Dave Humphreys

2027 Skoda Epiq review: Quick drive

4 Hours Ago

Hydrogen HiLux? Particulate-free Prado? Market leader launches 'breakthrough' Mirai fuel-cell EV as a prelude to wider rollout alongside battery EVs, expects growth to best hybrid expansion.

Senior Contributor

Senior Contributor

Australia’s top-selling car company Toyota is bullish about the potential for its hydrogen fuel-cell electric vehicles (FCEVs) to hit this market, at scale, as soon as 2024.

As a starting point, the company has imported 20 second-generation Mirais destined to serve on various private and public fleets for $1750 per month including fuel. This is a progression over the smaller-scale fleet trials it has conducted with the first-generation Mirai over the past few years.

“The path to mainstream sales for fuel-cell electric vehicles will be quicker than for hybrids,” claims Toyota Australia vice-president of sales and marketing Sean Hanley, noting it took 15-20 years for petrol-electric cars to go mainstream.

“To that end, we expect Mirai to become more readily available to our dealers within two to three years, accelerating as the refuelling infrastructure grows.”

With Australia’s government and major companies such as Fortescue backing ‘green’ hydrogen as a key power storage mechanism of the future – for domestic use and export – Toyota’s local arm is clearly thinking in similar terms.

Australia’s market penetration of battery electric vehicles (BEVs) – more commonly seen as the ideal zero-emissions technology for urban transport – is very small by world standards, though the average Australian drives less than 15,000km per annum. The lack of incentives and CO2 targets are seen as reasons.

Tesla and Volkswagen consider FCEVs a technological dead-end and have doubled down on BEVs, but Toyota and Hyundai are investing in both zero-CO2-emissions options and see each as playing a vital role in decarbonisation of transport.

The ADR-compliant new Mirai is the second FCEV to market after the Hyundai Nexo, which has just entered service on the ACT government’s fleet, where it’s fuelled by a wind-powered electrolyser.

To support the Mirai, Toyota has built its own solar-powered refuelling site in Melbourne.

Toyota’s local arm believes FCEVs using this technology are only held back by lack of infrastructure, and will be “readily available” in dealers within three years.

Toyota has more than 20 per cent market share and the nation’s biggest customer-facing sales network, so any claim of this sort warrants attention.

One element to consider is Toyota’s dominance in regional Australia. Buyers of LandCruisers and HiLuxes who travel huge mileage well off the beaten path are often skeptical of how suitable electric technology will be for them.

