Derek Fung

Next Mercedes-Benz A-Class to channel some of the spirit of the original - report

55 Minutes Ago

News Editor

We have one of the most competitive, saturated new car markets in the world, and yet that hasn’t stopped automakers from wanting to get a piece of the action.

Genesis arrived in 2019, Polestar will touch down before the end of 2021, while Cupra and Ineos each should land in 2022.

But a number of other brands to have entered the Australian market over the past 25 years have since packed up.

While we’ve said goodbye to long-running brands like Holden, Saab and Daihatsu in that time, others had a much shorter time under the hot Australian sun. Here’s part one of this list.

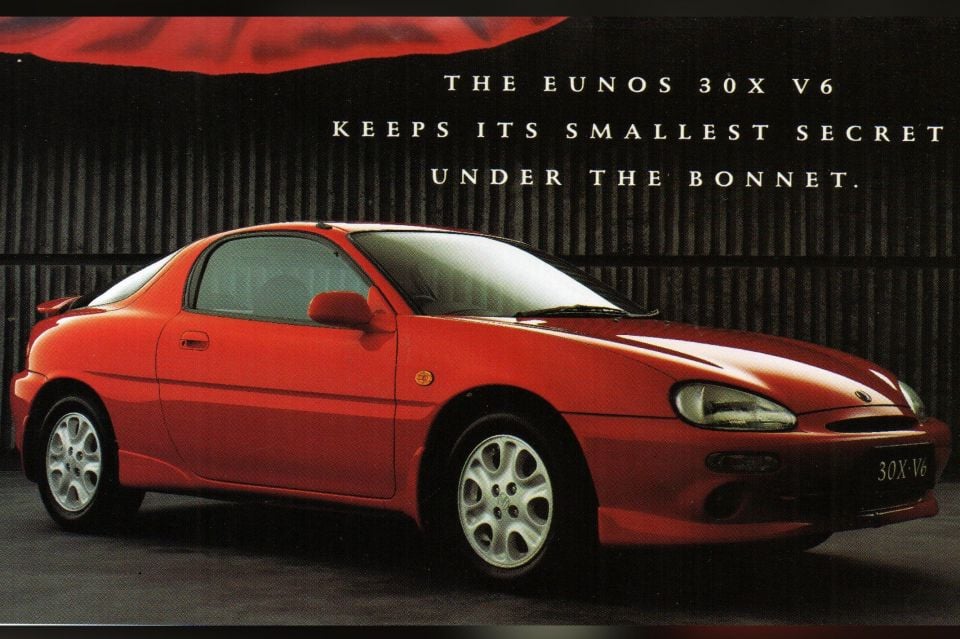

Years sold: 1992-96 Models sold: 30X, 500, 800

Like Toyota with Lexus, Mazda introduced a premium brand – Eunos – in Australia. But it never truly committed to it being a standalone brand, and after just a few years the Mazda name was added as a prefix before the Eunos name was dropped entirely.

Wounds hadn’t healed at Mazda. The company had embarked on an ambitious strategy during Japan’s bubble economy in the late 1980s and early 1990s, rolling out the Autozam, Efini and Eunos brands in Japan and readying a serious contender to Honda’s Acura, Nissan’s Infiniti and Toyota’s Lexus brands in the shape of luxury brand Amati.

But after announcing the new brand in 1991 and spending hundreds of millions of dollars on its launch, the economic crisis in Japan led Mazda to terminate Amati in 1992 around two years before its planned launch. The flagship, 12-cylinder Amati 1000 was stillborn, while the other models were given either the Eunos or Xedos nameplates depending on the market.

At its local launch in 1992, the Eunos brand consisted of two models: the 30X, sold elsewhere as the Mazda MX-3 and packing a tiny 1.8-litre V6; and the 500, related to the Mazda 626 but wearing slinky styling and using a 2.0-litre V6.

Arguably the most interesting Eunos was the flagship 800, introduced in 1994. This was another front-wheel drive model, in contrast with the slightly larger, rear-wheel drive Mazda 929 luxury sedan, but which offered a choice of a 2.5-litre V6 or an innovative 2.3-litre supercharged Miller Cycle V6 in the 800 M.

