James Wong

2026 Kia EV4 GT Sedan revealed

4 Hours Ago

Senior Contributor

Renault, seemingly revitalised under the leadership of Luca de Meo, says it sees myriad rapid changes in the car industry as just more potential revenue streams, or “value chains”.

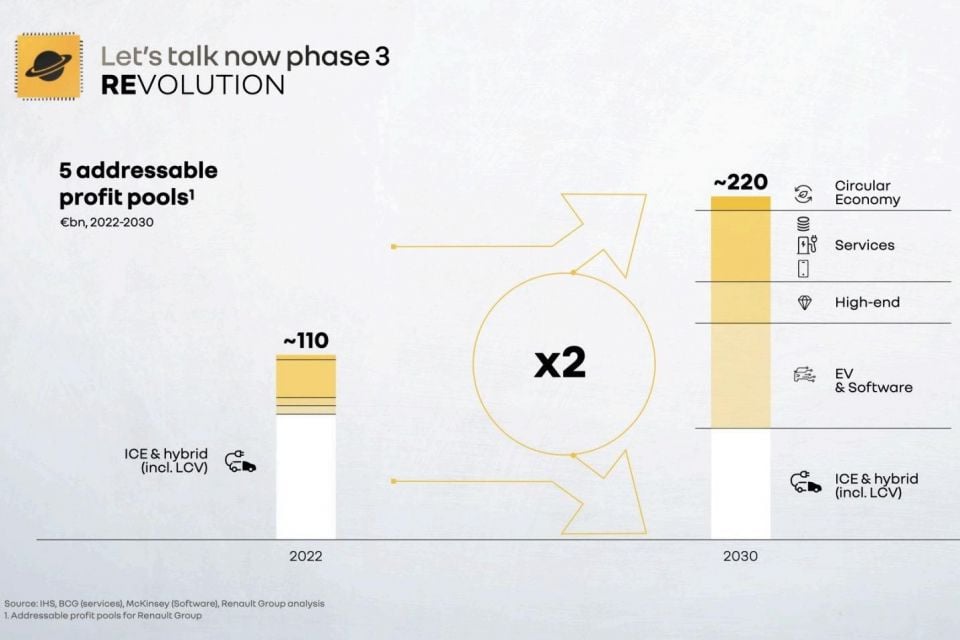

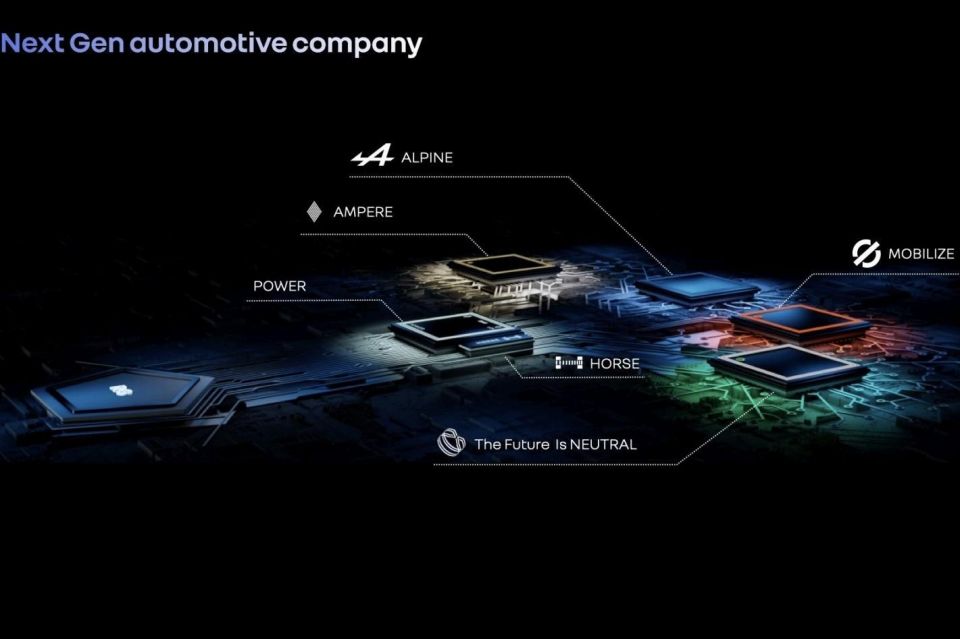

The Renault Group will split into five focused businesses under one umbrella, aimed at becoming a “Next Gen automotive company” with double today’s revenue opportunities by 2030.

