Ben Zachariah

2026 KGM Musso EV review

6 Hours Ago

We talk about COVID-19, market recovery, digital retail, electric vehicles, grey imports, independent repairer data, the Takata disaster and clean-up, Vinfast buying the Holden Proving Ground, and whether new cars are getting too expensive.

Senior Contributor

Senior Contributor

The Federal Chamber of Automotive Industries (FCAI) calls itself the peak representative organisation for companies who distribute new passenger vehicles, SUV and light commercials into Australia.

Your choice among Australia’s 70-odd vehicle brands is almost certainly a paid-up member – Alfa Romeo to Volvo, and all those alphabetically in between – so it goes without saying that the FCAI’s views on the industry broadly reflect those of all OEMs in the market.

This is reinforced by the fact that the current FCAI board is chaired by Toyota Australia president Matt Callachor, and includes the local heads of Mazda, Volkswagen, Honda, Nissan, Mitsubishi, Yamaha, Audi, Jaguar Land Rover, and Mercedes-Benz.

Chief executive Tony Weber is always happy to discuss the big issues: CO2 emissions, recalls, vehicle pricing and retail strategies, fuel quality, aftermarket data… the list is long. Here’s a transcript of our recent virtual chat.

Tony Weber: We’ve had historically many economic crises that originate from not the fundamentals of the economy being false [but something external] and that is exactly the same in this case. The Second World War is a good example. And this is probably the biggest shock in the last hundred years.

But I think that once we get the health issues addressed, the fundamentals remain pretty good. The budget was strong, the government’s doing the right thing, it’s addressing the credit issue which has been absolutely fundamental to our demise over the last 30 months.

There’s the instant asset write-off putting money into the hands of businesses rather than government, and spending in that way. I think the response has been good.

We get the health response under control, we then can come out. But I don’t have a crystal ball and I can’t tell you what that date will be, the tipping point. But I think we’re handling it as an economy and as a nation, well.

TW: To answer that question you have got to think about, what are the fundamentals that are really important here? Now obviously economic growth is fundamental, but you’ve got to cut down to another level.

I think employment levels are really important, so if the government can control the level of unemployment, that’s number one. And the other thing that’s really important is population growth. Because that stimulates demand. So I think they’re the two underlying measures.

TW: I think right across the economy we’ve all learned how to do things differently, by necessity. And I think that is, not going to drive change, but it’s going to accelerate change. I’ve seen that right across the economy.

How people actually consume has changed dramatically in the last five years. Buying online has become very popular… it’s changing quite rapidly, and I think this will just accentuate that change.

Look at contactless buying – consumers’ needs are changing. They don’t need to go to the local department store anymore. They’re happy to buy online and that also goes across to our sector.

The traditional franchising model that has been in place since the end of the Second World War, it was going to evolve anyway. I think the evolution of that will be pushed forward by these experiences because consumers are demanding it.

We have the technology and we’ve proven that technology is really capable and trustworthy. We will move on, and as a sector we need to move along with the rest of the economy and do things differently. That’s natural because that’s what consumers want, not just for cars but buying shoes or jeans, or even their groceries.

The world’s changing and the automotive sector has to move on. We can’t be a group of staid old men sitting around [saying] ‘well this is how we used to do it in the ’70s. The ’70s are well gone.

