Damion Smy

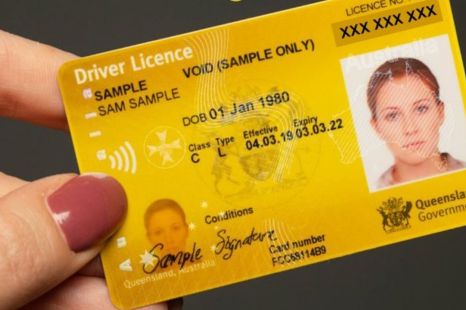

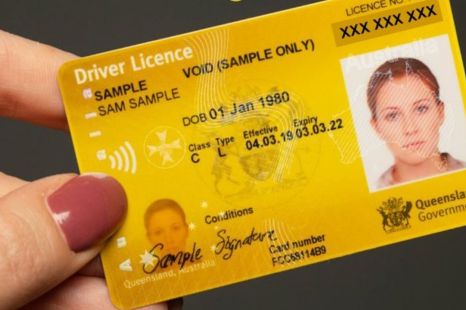

230,000 Australian driver licences exposed in ransomware attack on vehicle finance firm

12 Hours Ago

We track the declining popularity of passenger cars and the rise of SUVs in the Australian auto market between 2015 and 2025.

Publisher

Publisher

The Australian new‑vehicle market reached a record 1,241,037 deliveries in 2025, but the headline number only tells a small part of the story.

Across the last 11 years, total market growth has been modest – up 85,629 units or 7.4 per cent compared with 2015. The real change has happened inside the total, as demand has shifted away from traditional passenger cars and towards SUVs and, to a lesser extent, light commercial vehicles.

In 2015, passenger cars were still the backbone of the market. They accounted for 515,683 deliveries, or 44.6 per cent of all new vehicles sold that year. SUVs, while already popular, sat behind them at 408,471 deliveries for a 35.4 per cent share.

Light commercial vehicles (utes and vans) accounted for 199,070 sales (17.2 per cent), while heavy commercial vehicles made up just 2.8 per cent of the market.

CarExpert can save you thousands on a new car. Click here to get a great deal.

By 2025, that hierarchy had been completely rewritten.

Passenger car deliveries fell to 164,847, shrinking their share of the market to 13.3 per cent. SUVs surged to 757,697 deliveries, capturing a 61.1 per cent share. Light commercial vehicles rose to 273,229 (for a 22.0 per cent share), while heavy commercial vehicles grew to 45,264 (3.6 per cent).

The scale of the shift is stark. Between 2015 and 2025, passenger cars lost 350,836 annual sales (down 68.0 per cent). Over the same period, SUVs gained 349,226 sales (up 85.5 per cent). The difference between those two numbers is just 1610 vehicles, showing that almost the entire decline in passenger car demand has been absorbed by SUVs rather than disappearing from the market altogether.

The transition wasn’t instantaneous, but the data shows several clear inflection points.

Even the sharp contraction in total sales during 2020, when the market fell to 916,968 deliveries, did not reverse the trend. Passenger cars dropped to 222,103 sales that year, while SUVs still recorded 454,701 deliveries and were already approaching a majority share. When volumes rebounded in the years that followed after COVID, growth flowed almost entirely into SUVs and light commercials, not back into passenger cars.

Light commercials tell a more measured story. From 199,070 sales in 2015, the segment rose to 273,229 in 2025, an increase of 74,159 vehicles (up 37.3%). Their market share climbed from 17.2 to 22.0 per cent over the decade.

The share of light commercials peaked in 2021 at 24.1 per cent, before easing slightly as SUV growth accelerated again. In contrast to passenger cars, utes and vans never experienced a structural collapse; instead, they steadily expanded in popularity alongside SUVs.

Heavy commercial vehicle sales also grew in absolute terms, from 32,184 to 45,264 deliveries (up 40.6 per cent), but their share of the overall market has remained relatively stable, peaking at 4.4 per cent in 2022.

One of the most revealing aspects of the data is how little overall expansion there has been relative to the internal reshuffle. The total market added 85,629 sales between 2015 and 2025, but that net growth masks a reallocation of more than 350,000 units away from passenger cars.

In share terms, passenger cars lost 31.3 percentage points over the decade, while SUVs gained 25.7 percentage points. Light commercials added 4.8 points, and heavy commercials 0.9 points.

The market has not simply “grown into SUVs”. Instead, buyers have actively substituted one body style for another, turning what was once a market dominated by traditional cars into one where SUVs are now the default choice.

By 2025, nearly two‑thirds of all new vehicles sold in Australia were SUVs, and fewer than one in seven were passenger cars. That reality has implications well beyond annual sales charts.

It shapes which models automakers prioritise for Australia, which segments attract the most competition, and which nameplates struggle to justify ongoing investment. It also explains why new‑brand strategies in recent years have overwhelmingly focused on SUVs and utes rather than conventional hatchbacks or sedans.

| Year | Total market | Passenger | SUV | Light commercial | Heavy commercial |

|---|---|---|---|---|---|

| 2015 | 1,155,408 | 515,683 | 408,471 | 199,070 | 32,184 |

| 2016 | 1,178,133 | 486,257 | 441,017 | 217,750 | 33,109 |

| 2017 | 1,189,116 | 450,012 | 465,646 | 236,609 | 36,849 |

| 2018 | 1,153,111 | 378,413 | 495,300 | 237,972 | 41,426 |

| 2019 | 1,062,867 | 315,875 | 483,388 | 225,635 | 37,969 |

| 2020 | 916,968 | 222,103 | 454,701 | 205,597 | 34,567 |

| 2021 | 1,049,831 | 221,556 | 531,700 | 253,254 | 43,321 |

| 2022 | 1,081,429 | 203,056 | 574,632 | 256,382 | 47,359 |

| 2023 | 1,216,780 | 211,361 | 679,462 | 274,185 | 51,772 |

| 2024 | 1,237,287 | 211,073 | 704,557 | 270,351 | 51,306 |

| 2025 | 1,241,037 | 164,847 | 757,697 | 273,229 | 45,264 |

| Segment | 2015 | 2025 | Absolute change | % change |

|---|---|---|---|---|

| Total market | 1,155,408 | 1,241,037 | +85,629 | +7.4 |

| Passenger | 515,683 | 164,847 | −350,836 | −68.0 |

| SUV | 408,471 | 757,697 | +349,226 | +85.5 |

| Light commercial | 199,070 | 273,229 | +74,159 | +37.3 |

| Heavy commercial | 32,184 | 45,264 | +13,080 | +40.6 |

MORE: Another record year for new vehicle sales in Australia, but growth modest overall in 2025

Alborz Fallah is a CarExpert co-founder and industry leader shaping digital automotive media with a unique mix of tech and car expertise.

Damion Smy

12 Hours Ago

Damion Smy

14 Hours Ago

Damion Smy

16 Hours Ago

James Wong

17 Hours Ago

William Stopford

17 Hours Ago

Damion Smy

18 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.