It might seem a touch confusing but bear with us as we explain. The five Renault Group companies are called Power, Alpine, Ampere, Mobilize, and The Future Is Neutral, and each will have their own governance and P&L.

Renault’s combustion and hybrid division

The traditional Renault Group core business making internal combustion (ICE) and hybrid cars under Renault, Renault Van, and Dacia branding.

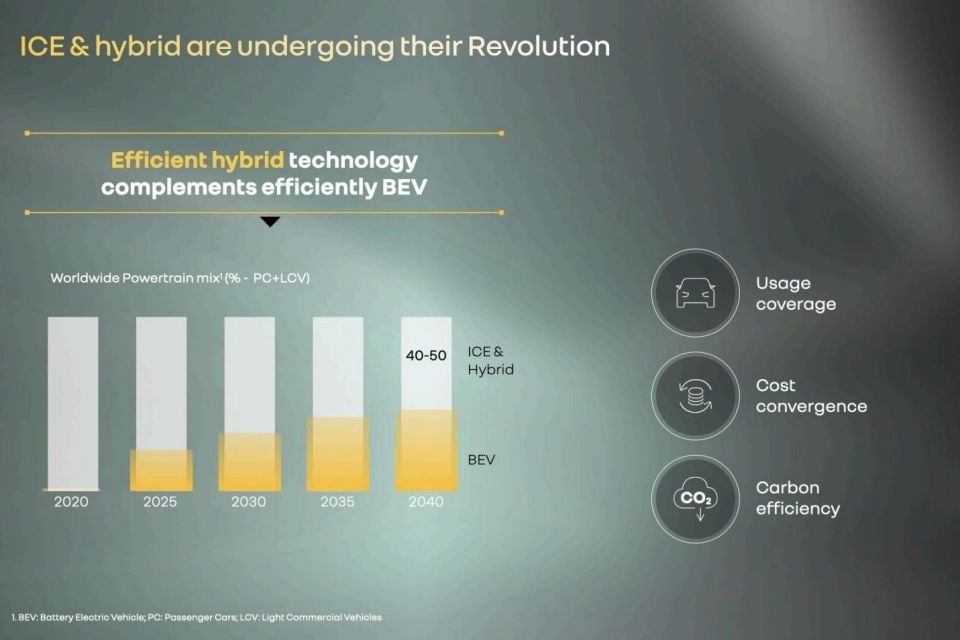

ICE and hybrid vehicles will still represent up to 50 per cent of passenger cars sales worldwide in 2040, Renault says, adding that it expects sales to keep growing 2 per cent, per year on average over 2022-2030.

