2004 Models sold: 1.5i, Cielo, Espero, Matiz, Lanos, Kalos, Nubira, Lacetti, Leganza, Tacuma, Korando, Musso

Hyundai launched in Australia in 1986, opening the door for other Korean automakers, and yet it took almost a decade for Daewoo to make its way here. Its only model at first was the 1.5i, a scarcely changed 1984 Opel Kadett E/Vauxhall Astra.

That model had never been sold here so the unimaginatively-named 1.5i was an old if unfamiliar-looking vehicle to Australians, if not to residents of New Zealand and North America as GM had sold the Daewoo-built version there as a Pontiac LeMans.

As the name suggests, it was offered only with a 1.5-litre four-cylinder engine, which produced 57kW of power and 127Nm of torque, mated with either a five-speed manual or three-speed automatic. The 1.5i was sold here as a three- or five-door hatch or four-door sedan, but in only a single trim level.

Being based on the Opel/Holden Astra’s predecessor, it was a bit bigger than similarly-priced rivals like the Ford Festiva albeit similar in size to the hot-selling Hyundai Excel. Unusually, the Australian-market model missed out on a facelift afforded to overseas variants in 1993.

The 1995 Espero also used old Opel mechanicals, however it was cloaked in crisp styling for which Bertone was largely responsible and had first been pitched to Citroen. However, it still looked old and indeed it was, having been launched in Korea in 1990.

Priced slightly below the rival Hyundai Sonata, the Espero was available in a single trim level with a naturally-aspirated 2.0-litre four (84kW/164Nm) and a choice of five-speed manual or four-speed automatic transmissions.

Daewoo sales rose from 2482 in 1994 to 4145 units in 1995, helped by the brand’s Freecare package. This gave buyers free servicing for the length of Daewoo’s three-year, 100,000km warranty. An Australian Cattle Dog also featured prominently in advertising, a whimsical touch.

Sales surged in 1996 to 12,960 units solely on the back of the Cielo, a restyled version of the 1.5i with an optional twin-cam 66kW/137Nm 1.5-litre, with Espero sales flat in its sophomore season. This was a prelude to greater success for the Daewoo brand.

1997 brought a complete revitalisation of the brand. The dated Cielo and Espero were phased out, and in their place was an entirely new line-up developed by Daewoo and featuring Italian styling.

The curvaceous Lanos succeeded the Cielo as Daewoo’s rival for the likes of the Hyundai Excel and Ford Festiva, and was available in three- and five-door hatchback and four-door sedan body styles. The engine was once again a naturally-aspirated 1.5-litre four-cylinder (63kW/130Nm or 78kW/145Nm), mated with either a five-speed manual or four-speed automatic.

