William Stopford

2026 Kia EV9: Hot GT arrives as Korean brand's priciest model ever

6 Hours Ago

Happy families! Alliance promises 35 EVs in 2030, various imminent new models, and $36 billion battery splurge. And a new Mitsubishi ASX...

Senior Contributor

Senior Contributor

Alliance partners Renault, Nissan and Mitsubishi today called their cooperation “stronger than ever”, while announcing a ‘2030 roadmap’ to provide some clarity around next-generation cars.

Specifically the agenda outlined how much each brand’s future products would share with one another to keep costs down, and how much differentiation they’d retain to earn different badges.

It was a veritable happy family. The heads of each company presented back-and-forth, with an obvious focus on Europe – where strict emissions regulations are incentivising cooperation as a means of slashing capital costs.

MORE: Renault-Nissan-Mitsubishi Alliance to triple EV spend – report

“Looking under the hood of the Alliance,” is what chairman Jean-Dominique Senard called the presentation today. The “lack of trust” that undid the reign of Carlos Ghosn in 2018 and had the group teetering “belongs to the past,” he said.

The other major focus was on huge mutual investments in common electric vehicle architectures, to ensure the group keeps up with other big players – and naturally to ensure shareholders stay attuned and invested.

Today’s picture of unity and common purpose comes about a year and a half after the alliance announced its reformed ‘leader-follower’ working relationship to better divvy up key jobs and slash investment double-ups.

Let’s sum this presentation up, and bring you some key take-aways.

The Alliance expanded on this very scheme, whereby a given member takes charge of a given vehicle development program, leaving the others to make stylistic differences on the same bones.

This “smart differentiation methodology” defines the right level of commonality for each vehicle, pooling resources on platforms, production plants, and powertrains.

This is supplemented and enhanced by what the members call “a stricter approach to design and upper-body differentiation”.

The Alliance members added they’d grow the application of common platforms in the coming years from 60 per cent today to more than 80 per cent of a combined 90 models in 2026.

“This will allow each company to deepen their focus on their customers’ needs, their best models and core markets, while also extending innovations across the Alliance, at a lower cost,” went the statement.