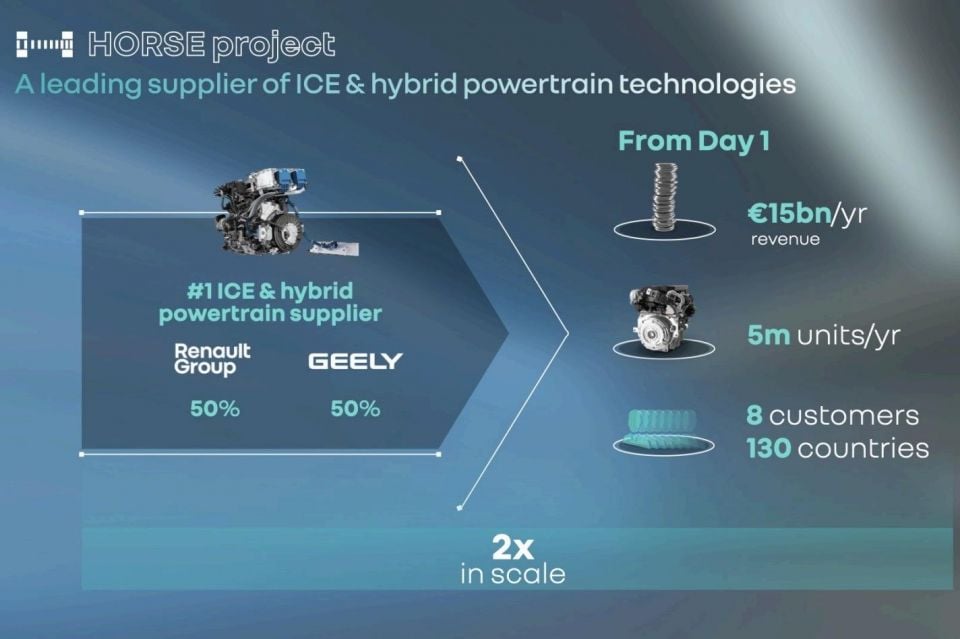

This wing of the business factors in the new 50:50 joint-venture powertrain company with Geely which will supply additional powertrains to Alliance brands Nissan and Mitsubishi as well as its owners and their brands.

From day one this entity will have a turnover of more than €15 billion ($A23b) and a volume of five-million units per year, supplying common drivetrains to at least eight related OEMs. It will have 17 plants supplying 130 countries, five R&D centres, and 3000 engineers.

It will make engines, gearboxes, HEV systems and batteries, and via the JV will double both its scale and market coverage from 40 per cent to 80 per cent worldwide.

It also wants to develop technologies in the field of alternative fuels, seeking for cooperation with a “potential partner from the energy industry”.

MORE: Renault and Geely announce ICE and hybrid joint venture company

Renault’s halo EV brand with performance focus

Intended to be the “high-end zero-emission global brand with a racing pedigree”, capitalising on its A110 coupe and entry into Formula 1.

Alpine today runs a team of 2000 people, of which a claimed 50 per cent are engineers.

Alpine’s planned new line-up will be full-electric from 2026. By then it plans to be selling the next-generation A110, and two additional models in the form of a B-segment hatch (a hot version of the 2024 Renault 5 EV) and a small SUV.

The company then plans two larger and “cutting-edge” cars to support its international expansion, with half of its sales growth intended to come from new markets beyond Europe including North America and China.