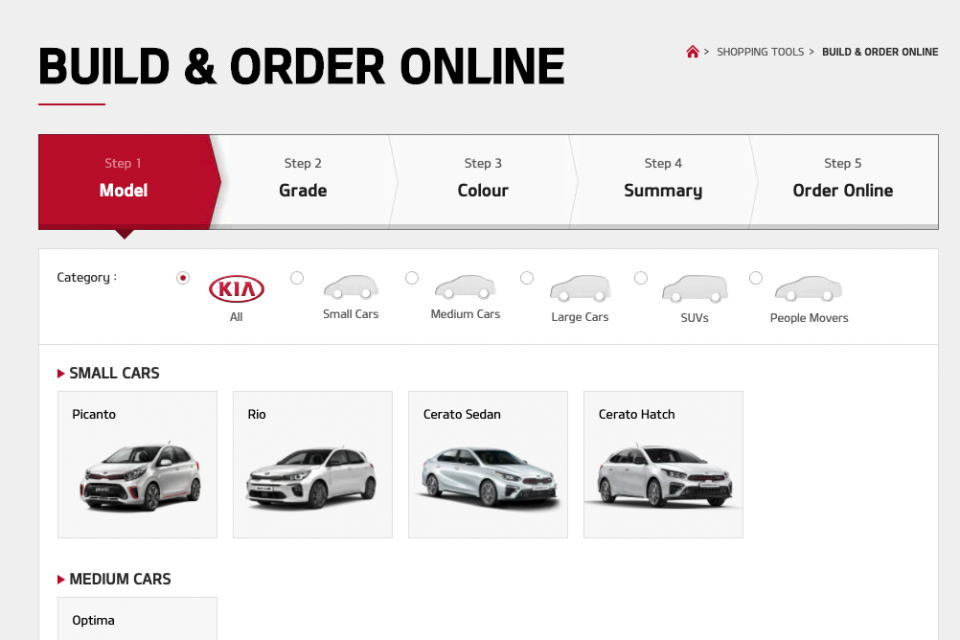

TW: We can talk about the agency model, but we should talk about a whole raft of things… There’s a whole raft of options out there, and people talk about the agency model like it’s one fixed model. There are a million-and-one variations of the agency model.

For anyone that’s got an Apple product, whether that be a phone or an iPad – my household has about 28 of them – they’ve been bought through a version of the agency model. Harvey Norman is an agency model, to go and buy yourself an oven is [done via] an agency model.

And there’s a whole raft of ways in which we get products to markets, and people expect that because they expect innovation. Some of our members are delivering it in a different way, they don’t have a dealership network (Ed note: Weber is referring to Tesla).

So, I don’t think we should restrict innovation. We shouldn’t restrict change. What we need to do is focus on how we deliver the two things that we deliver in motor vehicle land well.

So we deliver a product, and we deliver a service. Because that’s the difference between buying a book and buying a car, as we’ve always argued. If you buy a book, you go and buy it, and you never need to go back to the bookshop.

You buy a vehicle, it traditionally remains on roads in Australia for 20 years, it needs to be serviced and maintained adequately, and Takata is a really good example of that. We just need to focus on how we actually put that product in the hands of consumers and how we service that product over the next 20 years.

And I think however we do that, that should be determined by the market and how people react. And just like if I had the local corner shop, it shouldn’t have meant in the 1970s or ‘80s that Coles couldn’t open up around the corner.

And just like Coles should not be dictating that there shouldn’t be delivery services for groceries coming into the marketplace either, we should allow flexibility, innovation and change.

… That shouldn’t be held back by regulators either.

TW: I recognise what you’re saying. I think one of the most important things about the Australian market is, it is incredibly competitive. And if you go back to what actually drives markets, it’s competition. And when you have strong competition, who wins? Consumers, and that’s a good thing.

If you go back and look at the history of Australian politics and policy development in this space, you naturally go back to the Button Plan, which was really about pushing competition in the marketplace, so that you get the reduced prices, and as much competition as possible. And we’ve ticked those boxes, [though] there’s been some consequences along the line.

So, fuel standards are a substantial issue, and we’re constantly in touch with the government about this. It goes to a broader issue across the economy that you’d be well aware of, Mike. We need to do whatever we can. Limited resources of low-emission vehicles will go to markets that have standards to meet. We recognise that.

But ultimately, over time, that issue will be addressed as the supply constraints out of the factories are addressed and more low-emission vehicles come into the market.

The other advantage of competition is ‘Brand A’ wants to get a leg up on ’Brand B’, and that will drive the pull to get those low emission vehicles into the Australian market, into the hands of Australian consumers.

We recognise there’s a lot of work to be done here. Our CO2 target that we announced earlier this year is part of that strategy to actually address it. But it’s not going to be the absolute solution. We need to keep working with governments, we understand the difficulties they face, we understand the problems with the [petrol] refining industry here.

We need to make the best of what we can do, and get the best possible product into the hands of Australians, because they are demanding more and more electrified vehicles, and you see that in our sales figures.

TW: That’s certainly an issue that’s been in play for many decades in Australia, parallel imports.

As I said to you earlier, we not only sell products. We sell services to the marketplace. And we can talk about this at a theoretical level, but we’re going to apply this to an applied level, because the problem with vehicles is we need to protect not just the first purchaser, but the second, third, fourth, fifth.