Mazda claimed the latter offered the performance of a 3.3-litre V6 with the fuel economy of a 2.0-litre four. Indeed, it used less fuel than the 2.5-litre but put out more power and torque: 147kW/282Nm and a 9.3-second 0-100km/h time versus 122kW/215Nm and 11.4 seconds.

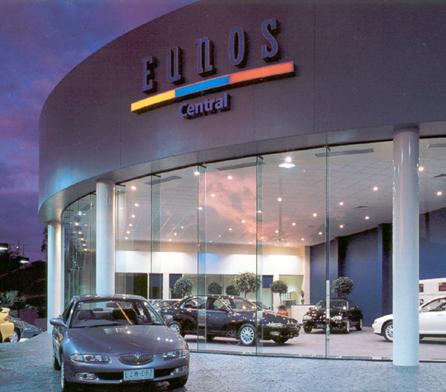

When Eunos launched here in 1992, it started with just 10 dealerships, nine of which already had Mazda franchises. There was at least some effort employed to give the brand’s retail spaces a unique look and feel befitting a luxury brand, and sales were at least in the ballpark of Lexus’. Annual sales for the Eunos line-up peaked at 1738 in 1994.

Late in 1996, Mazda dropped any pretense of Eunos being a standalone brand. Its products kept the Eunos name, but added the Mazda brand name as a prefix and were available across the broader Mazda dealer network. This led to a rather confusing period in Mazda showrooms, particularly at the higher end where the rechristened Mazda Eunos 800 and Mazda 929 overlapped in price.

The svelte 929 got a soporific restyling in 1996 which helped tank sales, Mazda dropping the long-running nameplate in 1997. That year, Mazda Australia also cleared up any perceived overlap between the Eunos 30X and MX-6 by axing both, while the bland restyle of the 626 – and the loss of its optional V6 – helped make room for the Eunos 500.

There was a slight bump in sales in 1997 to 966 units, up from 931 the year before, but it was short-lived. For context, Lexus sold 1236 vehicles in 1997 and its star was rising as Eunos’ was falling. The following year, Lexus would sell 1875 vehicles while Mazda sold just 375 Eunos models.

1999 would be the last year for the Eunos 500, while the Eunos 800 was also axed that year, at least in name. For the new millennium, there’d be a new Millenia sedan atop the range which was little more than a mildly facelifted Eunos 800, now available only with the Miller Cycle supercharged V6.

It was a handsome makeover but it failed to hide the Eunos 800’s age. But for a spike in 1997, Eunos 800 sales had been sliding from a first-year high of 338 units and were in the double digits by 2000. The updated Millenia didn’t turn this around, and by the end of 2002 the Millenia would follow the Eunos nameplate to the automotive graveyard.

Years sold: 2007-10 Models sold: H3

Before its Chapter 11 bankruptcy filing in 2009, General Motors was on a tear with new products. To name just a few, it had two small roadsters, a long-awaited second-generation Saab 9-5, and plans to roll out a raft of Buick, Cadillac, Chevrolet and Pontiac models on the Australian-developed Zeta platform.

Hummer was the newest of GM’s menagerie of brands and GM was taking it global, while also reportedly working on a smaller H4 to battle the Jeep Wrangler.

While Ford was divesting itself of the luxury brands in its Premier Automotive Group, GM was trying to strengthen its suite of upscale brands. To that end, GM established GM Premium Brands in Australia, which comprised Hummer and Saab. Cadillac was announced as the third member of the stable in 2008, and second-generation CTS sedans were loaded on a ship bound for Australia as almost all 16 planned Cadillac dealers started erecting Cadillac signage.

With the Global Financial Crisis raging, however, GM cancelled the planned introduction of Cadillac at the 11th hour, with those CTS sedans redirected to New Zealand.

The Hummer brand had been formed after GM acquired AM General, manufacturer of the original Humvee military-use off-roader. It had been rechristened as the Hummer H1, while a H2 – based on GM’s full-sized SUVs and pickup trucks – was launched in 2002.

