Max Davies

2026 Toyota HiAce review

2 Hours Ago

Tesla is the king of BEVs, but legacy challengers are lining up to take its crown. Bloomberg Intelligence has some interesting findings...

Senior Contributor

Senior Contributor

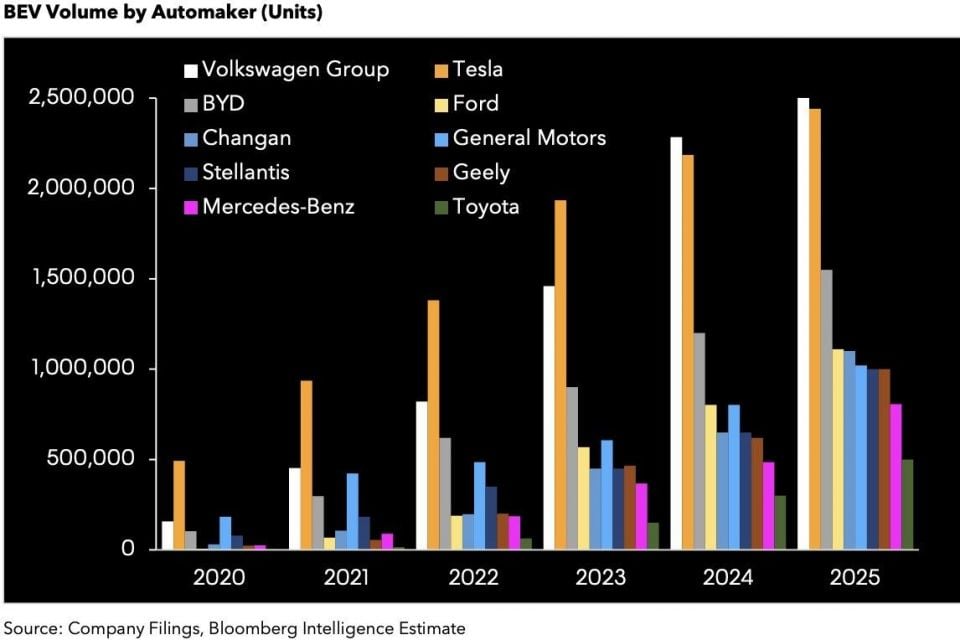

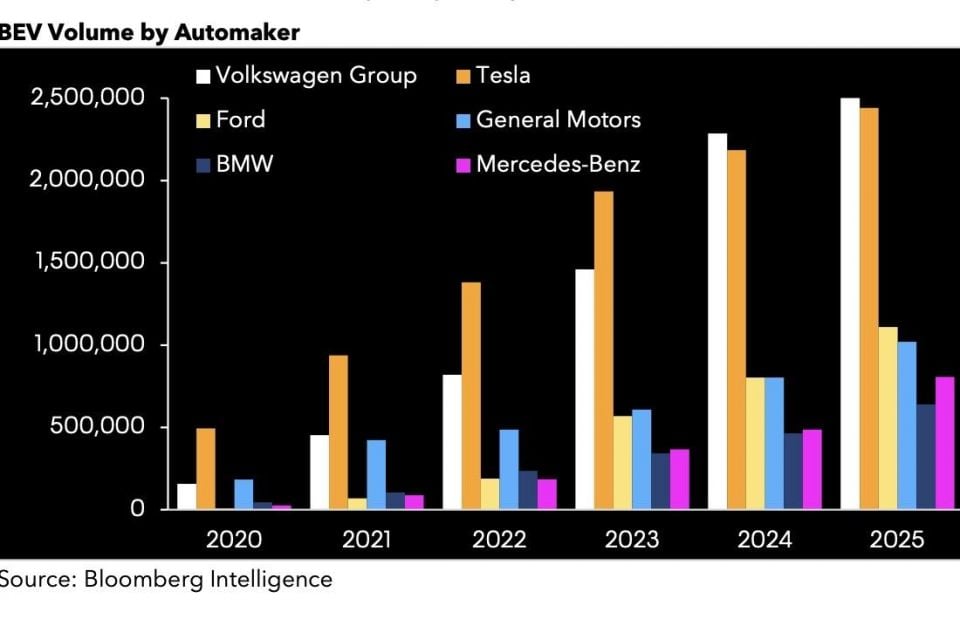

Market insight provider Bloomberg Intelligence has released a wide-ranging report into global electric vehicle (EV) trends and take-up, making a headline claim that Volkswagen AG will overtake incumbent leader Tesla in 2024, with China’s BYD set for third spot.

