William Stopford

Hyundai Santa Fe losing its most controversial feature

4 Minutes Ago

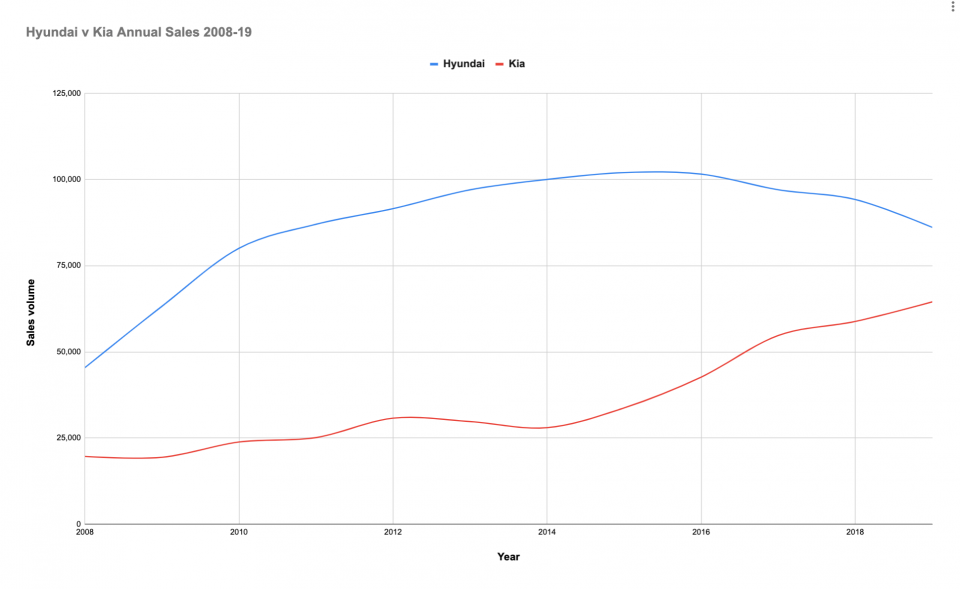

In the past five years, Kia has gone from selling one-third as many cars as its senior partner in Australia, to being almost equal. Here we chart the closing of the gap.

Senior Contributor

Senior Contributor

Monitoring Australia’s new vehicle sales database tells you many things about changes in buyer tastes and brand acceptance.

And few case studies are as interesting as the comparison between Korea’s powerhouse Hyundai, and a company widely seen as its smaller ‘sibling’ Kia. The former does not own the latter outright, but is by far the largest shareholder and most consider it the senior partner.

Yet at the time of writing, Kia had outsold Hyundai in Australia for two consecutive months – something it had not achieved even once before in its 23 years selling passenger cars and SUVs in Australia (it had sold light trucks in low volumes for a period before January 1997).

And the year-to-date (YTD) comparison is quite fascinating. Kia Australia has sold 17,971 new vehicles this year and contracted a respectable 7.0 per cent compared to the same period in 2019, in an overall market that’s down 21 per cent.

Hyundai’s local arm has sold 18,941 new vehicles, down 29.4 per cent.

That means their respective market shares are now closer than they have ever been. Hyundai sits third overall behind Toyota and Mazda with 7.0 per cent share, and Kia sits fifth with 6.6 per cent share.

Between them sits Mitsubishi, down 38.8 per cent year-to-date.

We’ve tapped into the VFACTS database, supplied by the Federal Chamber of Automotive Industries, which uses figures supplied by the manufacturers.

| Year | Hyundai | Kia | Margin |

|---|---|---|---|

| 2020 (YTD) | 18,941 | 17,971 | 970 |

| 2019 | 86,104 | 64,503 | 21,601 |

| 2018 | 94,187 | 58,815 | 35,372 |

| 2017 | 97,013 | 54,737 | 42,276 |

| 2016 | 101,555 | 42,668 | 58,887 |

| 2015 | 102,004 | 33,736 | 68,220 |

| 2014 | 100,011 | 28,005 | 72,006 |

| 2013 | 97,006 | 29,778 | 67,228 |

| 2012 | 91,536 | 30,758 | 60,958 |

| 2011 | 87,008 | 25,128 | 61,880 |

| 2010 | 80,038 | 23,848 | 56,190 |

| 2009 | 63,207 | 19,407 | 43,800 |

| 2008 | 45,409 | 19,661 | 25,748 |

As you can see, Kia’s annual sales were less than one-third that of Hyundai’s as recently as 2015. Now they’re separated by a whisker.

This graph tells a tale. I didn’t include 2020 because, given there are no full-year sales, the lines became skewed.

So, what might be behind this?

We’d suggest Kia’s suddenly desirable products, its sharp campaign prices in a market where cars are getting more expensive, a dominance of lower-volume vehicle segments (it tops the Micro Car and People Mover markets), and its market-leading seven-year warranty.

Moreover, Kia’s multi-franchise dealers will no doubt be putting more resources into the brand, and the presence of more Kias on the road perpetuates because each unit is essentially a rolling billboard.

Kia has the new Sorento launching this year, which should give it a boost alongside the Seltos.

However, Hyundai is gearing up for the updated i30 hatch range, new i30 sedan launch, new Sonata, i20 N pocket rocket, and range-topping Palisade SUV in the next year or two.

But what it really needs is its long-fought-for dual-cab ute, rumoured to be called Tarlac. And to hope Kia doesn’t get its own version…

MORE: April 2020 new cars sales, including a surprise podium finisher

William Stopford

4 Minutes Ago

CarExpert

1 Hour Ago

Damion Smy

3 Hours Ago

Damion Smy

3 Hours Ago

Derek Fung

7 Hours Ago

James Wong

14 Hours Ago