MORE: Alpine adding two larger EVs as it focuses on global expansion

Renault’s EV wing, designed to operate more like a startup

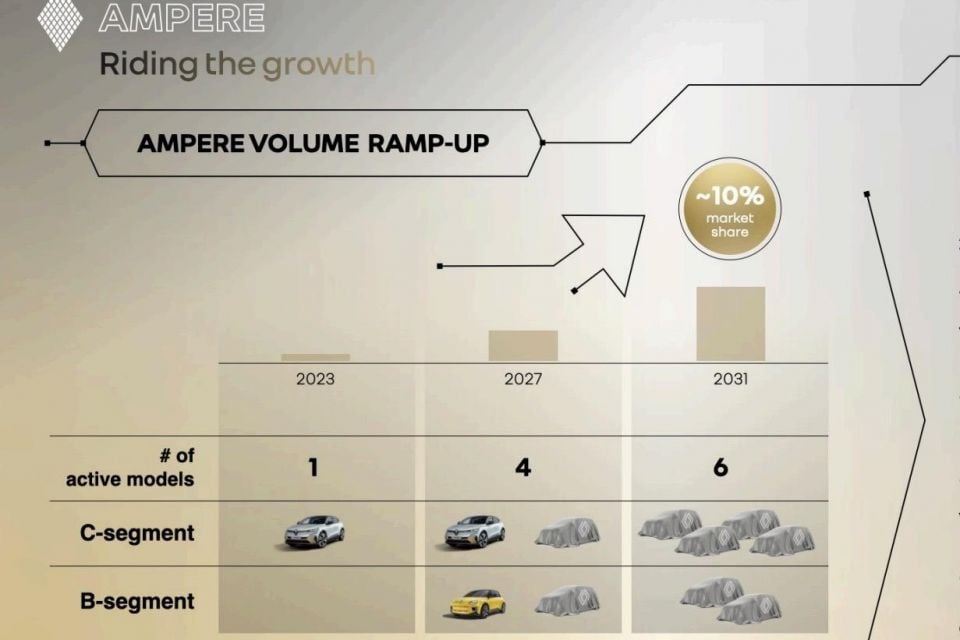

In plain English, Ampere will develop, manufacture, and sell BEV passenger cars, with software-defined vehicle technology such as over-the-air updates, affixed with Renault badges.

Business-speak in the Renault presentation says it is the “first EV and software pure player born from an OEM disruption”, which is a fancy way of saying an established brand using a clean sheet.

The plan is for Ampere to “bring the best of both worlds”, meaning the know-how and assets from Renault Group but the focus and agility of an EV pure player like Tesla.

The company is also seeking external investors and weighing an IPO on Euronext Paris in the second part of 2023. Renault plans to keep a “strong majority” in Ampere and is reportedly counting on the support of potential investors such as Qualcomm.

Based in France, Ampere will be an OEM with around 10,000 employees, including around 3500 engineers, half of them specialised in software.

Before 2030, Ampere’s line-up of six Renault-badged EVs will cover 80 per cent of the EV mainstream profit pool as it currently stands: the B segment with the new Renault 5 and Renault 4, and the C segment with Megane E-Tech, new Scénic, and two other EVs yet to be revealed.

Ampere plans to produce around a million EVs for the Renault brand in 2031, it says.