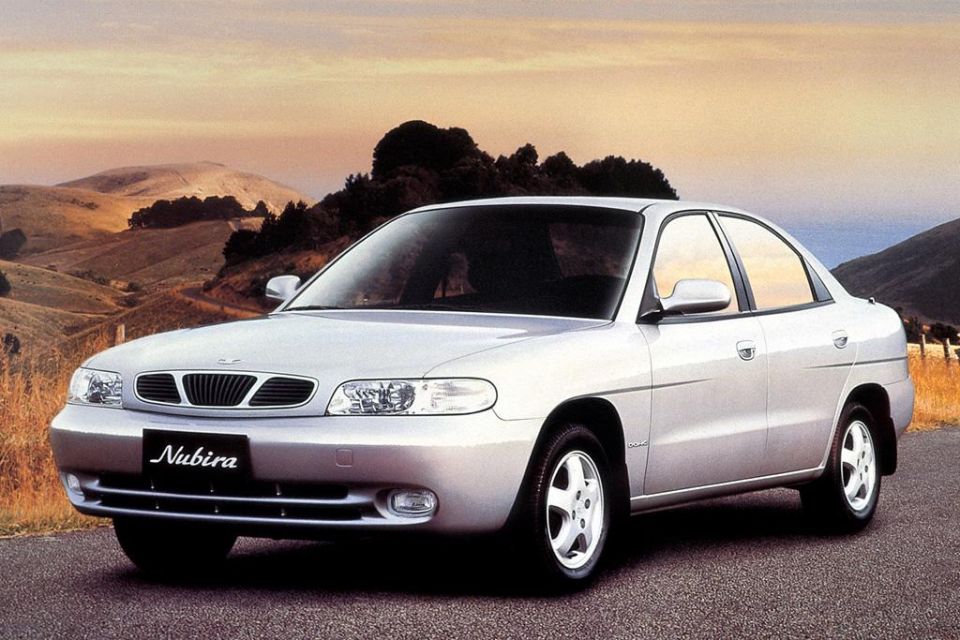

The new Nubira was a more direct rival for the likes of the Hyundai Lantra, also offered with four-door sedan and five-door wagon body styles; a stubby-looking five-door hatchback was sold from 1998 to 1999, with a rare EuroSunHatch variant packing a power-folding panoramic fabric sunroof.

Like the old 1.5i and Espero and despite its new, independently-developed platform, the Nubira used GM-developed engines: a 78kW/145Nm 1.6-litre in the base SE and a 98kW/185Nm 2.0-litre in the CDX.

Finally, the Leganza took over from the Espero as the brand’s flagship sedan, rivalling the likes of the Hyundai Sonata and Kia Credos. It shared its 2.0-litre engine with the Nubira, though Daewoo upgraded to a 100kW/191Nm 2.2-litre in 1999. This was a slightly different tune to that found in the Holden Vectra, though both cars’ engines were manufactured in Melbourne.

The Lanos and Leganza were styled by Giorgetto Giugario at ItalDesign, the latter influenced by the earlier Jaguar Kensington concept of 1990 which had in turn influenced the first-generation Lexus GS/Toyota Aristo not sold here.

The Nubira wasn’t penned by Giugario but was designed at the I.DE.A Institute, responsible for vehicles like the 1993 Lancia Delta.

While all wore fresh styling and used new platforms developed under Daewoo’s vice president of engineering Ulrich Bez, formerly of BMW and Porsche, none were class-leading.

The Leganza was arguably the best of the lot, with the Lanos and Nubira feeling underdone dynamically – our family had both a Nubira and a ‘97 Astra and the latter had ride and handling vastly superior to that of the former, despite a platform several years older.

Sales climbed to 16,509 units in 1997, and the first full year of the new Daewoo line-up saw the brand’s sales reach their highest ever point: 21,772 units. But here, Daewoo plateaued. That was despite Daewoo’s acquisition of a controlling stake in SsangYong in 1997, which led to the rebadging of the Musso and Korando as Daewoos in 1998 – the latter was a huge flop, discontinued quickly after logging just 113 sales.

The line-up also expanded in 1999 to include the Matiz light hatch – which used an Italdesign design Fiat rejected for the Cinquecento plus a 0.8-litre three-pot – and in 2000 to include the new Tacuma, a small, Nubira-based MPV. Daewoo had its largest model line-up yet, spanning from an $11,000 city car to a $39,000 SUV, but, unfortunately for the brand, word had gotten out about its troubles back home.

The company had been teetering on the brink since the 1997 Asian financial crisis, and its finances had gotten dire. Its parent conglomerate went bankrupt in 1999 and the auto division was forced to offload SsangYong in 2000. After unions rejected a restructuring process that would result in thousands of layoffs, it declared bankruptcy the same year.

Talks with Ford had gone nowhere, but Daewoo had been in discussions with General Motors about an acquisition. GM ended up buying the bankrupt company in 2002 for US$1.2 billion, and eased tensions in Korea by hiring back laid-off workers.

Australian sales almost halved to 11,318 units in 2001, slipping further to 9377 units in 2002. While Daewoo models were already being rebadged under GM nameplates in other markets, the Daewoo brand carried on for a little while longer in Australia.

The Kalos sedan and hatch replaced the Lanos in 2003, with the Lacetti sedan replacing the Nubira the same year. Neither could arrest Daewoo’s sales slide, and in June 2004 GM pulled the plug on the brand in Australia. Its final annual tally was just 5514 sales, with 134,251 Daewoos in total sold over the brand’s decade-long run.

The Kalos reappeared in 2005 wearing Holden Barina badges, replacing the critically-acclaimed XC Barina. The Korean replacement wasn’t as good, but it looked fresh and could be sold at a much lower price.