The third and last Hummer model, and the only one to make its way to Australia, was the H3, sourced from a factory in Port Elizabeth, South Africa. Underneath its brash styling was a version of the GMT355 platform, which underpinned both the Holden Colorado and Isuzu D-Max here and the Chevrolet Colorado, GMC Canyon and Isuzu I-Series in North America.

Its close relation to the Colorado/Canyon/I-Series was most evident in the engine bay, in which sat a 3.7-litre inline-five petrol engine producing 180kW of power and 328Nm of torque. The inline-five was reportedly the only feasible engine that could fit under the H3’s stubby bonnet and was based on the Atlas/Vortec 4.2-litre inline-six. Transmissions were a four-speed automatic or five-speed manual.

GM did manage to get a V8 engine to fit under the bonnet, a 5.3-litre mill pumping out 224kW and 434Nm. Alas, its timing was inauspicious. The H3 Alpha launched in the US for the 2008 model year, but by early 2009 GM was looking for a buyer for both Hummer and Saab as it tried to shrink its sprawling portfolio of brands.

Hummer’s honeymoon period was over. The brand’s image was the antithesis of that which GM was trying to portray to the US Government to show it was worth being bailed out. Its future included profitable, large SUVs, sure, but it wanted the petrol-electric Chevrolet Volt as a paragon of virtue rather than the Hummer as a lightning rod of criticism.

With GM going through bankruptcy proceedings and Hummer on the precipice of being sold to Chinese company Tengzhong, GM stopped importing Hummer H3s to Australia late in 2009. While it said it would continue to distribute the vehicles for a period of time under new ownership, the deal with Tengzhong fell through and the last member of GM Premium Brands left Australia in 2010.

Hummer’s best year in Australia was 2008, when it sold 1078 H3s. The following year, it sold less than half. In total, it sold 1838 vehicles between 2007 and 2011.

Years sold: 2010-14 (Geely), 2012-15 (ZX Auto), 2015-18 (JMC) Models sold: Geely MK, ZX Auto Grand Tiger, JMC Vigus

Although Geely and ZX Auto aren’t affiliated, their histories in Australia are very similar. Both were imported by Western Australia dealer extraordinaire John Hughes, both brands were available with only one model, and both quickly faded from the Australian market.

JMC appeared with its Vigus ute just as the ZX Auto Grand Tiger was disappearing, but it was no more successful despite its more modern-looking product.

You can read about all three brands in Eight Chinese cars that flopped in Australia.

Years sold: 2011-14 Models sold: J1, J3, J11

Great Wall Motors had opened the door for Chinese brands in Australia, and the likes of Chery, Geely, JMC and ZX Auto stepped in shortly thereafter.

Unfortunately for these brands, the Australian market proved a trial by fire, exposing them to hurdles like poor safety ratings, government regulations, asbestos-related recalls, and widespread skepticism of their quality and reliability. All four of these brands scurried away quite quickly, dropping previously announced plans to bring new models here. Even more successful Great Wall took a huge hit in its first decade here.

Like Great Wall, Chery offered a crossover, though it was sold alongside two passenger cars instead of two utes. The J11 was a rather blatant Toyota RAV4 clone; Chery was known for cribbing others’ designs. The J1 light hatch and J3 small hatch were more original.

Distributed by Ateco, Chery quickly fell afoul of government regulations mandating electronic stability control. That meant its products initially couldn’t be sold in Victoria, and when these regulations were implemented on a federal level the brand had to discontinue the J1. That took its toll on the brand’s sales, which had peaked in Chery’s first year at 1822 cars.

Before it left, the J1 had had its price slashed to an astonishing $9990 drive-away – one of the only sub-$10,000 drive-away cars of the new millennium besides the Daewoo Matiz and Geely MK.

All the Chery models were dirt cheap, with the J3 priced as low as $12,990 drive-away and even the J11 SUV offered for as low as $17,990 drive-away. Other figures were low, too, like the number of stars in their ANCAP ratings: the J1 had a three-star rating that led Chery to recall and fix the structural integrity of its seats, while the J11 mustered just two stars.

Chery updated the J3 and J11 with new engines and ESC and the latter even received a handsome facelift, but with no factory support the brand’s Australian operation was left to fade away. Just 4670 vehicles were sold here during its run.