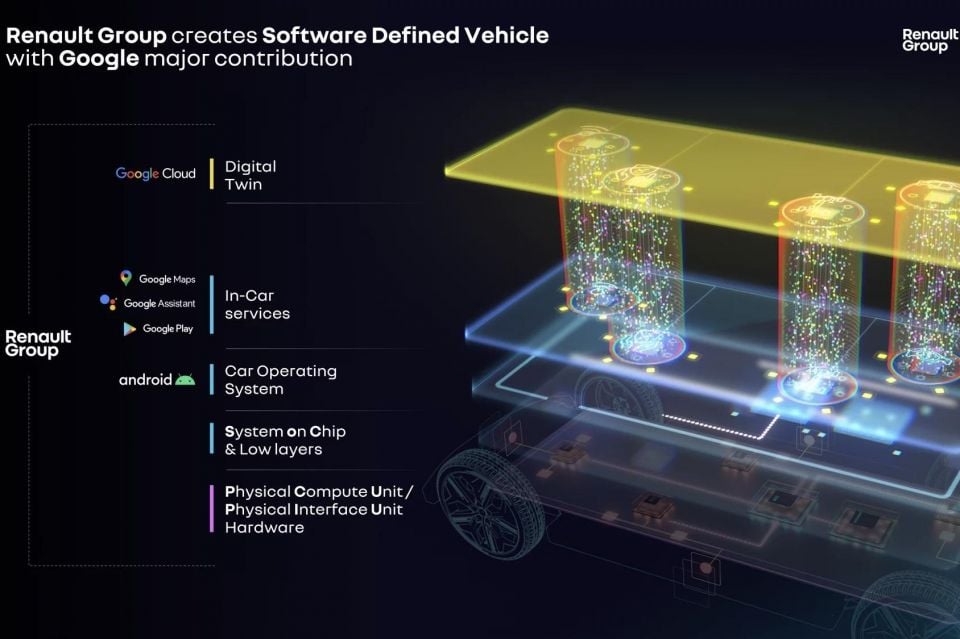

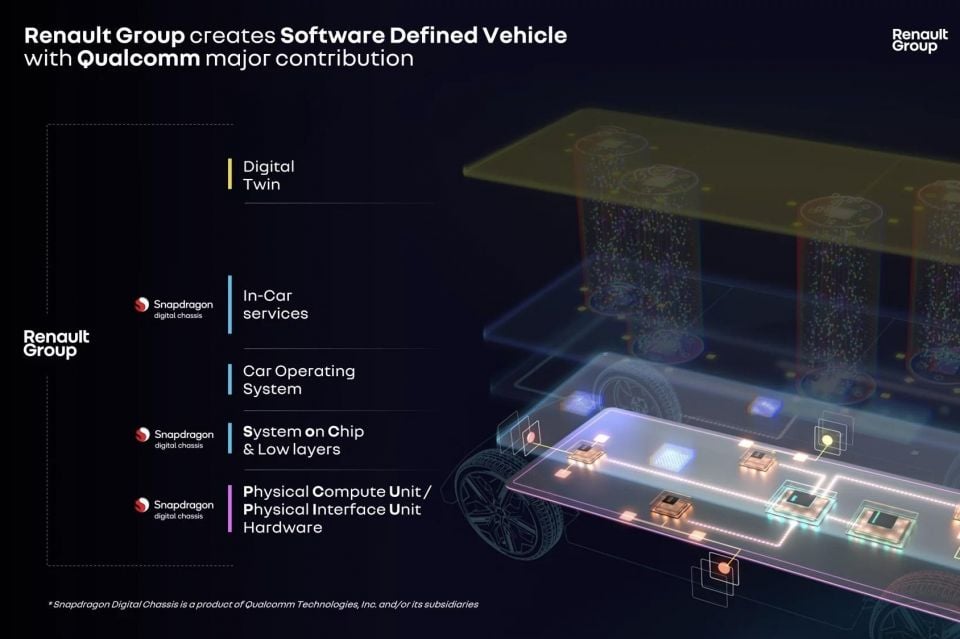

Renault Group is building hardware and software partnerships with Qualcomm Technologies (computing platforms based on the Snapdragon Digital Chassis), and Google (Android-based open operating platform with third party app developer access).

Renault’s financial service and vehicle-sharing wing

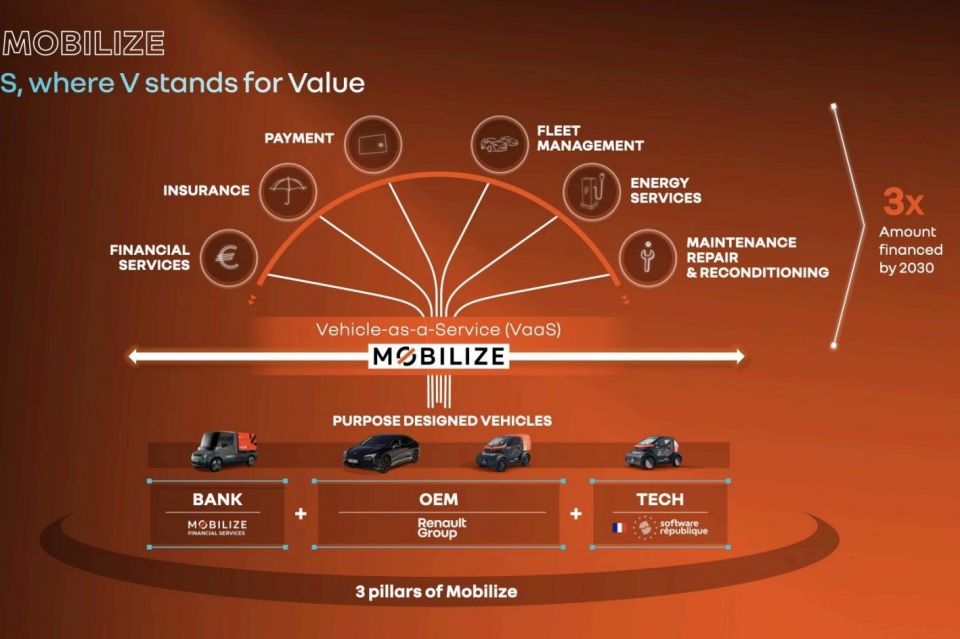

Mobilize Financial Services already has four million customers, and will expand its traditional business while developing new profit streams such as subscriptions, insurance, and operational leasing.