The Lacetti reappeared in 2006, badged as the Holden Viva and now also available as a hatch, sedan and wagon, offering Holden buyers a second small car option. Finally, Holden introduced the Epica in 2007 as a replacement for the Vectra.

This was a rebadged Daewoo Tosca, a replacement for the Leganza-replacing Magnus; like the Magnus, it was rather unusual in featuring transverse-mounted 2.0-litre and 2.5-litre inline six-cylinder engines designed by Porsche. If only the styling was half as memorable.

Daewoo never really died, with its final independently developed models rebadged by General Motors not only as Holdens but also as Chevrolets in markets like Europe and North America and even as Suzukis in North America.

The Korean automaker became GM Daewoo after the 2002 buyout, and was later reestablished as GM Korea in 2011. Models have continued to be developed and manufactured in Korea, even as the Daewoo name has been gradually withdrawn globally – even in its home market, GM Korea models are badged as Chevrolets now.

Years sold: 2012-20 Models sold: Q30, QX30, G37, Q60, Q50, M/Q70, FX/QX70, QX80

Genesis executives must be pretty tired of the “I” word.

As the latest luxury brand to enter the Australian market, they’re often asked – both obliquely and directly – how they’ll avoid the same fate as Infiniti, Nissan’s luxury brand which withdrew from Australia just as Genesis was setting up shop.

Infiniti came to Australia in 2012 as part of a global push by Nissan of its luxury brand, also crossing the pond to Europe. But this 21st century effort wasn’t the first time Infiniti had come to Australia. A much more half-hearted effort had been launched in 1993 with four Nissan dealerships nationwide tasked with selling the slick, V8-powered Infiniti Q45.

This wore a lofty price tag of $133,935, which was around $7000 less than a Lexus LS400 and almost $50,000 less than a BMW 740iL (and in line with a 540i) but a whopping $60,000 more than the next most expensive model in Nissan showrooms, the 300ZX.

While Infiniti was a full-fledged separate brand in the US, the market it was developed for, the Q45 was marketed here as a “Nissan Infiniti” and shared showroom space with more price-conscious fare like the Pulsar.

Perks for buyers included three years of free servicing plus complimentary Maxima loan cars – despite the Nissan badge, the Maxima was sold in the US as the Infiniti I30 so it’s not like owners were being given Pulsars. Still, the presence of the Q45 in Nissan showrooms was evidently a deterrent to luxury car buyers.

Nissan projected 10 monthly sales, roughly half that of the LS400. It didn’t come close – over four years, Nissan sold around 132 Q45s. In 1995 alone, Nissan mustered only 11 sales. In comparison, Lexus’ best year for the LS400 resulted in around 400 sales. The Q45 was axed locally in 1996.

Though the brand was more successful in the US, it fell on hard times in the late 1990s. It took the first-generation G35 and FX SUV of the early 2000s to really reinvigorate the brand, which had been on death’s door.

During the 2000s Infiniti dropped its slow-selling Q45 and Nissan Maxima-based I35, introduced a new BMW 5 Series rival called the M35/M45, and replaced its QX4, a rebadged Pathfinder, with a restyled Nissan Armada called the QX56.

It was the closest thing to a straight rebadge as Nissan’s luxury brand moved away from that practice and instead embraced more focused models targeted directly at the European luxury leaders.

Infiniti continued to focus on the key US market during this boom time but decided to go global in the 2010s, by which point it was onto its second-generation G and FX and third-generation M.

Though Infiniti had reportedly weighed entering Australia in the late 2000s, the Global Financial Crisis derailed these plans much as they did for General Motors’ Cadillac brand.