Years sold: 2003-15 Models sold: Fortwo, Forfour, Roadster

Australia’s sprawling suburban landscape seemed ill-suited for Daimler’s city-dwelling microcar brand, something borne out by sales figures. Nevertheless, Smart – ironically, rather imprudently – continued to maintain a presence in the Australian market for just over a decade.

The brand started selling cars in 1998 in Europe, though it took until 2003 for it to come here. Though it launched with only the two-seater Fortwo city car, Smart quickly followed it with the distinctive Roadster later that year and the larger Forfour in 2004. During this time of expansion for the Smart brand, the company shelved plans for a Formore SUV. Fast forward almost twenty years and it’s finally going to release one.

If Smart was going to succeed here, it needed more than a microcar that would appeal only to a tiny group of inner-city trendies. Unfortunately for the brand’s local operation, the Roadster and Forfour proved short-lived.

The Roadster was never going to be a volume seller, being a tiny, featherweight, mid-engined convertible with a turbocharged three-pot. The 840kg Roadster did give the brand an enthusiast offering, even if it only had a dopey semi-automatic transmission and no manual, though it also gave the brand a headache: Smart ended production of the model as it was flooded with a deluge of warranty claims for the car’s leaky roof. Maybe the Formore would have been a better idea…

With Mercedes-Benz taking full control of Smart at the time, axing the Roadster was one way to right an increasingly unprofitable ship. Another was to axe the Forfour, a more conventional, front-wheel drive hatchback developed jointly by DaimlerChrysler and Mitsubishi.

Related to the Mitsubishi Colt, the Forfour was built alongside that car at Mitsubishi’s NedCar plant in the Netherlands. Despite its relation to the Colt, including sharing its petrol engines, the Forfour was priced closer to a Lancer, though it still undercut the Mercedes-Benz A-Class by several thousand dollars. Nevertheless, it didn’t meet even conservative sales targets, and its global axing meant it was struck from the local line-up.

That left just the original: the Fortwo. After posting 799 sales in 2005 and 773 in 2006, admittedly with the Fortwo being the volume seller, the Smart brand commenced a long slide into oblivion. Sales declined every year but one, and the brand celebrated its 10-year anniversary in Australia with a tally of just 126 sales.

Even though pricing had been made sharper and the brand had switched to an online sales/service model in 2013, innovative for the time, sliding sales had made it almost impossible for the brand to continue. A business case couldn’t be made for the third-generation Fortwo or the revived, Renault Twingo-based rear-engine Forfour on the back of declining sales, and Smart disappeared from Australia in 2015. Smart sold 4452 vehicles during its 12-year run.

Years sold: 1995-2017 Models sold: Exora, Gen 2, Jumbuck, M21, Persona, Preve, S16, Satria, Savvy, Suprima S, Waja, Wira

Proton is easily one of the longest-lived brands on this list, which says more about the company’s stubbornness than its success. If not stubbornness, to what else can you ascribe Proton’s bizarre inability to sell half-decent, budget-priced fare in a market where the likes of Hyundai, Kia and even Daewoo could become ascendant? In the end, Proton fizzled out having never reached even one per cent share of the Australian passenger car market.

The Malaysian brand, initially wholly owned by that country’s government, entered Australia in 1995. Its only product at first was the Wira (later Persona) sedan and hatchback, a restyled Mitsubishi Lancer, and Proton planned to sell 4000 cars in its first year. Slow sales, however, led distributor Inchcape to drop the brand in 1996, leaving Proton to organise factory distribution.

The Persona was followed in 1997 by the Satria, which was a rebadged version of the new Mitsubishi Mirage’s immediate predecessor that later gained a genuinely enjoyable GTi flagship. That year, the range was bolstered by the M21 coupe – again, this was a previous generation of a recently redesigned Mitsubishi, in this case the Lancer coupe. Proton sales reached 3182 units in 1998, with the Satria having the lion’s share.