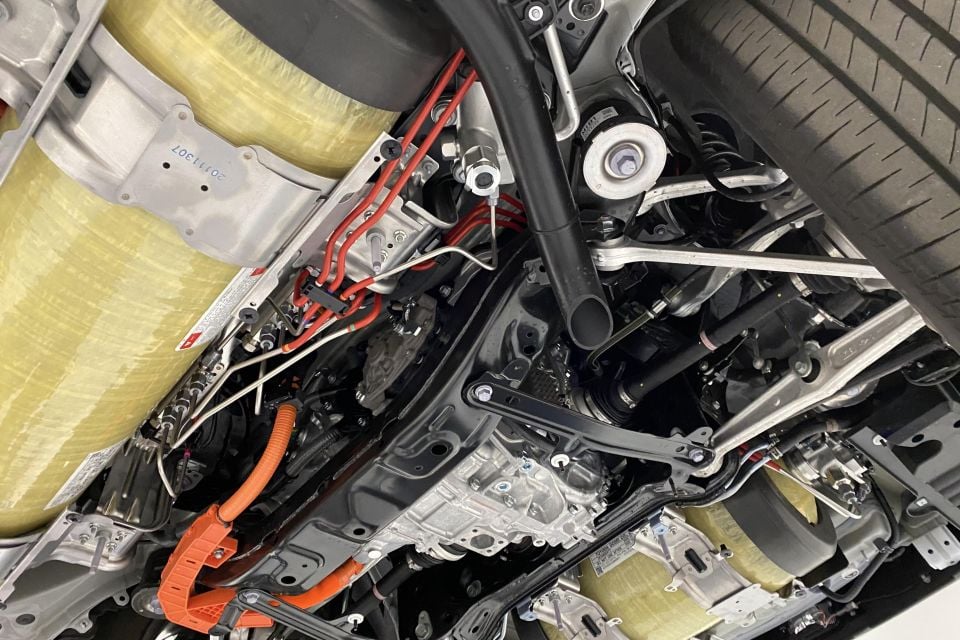

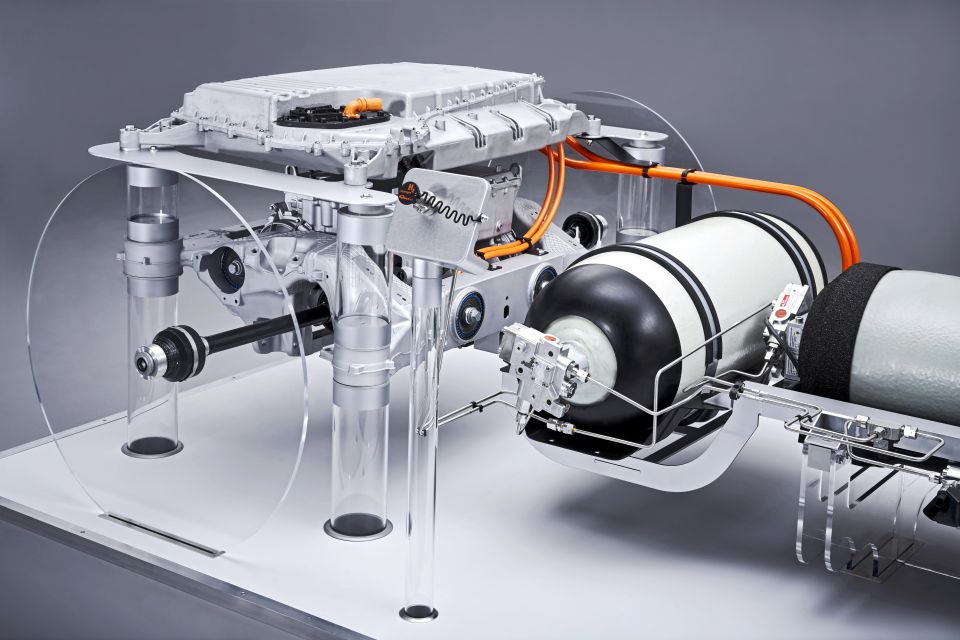

In brief, hydrogen FCEVs store pressurised hydrogen in chassis-mounted tanks and mix it with oxygen in a stack of membranes. The chemical reaction makes charge to spin the motor, and emits clean water and purified air as byproducts.

The Mirai and Nexo can drive about 650km, take between three and five minutes to refill at a bespoke bowser, and emit only water and purified air instead of CO2 or NOx particulates.

“I was a member of the team responsible for the introduction of the very first Prius [in 2001]. It was a quantum leap for our industry at the time, and now almost exactly 20 years after Prius, here I am introducing another breakthrough car,” said Mr Hanley.

In a speech at Mirai’s local launch, he stated it was Toyota’s view that multiple technology types are needed to hit its corporate goal of net-zero emissions by 2050.

“You know, when we talk about being carbon neutral, a lot of people say all we have to do is use battery electric vehicles because they don’t emit any CO2. But the truth is, it’s not that simple,” he contended.

“BEVs are just one part of the solution, and Toyota is developing our own… but we’re not putting all our eggs in just one basket. In addition to battery electric vehicles, we’re continuing to develop hybrids, plug-in hybrids and fuel-cell electric vehicles.

“…Ultimately, it’s the market that will decide and our goal is to provide options to support those choices. And we will continue to offer those choices providing the right solutions for the right applications at the right time. Australia is a big country with diverse customer needs.

“Our success has been built on providing high quality, durable and reliable vehicles that are fit-for-purpose in every corner of this country… Customers will not compromise on capability.