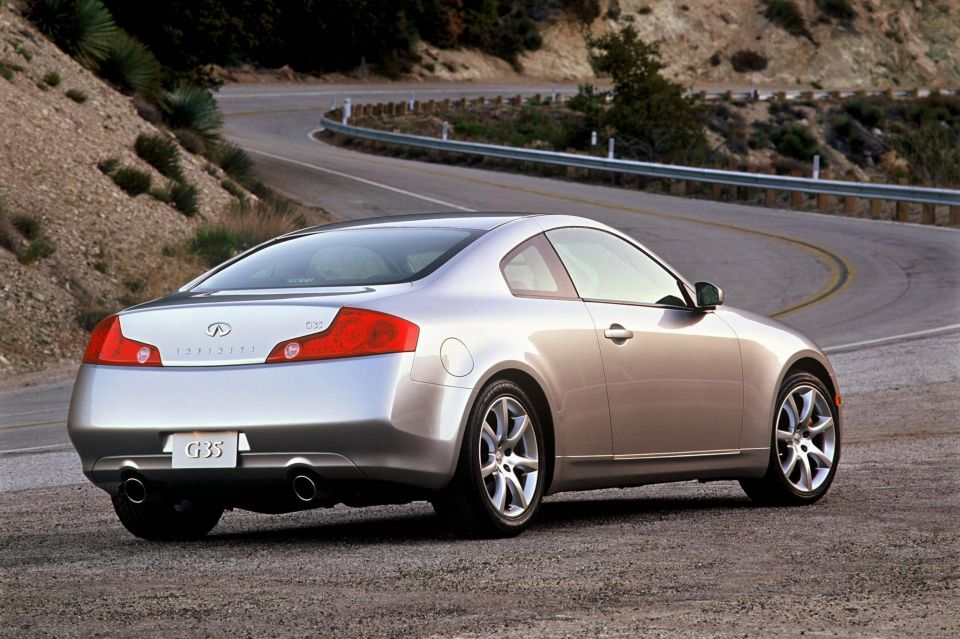

Instead, Infiniti arrived in 2012. The local range consisted of the G37 coupe and convertible, M30d, M35h and M37 large sedan, and the FX37, FX30d and FX50 crossover.

All of these models used the rear-wheel drive FM platform that also underpinned the Nissan 370Z, complete with double-wishbone front and multi-link rear suspension; the FX, uniquely for the Australian line-up, came with all-wheel drive.

None were brand new. The G37 coupe had been in production since 2007, the second-gen FX since 2009, and even the M had first gone on sale in the US in 2010.

The luxury brand employed a slow burn approach, touting its focus on “quality not quantity” and launching with only three dealerships in its first year, all separate from Nissan’s – you can see why people are drawing comparisons between Genesis and Infiniti, then.

Much as Genesis’ Australian CEO announced he was targeting a 10 per cent share of the luxury car market, Infiniti also set the same goal. It was part of a broader goal directed by Nissan CEO Carlos Ghosn of reaching 10 per cent share of the global luxury car market, or 500,000 annual sales.

While COVID wasn’t yet around to delay Infiniti’s dealership rollout like it did Genesis, Infiniti wasn’t without its hurdles – the franchise initially signed to handle Infiniti in Melbourne backed out, forcing the brand to find another.

Sales were slow at first, with just 304 in its first full year on the market, 2013. Infiniti responded that year with significant price cuts – between $7500 and $10,000 off the FX range, around $10,000 off every M, and a minimum of $10,000 slashed from every G37. The M also had its prices cut by several thousand more the following year.

Confusingly, almost immediately after Infiniti was launched locally it changed its global naming structure. This coincided with the appointment of former Audi CEO Johan de Nysschen as the brand’s head; he would leave two years later for Cadillac. Prior to his appointment, Infiniti also announced it was shifting its global headquarters to Hong Kong.

All models would receive a two-digit number signifying their position in the line-up, rather than what was under the bonnet, and this was prefaced with ‘Q’ for passenger cars and ‘QX’ for SUVs.

The M therefore became the Q70, the FX the QX70, and the G37 the Q60, with the new names rolled out in Australia during 2014. Q was an important letter for Infiniti, with the Q45 having been its first model.

It replaced a rather haphazard naming structure where, like Lexus, the letters in a car’s name didn’t really mean anything, however it created some confusion – the Nissan Pathfinder-based JX not sold here, for example, was renamed the QX60 but was of no relation whatsoever to the Q60 coupe and convertible.