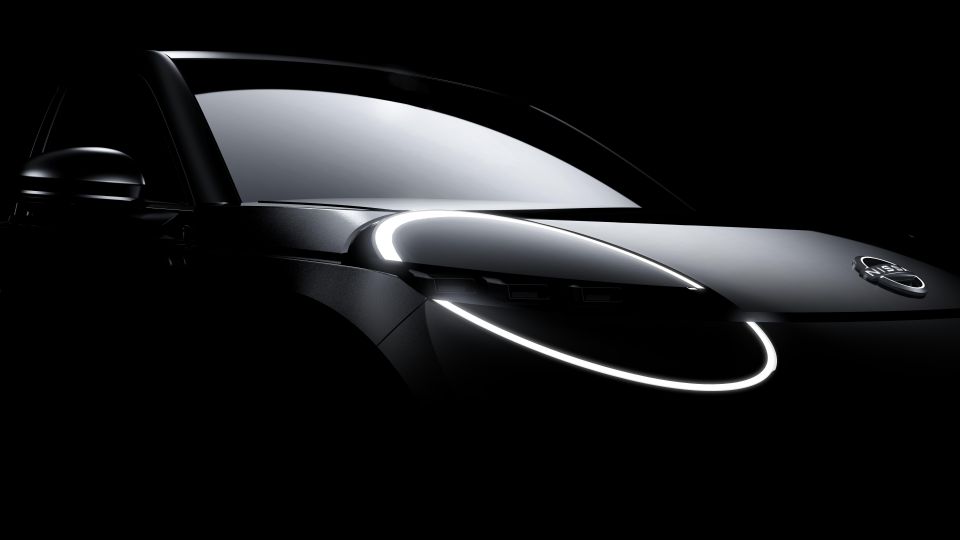

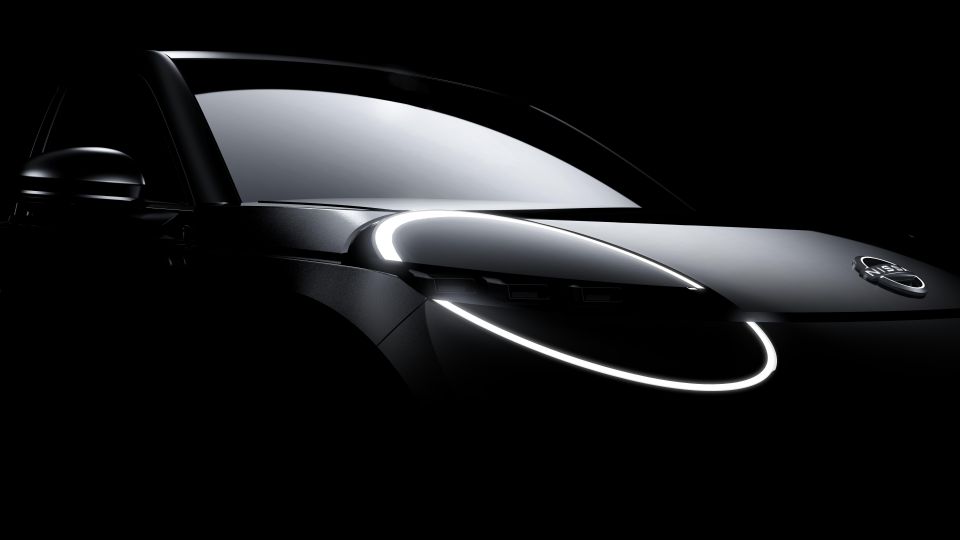

Keen on examples? Two provided were a Mitsubishi ASX successor based on the Renault Captur and made at the same Spanish plant, and a Nissan Micra successor based on the new Renault 5.

But in time there will be cross-relationships going in all directions: Mitsubishi is a leader in low-cost cars, utes and plug-in hybrids. Nissan in electric car technology and big SUVs. Renault at small cars and vans. These are just a few examples.

Renault, Nissan and Mitsubishi say they collectively “pioneered” the EV market, with the Zoe, Leaf and i-MiEV all having claims. But in the interim they’ve all been overtaken – most obviously by Tesla, but in some segments also by the likes of Volkswagen, Ford, GM, and Hyundai.

The Alliance is accelerating progress with a total €23 billion ($A36b) investment in the next five years on electrification, leading to 35 new electric models across all its brands (including Infiniti and Dacia) by 2030.

A claimed 90 per cent of these models will be based on five common EV platforms, covering most markets, in all major regions, the Alliance added.

These are:

Shared platforms and subsequently shared electronics allows commonality in active safety and driver-assist systems, commonly called ADAS.

The Alliance says Nissan (with its Mitsubishi junior partner) and Renault will share a common battery supplier, and using other means of driving scale to cut the cost of said batteries by 50 per cent from 2026, and 65 per cent by 2028 (against today’s levels).

Nissan has been tapped to handle the development of the Alliance’s hoped-for all-solid-state batteries (ASSB) with double the energy density of today’s lithium-ion batteries, and faster charging capability.

The stated aim is ASSB in mass production from 2028 and at an unspecified time beyond that to bring costs into parity with petrol and diesel vehicles.

The Alliance also plans to control all its hardware and software in-house, and to pool investments into charging providers and battery recycling for second-life usage.

By 2026, more than five million Alliance cloud systems are expected be delivered (meaning, in new cars) per year, with 25 million total on the road by then.

The Alliance says it will also be the first global, mass-market OEM to introduce the Google ecosystem in its cars, though Volvo might have some questions…

Under Renault leadership (leader-follower again in action), the Alliance says it’s developing a common and centralised electrical and electronic architecture converging hardware and software applications.

The group’s first “full software defined” vehicle is promised 2025. This phrase means much of the car will be able to handle over-the-air updates to keep it fresh and bolster residuals – much like Tesla’s current strategy.

William Stopford

6 Hours Ago

Paul Maric

7 Hours Ago

Damion Smy

7 Hours Ago

Damion Smy

10 Hours Ago

William Stopford

10 Hours Ago

CarExpert

11 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.