The company had predominantly rebadged or lightly restyled Mitsubishis since its first model, the 1985 Saga. As it matured, however, it set its sights on developing its own products. The first step towards that was the handsome if optimistically priced 2001 Waja, a heavily restyled Mitsubishi Carisma that flopped badly in Australia, which was then followed by the in-house Gen.2.

A smaller Savvy hatchback plus the return of the Satria, which looked even more handsome this time around, temporarily dragged sales numbers back up. It was the Jumbuck ute, however, that proved to be the brand’s most successful model in the mid-2000s.

It may have been based on the old Wira/Persona, but it received a live axle and leaf springs at the rear and a price tag that made it Australia’s cheapest ute at $16,990 drive-away. That was enough to get some buyers to overlook the disastrous one-star ANCAP rating.

The Jumbuck was axed in 2009, but Proton still had some cards to play like the S16 sedan – briefly Australia’s cheapest car – and its next-generation Prevé and Suprima small cars, as well as the Exora MPV.

Despite the new product, sales waned in the 21st century – from a height of 2336 sales in 2007, sales continued on a largely downward trajectory. With sales slumping to just 182 units in 2016 and stricter emissions regulations enacted locally, Proton closed up shop in 2017 and has yet to return. It has since been acquired by Geely and offers a range of rebadged Geely models.

Years sold: 2012-19 Models sold: Tunland, Sauvana, View

It’s rarely an encouraging sign when a car brand goes through three different distributors in less than a decade. That’s what happened with Chinese brand Foton, however, which was first imported by FAA Automotive Australia, then Ateco, and then finally a factory-backed operation. Throw in the importer that was initially set to bring Foton here and you’ve got four.

The brand launched with the Tunland ute, a cut-price Toyota HiLux rival that despite this tortuous corporate history appears to have been one of the better Chinese utes offered during the 2010s. It came standard with a Cummins-sourced 2.8-litre turbo-diesel four-cylinder engine producing 120kW of power and 360Nm of torque (later 130kW and 365Nm).

Pricing was cheaper than a Toyota HiLux, with the cheapest dual-cab ute sliding under $30,000 at launch, but the Tunland was pricier than the likes of the Great Wall V200 and SsangYong Actyon Sports. Despite this premium, it launched here without electronic stability control, leading to a disappointing three-star ANCAP rating.

Foton announced it would bring the Sauvana SUV and the View van in 2014, but these appear to have been imported only in limited quantities and there’s no sales data available via VFACTS. Sales data exists only for the Tunland, and only for 2014-17. In its best year, Foton sold 1065 Tunlands.

Reportedly, slow sales led to price cuts for the Tunland just a year after its launch. Ateco took over distribution in 2014 but this was short-lived, with a factory-backed operation taking over in 2017. Like the original importer, this one was based on the Gold Coast. A facelifted Tunland was launched in 2019 but Foton’s ute, van and SUV models were withdrawn from local price lists, though the company still sells larger commercial vehicles here.

Years sold: 2018-21 Models sold: A110

Alpine is exiting the Australian market this year simply because government regulations prohibit it from selling its only product, the A110.

The retro, mid-engine coupe rival to the Porsche 718 Cayman doesn’t meet ADR 85 side-impact crash rules coming into force for all passenger cars in Australia on November 1, 2021.

It launched in 2018, and since then just 83 have been sold according to VFACTS sales data. Lack of brand recognition is likely to blame for its low-volume status, with the vastly better-known Porsche racking up five times as many sales.

Don’t count on the brand being gone forever, though, according to an Alpine spokesperson.

“We are aware of the future, electric-only, model roll-out from Alpine and will communicate more information for the Australian market when appropriate,” the spokesperson said.

Future products for the brand include a next-generation A110, a mid-sized SUV, and a hot hatch, all boasting electric powertrains.

Go deeper on the cars in our Showroom, compare your options, or see what a great deal looks like with help from our New Car Specialists.

William Stopford is an automotive journalist with a passion for mainstream cars, automotive history and overseas auto markets.

Derek Fung

55 Minutes Ago

Damion Smy

12 Hours Ago

Damion Smy

13 Hours Ago

Ben Zachariah

15 Hours Ago

William Stopford

16 Hours Ago

Damion Smy

19 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.