While a BMW 3 Series-rivalling sedan wouldn’t arrive until early 2014 with the G37-replacing Q50, still on the FM platform, Infiniti had a decent spread of models and, most interestingly, a lineup that included hybrids, turbo-diesels and even a 287kW/500Nm 5.0-litre petrol V8 in the QX70.

Sadly, the Q70 wasn’t available here with its 313kW/565Nm 5.6-litre V8, but its 268kW/547Nm hybrid V6 was no shrinking violet.

The aforementioned Q50 replaced the G37 sedan never sold here, and packed a choice of two Mercedes-sourced turbocharged four-cylinder engines: a 2.0-litre petrol and a 2.1-litre diesel.

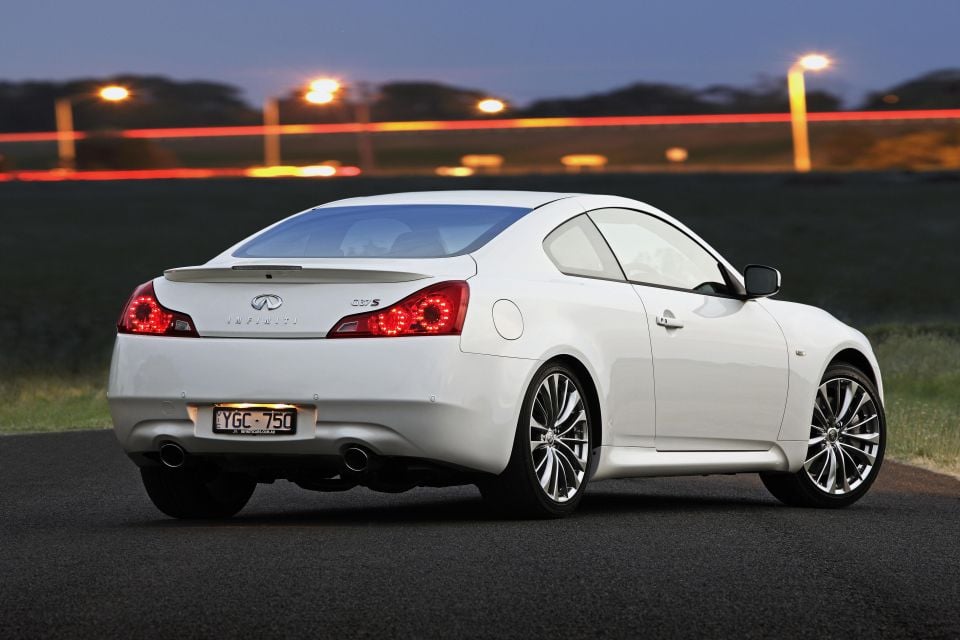

Infiniti belatedly introduced the Patrol-based QX80 in 2015 as a rival for the Lexus LX, while the following year was a bumper one for Infiniti. A redesigned Q60 coupe joined the range, based on the Q50 (no droptop this time), while Infiniti also introduced a new entry-level product in the Q30 and QX30 hatchback twins.

Part of a platform and technology-sharing deal with Mercedes-Benz that had given the Q50 its Benz engine, these models – confusingly both marketed as crossovers – shared the MFA platform with the Mercedes-Benz A-Class and GLA. It finally gave Infiniti a smaller SUV, with the first-generation, G37-based QX50 (nèe EX) not sold here.

Most enticingly, the Q50 and Q60 would receive a new twin-turbocharged 3.0-litre V6 engine in 2016. Not that the Q50 was wanting for performance, with its existing 225kW/350Nm 3.5-litre V6 hybrid doing the 0-100km/h dash in just 5.4 seconds.

The new twin-turbo was offered in two states of tune: one with 224kW and 400Nm, and a hotter one in the new Red Sport grade with 298kW, 475Nm and a sub-5 second 0-100km/h time. A pity the steer-by-wire system marred driver engagement.

Infiniti’s model range was growing but its diesel options were simultaneously being thinned – the Q70 and QX70’s Renault-developed V6 diesel was gone by the end of 2016, and the Q30 and Q50’s Mercedes-sourced diesels were axed in 2018.

While the important QX70 was being left to wither on the vine globally with no updates of consequence (and left with a dated, Nissan-like interior), Infiniti had a glut of new product and sales reached their zenith with 807 units in 2016. Then, they went backwards.