It will be a vehicle-as-a-service provider with purpose-designed vehicles, generating recurring revenue – up to three-time the aggregate over a vehicle’s life.

“What makes Mobilize different from any other automotive brand is that it comes from the services to the product and not the other way around,” Renault claims.

The bit focused on recycling the batteries and other stuff

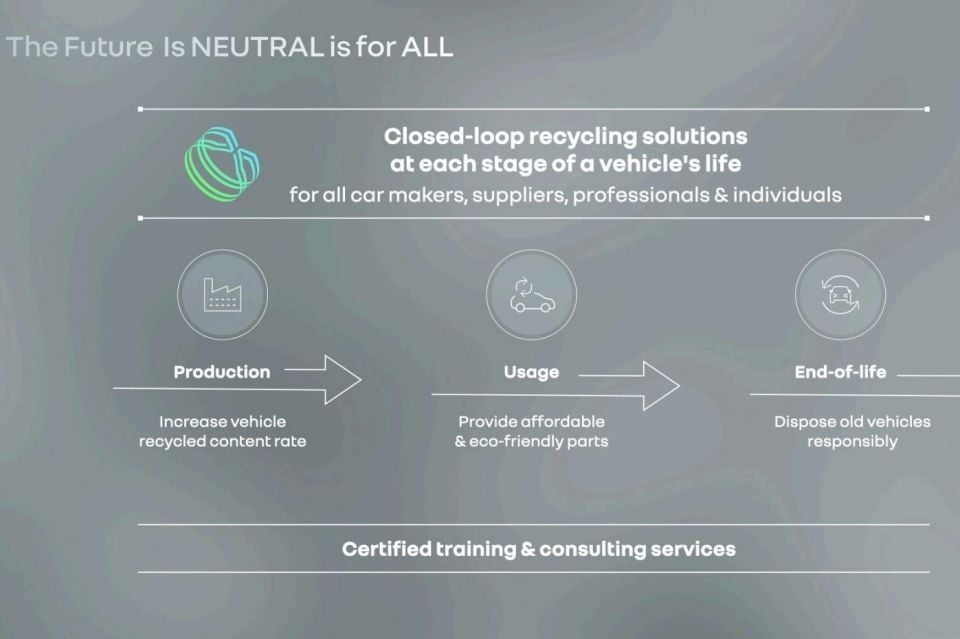

This entity will offer closed-loop recycling solutions at each stage of a vehicle’s life: meaning supply of parts and raw materials, production, usage and end-of-life.

It aims to reach above 90 per cent value chain coverage by 2030, and become the European leader at industrial scale in the burgeoning automotive circular economy.

It will service Renault Group as well as the entire industry, and is opening up a minority of its capital to outside investors with the objective to co-finance investments of around €500 million until 2030.

“Today’s announcements are a new sign of Renault Group team’s determination to prepare the company for the future challenges and opportunities generated by the transformation of our industry,” said Renault chief Luca de Meo.

“After having executed one of the fastest and unexpected recovery plans, after having prepared the company for growth by securing the development of the best product line-up in decades, we intend to position ourselves faster and stronger than competition on the new automotive value chains: EV, software, new mobility and circular economy.

“… Renault Group is one team of teams, benefiting from simplified governance and digital management platforms boosting collaboration and breaking silos typical of traditional organisations.”

Go deeper on the cars in our Showroom, compare your options, or see what a great deal looks like with help from our New Car Specialists.

James Wong

4 Hours Ago

William Stopford

4 Hours Ago

Damion Smy

6 Hours Ago

William Stopford

6 Hours Ago

Max Davies

8 Hours Ago

Andrew Maclean

8 Hours Ago