The average car in Australia is about 10.4 years old. That means for every one that’s actually introduced to the roads today, there’s one that’s verging on 21 years of age. Over those 21 years that car needs to be serviced and maintained. And I will give you no better example of this than the Takata NADI airbags.

Our members put a voluntary recall in place in December last year. And the Australian government authorities came and spoke to me, and it was in their view an absolute emergency. I said to them at that time, and I’ve said it multiple times, there are parallel imports in this country of that era that have these airbags, we know that.

And if you go on to websites like CarSales or CarsGuide you can see them being sold, and some of them in excess of $100,000 because they are collector’s items. I have been saying this, we’re now sitting here on the 22nd of October, but this issue was known in December last year.

No-one in government can actually tell me one thing they have done to try and address those vehicles. And as you know, if that airbag goes off and you’re sitting in the cabin – which you will be because it won’t just deploy – if it mis-deploys, it’s like being shot with a shotgun. And here lies the problem.

As technology becomes more and more sophisticated, as it will, how is it addressed? Because these cars come in as orphans, because the importer is nothing more than the importer, they have no connection back to the factory. They have none of the technical expertise.

Even if you get one of these cars, and it’s got Takata NADI airbags in it, how do you get access to an airbag replacement that is safe to replace the faulty one in your car? I don’t know. And this is a real problem.

TW: It’s an interesting notion. I think the thing is, our members supply cars to the market. The question is, in the short term, the government is saying ‘we think there’s probably an infant industry problem here and the market won’t respond appropriately given limited users’.

But I think electric vehicle recharging in 10 years time or 15 years time, it will be a discussion like today we’d have around the provision of service stations. The market will address this. I’m very confident of that, and I’m sure that is the view within government as well.

The market will respond, Australians are very apt to taking up technology – mobile phone, laptop use in Australia is so widespread. I don’t see that as a problem within the Australian market at all. That would not be in my top 200 list of concerns.

TW: Number one to your question is, the capped-price offers around servicing is just part of the fact that we deliver a product and a service. In a competitive market ‘Brand X’ wants to get a foot up providing long-term servicing at a guaranteed price, and it’s a win for the consumer.

We have, many years ago, changed to the view that [proprietary service data] information should be provided to the market. We’re part of a process, led by the Commonwealth Treasury at the moment, to actually supply information to the market. We’re working with the government, we’re working with other industry associations.

We know the vast majority of the 17-million car fleet at the moment is actually serviced in the independent repairer network, and that has been the case for a long time. They obviously have the information to service those cars.

If they don’t, I think there’s some interesting questions journalists could ask the independent repair sector…

I believe the issue is addressed, and we will go along and work with the government to actually formalise it.

TW: Well, safety’s always been a priority of our members. So it’s important that we have the best quality technology in cars, and it’s made an enormous difference to the safety of individuals.

We recognise that clearly these new technologies are expensive, because they are becoming more and more sophisticated. But as you get economies of scale through the factory, they do tend to reduce over time.

The good news for consumers once again is because there’s so much competition the market prices are low here. And certainly by international standards, we have really low prices because of the competition… there’s about 420 different models, and there is a wide array of prices in those.

TW: We’re just waiting on the final figures, but we think ballpark we’ve got it down, as of the first of October, to around 90,000 vehicles [needing new inflators], of the 3.2 million.

It has been quite a remarkable program. Our website, we’ve had over 11 million visits. And whilst there might be some people who have done that multiple times, when you have 17 million cars on the road in Australia, that’s quite an extraordinary number of visits.

We are absolutely committed to finalising this. We want to work with the regulators to get these cars sorted, and we also want to work with the state registration authorities. Because most people react to it, but there are some people, for whatever reason, who have industrial deafness to this issue, but it needs to be addressed.

It’s such a significant safety issue, it needs to be addressed. We need to get those last 90,000 fixed. And we want to work with governments in Australia, especially state registration authorities, to get those cars off the road.

TW: We don’t talk about our relationships with members and prospective members. Good try though!

—

Like these industry chats? They all live here. Here are just a few more that we’ve put together that you might want to check out.

Ben Zachariah

6 Hours Ago

James Wong

6 Hours Ago

James Wong

6 Hours Ago

James Wong

6 Hours Ago

Damion Smy

13 Hours Ago

William Stopford

14 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.