The dealership network began to shrink after reaching a total of 10 locations. The Brisbane showroom, one of its three original locations, was shuttered in 2017 and a Sydney showroom closed in 2018. Prices were slashed in 2018 by up to $7000 on the Q30/QX30, $5000 on the Q50, and $4000 on the Q60.

It wasn’t just in Australia where Infiniti failed to fire. The UK-built Q30/QX30 twins that were supposed to grow the brand in Europe didn’t resonate with buyers there, and the brand’s sales halved in 2018.

In March 2019, Infiniti announced it would be leaving Europe and the UK after around a decade on the market. Going against the Germans in their own neighbourhood was always going to be tough – just ask Lexus, which has a much smaller share of the luxury market there than here – but it had proved too much of a hurdle for Nissan’s luxury brand.

Infiniti’s dithering on a right-hand drive version of the second-generation QX50 was arguably the clearest indication the brand had no future in Australia. Here was a completely fresh product in one of Australia’s best-selling premium segments and yet a right-hand drive version wasn’t assured.

In September 2019, Infiniti announced it was packing up shop in both Australia and New Zealand, which it said was due to the lack of a viable business case moving forward; it had only launched in NZ in 2017.

All up, Infiniti sold 4404 vehicles in Australia between its launch in 2012 and the last remaining stock leaving showrooms in 2020.

The brand arguably never really staked a claim as to why buyers should consider it over stalwart Lexus or the dominant Germans. It had launched with a dated coupe and convertible, a sleek SUV halfway through what proved to be a long lifecycle, and a fresher (by comparison) sedan in a fairly low-volume segment.

With its withdrawal from markets like Australia and Europe, Infiniti has refocused on the US – the market it was originally created for – and China. But its sales are sliding in the US, plans for performance production models like the Q50 Eau Rouge and Q60 Project Black S have never eventuated, it doesn’t sell any EVs, and models like the Q50, Q60 and QX80 are showing their age.

It’s even gone backwards in terms of electrification, with the Q50’s hybrid option following the Q70 hybrid (and the entire Q70 line) to the automotive graveyard. Plans to have a range of electrified vehicles by 2021 never saw fruition.

Its QX50, QX55 and redesigned QX60 crossovers are pleasant enough but share a great deal under the skin with less expensive Nissans; in fact, Nissan’s COO has said, moving forward, the brand will be “Nissan-plus”.

The likes of Cadillac, Lexus, Lincoln, Volvo and arguably even Acura have a more defined brand identity and promising future, let alone upstarts like Genesis. The brand seems just as rudderless as it did in the late 1990s.

Years sold: 2008-09 Models sold: HiLux, Aurion

Though an enormously popular brand, Toyota had acquired a reputation for being rather staid by the late 2000s. The Celica and MR-2 had been axed in 2005, and Toyota was looking for something new to appeal to enthusiasts and chase off the ‘beige Avalon’ stigma.

Consisting of two models with supercharged petrol V6s, TRD was a homegrown counterpart to the likes of HSV and FPV if not, as Toyota insisted, a direct rival. It first previewed a hotter version of the Toyota Aurion in late 2006, following in early 2007 with a hotter HiLux.

The TRD Aurion was launched first in 2007, packing an impressive supercharged version of Toyota’s 3.5-litre petrol V6 with 241kW of power at 6500rpm and 400Nm of torque at 4000rpm, mated with a six-speed automatic transmission. These outputs were up 37kW and 64Nm on the already punchy Aurion V6, if on 98RON premium unleaded fuel, and knocked the claimed 0-100km/h time from 7.4 to 6.1 seconds.

There was just one other problem: it was still front-wheel drive. Like the TMR 380, of which just 20 were built before Mitsubishi announced the end of local production, the TRD Aurion stuck with the drive layout of the car it was based on.

Over-powered front-wheel drive sedans seemed to be having a brief moment in the sun. The TMR 380 pumped out 230kW and 442Nm, also from a blown V6. Around the same time in the US, General Motors was doubling down on its decades-long fascination with front-wheel drive V8s by shoving a 226kW/438Nm 5.3-litre small-block in its similarly-sized Buick LaCrosse, Chevrolet Impala, and Pontiac Grand Prix.