The report actually claims various global carmakers will challenge clubhouse leader Tesla through an impending wave of competing models, even though profit incentives are said to be throttled back by rising battery costs and a continued lack of scale.

In short, the report found Tesla’s insane valuation and battery-electric vehicle sales crown were yet to be challenged by incumbent automakers, whose “disappointing” EV sales mix highlighted the difficulty in executing bold ambitions amid shortages, rising costs and the scramble to secure batteries.

Scenario analysis suggests a 15 per cent global battery electric-vehicle market share in 2025 versus 6.0 per cent in 2021, it added, with China to continue its dominance ahead of number-two region Europe. The US and hybrid-heavy Japan trail.

“Tesla [is] set to retain its global sales crown for at least another year, aided by a new EU factory,” the report found, referring to its new plant in Berlin

“However, Volkswagen is poised to overtake the US company in 2024 and already leads in Europe. Execution will be key to encroaching on Tesla’s $750 billion market capitalisation,” it added.

The report said Tesla’s mid-term volume growth was contingent on its “questionable” Cybertruck rollout, while by contrast the VW Group will lob 16 new models by 2024 such as the Audi Q6, A4 e-tron, and A6 e-tron; Volkswagen ID.5, ID.6, and ID.Buzz; and Porsche Macan EV.

All up the Volkswagen Group targets a 25 per cent BEV mix from 2025-26, equating to around 2.5 million units per annum.

Volkswagen is also investing €30 billion in the EV supply chain including six new battery plants in Europe this decade. The Group also benefits from economies of scale from the high-volume MEB modular BEV platform, it added.

The report cautioned legacy brands trying to close the market valuation gap to Tesla would battle unless they siphoned off their EV-related assets into separate floats, which again is something on the VW agenda.

Volkswagen AG is on track to launch an IPO of the Porsche brand near the end of the year, worth a claimed €85 billion, with its potential 30 per cent BEV sales mix in 2023 and more than 45 per cent in 2025 “significantly ahead of peers”.

“German automakers – which are still jostling to be seen as the leaders of the legacy transition – only averaged a BEV sales mix of 5 per cent in 1Q, partly explaining their low multiples despite record margin. This comes alongside recession fears, rising rates, supply-chain constraints and inflation,” the report said.

Perhaps surprising to those who don’t follow the car world closely, China’s Warren Buffett-backed BYD is set to become the third-largest BEV player in 2022 and may exceed a million units annually from 2024, the report said, ousting GM which has its own big plans around in-house Ultium batteries.

At the same time it rather sharply criticised Mercedes-Benz.

“Despite angling to be regarded as one of the leading legacy BEV brands, Mercedes’ ambitious plan to have a 50 per cent electric vehicle sales mix by 2025 – with BEVs comprising the majority – far outstrips its lacklustre 4 per cent mix in 2021,” the report said.

Another honourable mention went to Ford, which Bloomberg said was down to the sell-out-success that is the F-150 Lightning.

“Ford is set to spin the electric vehicle narrative away from Tesla, with the F-150 Lightning getting a nearly year-long jump on the competition and making Ford the first automaker to ramp up production of a full-size battery-only pickup truck,” it said.

“General Motors and Tesla won’t compete in the space before 2023, and Rivian’s small scale makes it non-threatening.”

It said the fundamentals of Rivian and (fellow startup) Lucid’s production and deliveries had come under more scrutiny as markets adjust their valuations for small-scale carmakers that have never navigated macroeconomic shocks to their supply chains.

“Both companies have cut early-stage production and delivery estimates as the availability of materials and cost increases change the profit dynamics of drivetrain tech, while high inflation and low inventory upset consumer demand,” it added.

The full report talks about other regional trends in the BEV space, and can be found here.

Max Davies

2 Hours Ago

William Stopford

18 Hours Ago

Ben Zachariah

19 Hours Ago

Derek Fung

20 Hours Ago

Matt Campbell

1 Day Ago

William Stopford

2 Days Ago