“Last year, we had delivered a record 54,000 fuel-efficient hybrid vehicles, representing more than 85 per cent of all electrified vehicles sold in Australia. Right now, the most practical way to reduce automotive emissions is to buy a hybrid. But electrification comes in many forms.

“And Toyota believes that hydrogen-powered fuel-cell vehicles have enormous potential as the ultimate eco cars.

“As a fuel source, hydrogen is clean, safe and abundant, making up 70 per cent of the matter in the universe. It can be produced locally from various energy sources, including renewables.

“It enables a long driving range and quick refueling, both of which are equivalent to conventional petrol or diesel cars. And the only byproduct is water.”

FCEV critics point to their inferior energy efficiency over BEVs, and fear the global hydrogen supply chain will be too reliant on fossil fuels rather than renewably-powered electrolysis, which separates hydrogen from water for pressurisation.

Then there’s the paucity of hydrogen refilling infrastructure, though there are also multi-megawatt hydrogen projects underway across Australia right now funded by private and public sectors, and exports are often tied to the production being driven by renewable energy.

A quick look at the Australian Hydrogen Council website shows that the likes of Ampol and BP are members, too, among numerous energy companies, banks, and engineering firms. So investment will clearly be on the table.

“There were no petrol stations when the first car was driven back in the 19th century,” reckons Mr Hanley. “Yet the global auto industry now produces 18 million vehicles a year.

“We already have a hydrogen refiller as part of our hydrogen center, and the CSIRO has announced it will also build one at Clayton in Melbourne’s east. There you see a corridor emerging, and with the long driving range of FCEVs, you really don’t need a hydrogen refiller on every corner.”

Speculation might suggest small-sized hydrogen filling stations with onsite cold storage can be supplied by major generation sites in a future hub-and-spoke infrastructure model, though it’d be hard to decentralise the network in the same way as household BEV wallbox chargers do.

Intriguingly, the obvious upsides to FCEVs over BEVs – rapid refills, long ranges, and higher payload capacities due to fewer heavy batteries – appear to lend themselves particularly well to Toyota’s heavy duty vehicles. Or those of other brands.

This is also why hydrogen is almost unanimously viewed as an ideal way to decarbonise heavy industry and freight in the future. Trucks and buses (including Toyota and Hyundai models already in service worldwide), trains, and even ships can use the stuff.

“Those two factors align to make FCEV attractive for different ranges of physical applications, heavier vehicle applications,” confirmed Toyota’s product planning head Rod Ferguson.

Toyota’s emissions for its passengers cars and smaller SUVs are coming down as hybrid sales proliferate (the Corolla, RAV4 and Camry are now majority petrol-electric by sales), but its popular diesel commercial vehicles are high emitters, as found in the first industry-backed CO2 report published recently.

Australia’s car brands, under the aegis of the Federal Chamber of Automotive Industry, have laid out an emissions-reduction plan for the next decade in the absence of a federal government mandate. One goal is to make it easier to convince overseas head offices to send us low-emissions stock.

“These are very challenging targets, and we still have a big goal in front of us in terms of the light commercial vehicles, we are committed to achieving those goals by 2030 across our full range,” Mr Hanley said.

“Therefore we’ve never ruled out the expansion of technologies, whether it be hybrid or other [eg. FCEV], across the other parts of our brand.

“We never said we would achieve those targets in year one. And in fact, we always understood that commercial vehicles would take a little while longer than passenger vehicles purely because of fit for purpose and the demands of the market, the diversity of the market, and the terrain in Australia.

“It’s incumbent on us as a car company to bring that capability to the products. We’re committed to do that whilst reducing our CO2 footprint.”

MORE: Toyota showroom and data pages MORE: All CarExpert hydrogen FCEV-related stories

Go deeper on the cars in our Showroom, compare your options, or see what a great deal looks like with help from our New Car Specialists.

Dave Humphreys

4 Hours Ago

Damion Smy

5 Hours Ago

William Stopford

5 Hours Ago

CarExpert

7 Hours Ago

William Stopford

7 Hours Ago

Damion Smy

8 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.