Tweaks for the TRD Aurion included larger brakes, stickier Dunlop SP Sport Maxx tyres, stiffer springs and firmer damping, and a 12mm lower ride height, though its stability control calibration was reportedly unchanged and there was no limited-slip differential. Ultimately, however, that much power to the front wheels is a recipe for torque steer and axle tramp.

After a slight delay, the TRD Aurion entered showrooms in August 2007… only for Toyota to almost immediately suspend sales due to one of the first vehicles blowing its engine. A few months after resuming sales, which were proving to be slow, Toyota slashed the prices of the two-model TRD Aurion range by $4000 and $4500, respectively, and made them available at all Toyota dealerships instead of a select few.

It was still pricier than a more powerful (270kW/533Nm) if less well-equipped Ford Falcon XR6 Turbo, however, and lacked the all-paw traction of the admittedly less powerful Subaru Liberty GT Spec.B and Volkswagen Passat R36 that TRD said it was targeting.

The TRD Aurion had a handsome bodykit and came quite well-equipped, and there were grippy front sports seats and a red leather-and-suede upholstery in the 3500S (full leather in the 3500SL). Against a XR6 Turbo, though, it wasn’t a performance bargain.

The TRD HiLux had essentially no direct competition. The basic concept was arguably ahead of its time, as utes reach further upmarket – look at the Walkinshaw-tuned Amarok W580S, for example, or the more off-road-oriented Ford Ranger Raptor.

In a time when “performance” ute meant a HSV Maloo or Ford Falcon XR6 Turbo, however, the dual-cab TRD HiLux was unusual.

Like the TRD Aurion, it took an existing V6 – the HiLux’s 4.0-litre unit – that was then supercharged, part of a joint effort by TRD Australia, Toyota US and Eaton supercharger distributor Magnuson Products.

Total outputs were 225kW of power at 5400rpm and 453Nm of torque at 3400rpm – up 50kW and 77Nm – and the only transmission was a five-speed automatic.

The TRD HiLux received stiffer springs, Bilstein dampers and larger front brake rotors, although like the HiLux it was based on it lacked stability control and still had rear drums. Engineers didn’t mess with the HiLux’s off-road ability too much, with approach and departure angles unmarred and the 4000SL packing shift-on-the-fly four-wheel drive with a locking centre differential.

You paid $10-15,000 more than the HiLux SR5 on which the TRD HiLux was based, putting it lineball with the V8-powered HSV Maloo R8. The Maloo may have only seated two but it was around two seconds faster to 100km/h than the TRD HiLux, which took 7.2 seconds.

While Toyota Australia had spoken about a third TRD model joining the line in early 2008, by the end of the year it announced local TRD production would be ending the following March. At the time of the announcement, a total of 888 TRDs had reportedly been produced: 537 Aurions and 351 HiLux utes.

In announcing its closure, Toyota Australia boss David Buttner said he hadn’t expected the sub-brand to be profitable in the short-term – which was good, as it wasn’t – but the global financial climate had forced Toyota to reevaluate its expenditure.

In shuttering TRD’s local operation (the name continued globally), Toyota Australia was conceding defeat. It had proved to be one of the rare misfires by mighty Toyota.

Each of these three brands failed for different reasons.

Daewoo may have folded due to troubles at home, but its vehicles went on to enjoy some success as Holdens – success that arguably proved a double-edged sword for the now defunct GM brand.

Infiniti had some good products, but never seemed to find its footing here – its most distinctive product, the QX70, was left to wither, the QX80 arrived late, and there was a lack of SUV product in a market growing fonder of SUVs by the day.

Then there was TRD, which presaged today’s super dual-cab utes with its souped-up HiLux but suffered from poor timing.

In the next instalment, we’ll look at more brands that have failed over the past 25 years.

William Stopford is an automotive journalist with a passion for mainstream cars, automotive history and overseas auto markets.

Ben Zachariah

1 Hour Ago

Ben Zachariah

1 Hour Ago

William Stopford

7 Hours Ago

William Stopford

8 Hours Ago

Damion Smy

10 Hours Ago

Damion Smy

12 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.