We all knew that car sales in Australia during April would be disastrously low thanks to COVID-19, and VFACTs figures released today by the Federal Chamber of Automotive Industries have borne that out.

There were 38,926 new vehicles counted as sold last month, excluding the handful of brands that do not share data, most notably Tesla (to which we’ve reached out, and am yet to hear back from).

That’s a decline of 48.5 per cent over April 2019’s tally of 75,550.

It is also the largest single decrease of any month since VFACTs figures were first recorded in 1991. For context, the sales in April 2009 during the height of the Global Financial Crisis were 63,965.

Sales in South Australia, Tasmania, NSW and Victoria fell by 50 per cent. Counter-intuitively sales in the ACT grew 25 per cent, in large part down to replacement vehicles purchased following a huge hail storm.

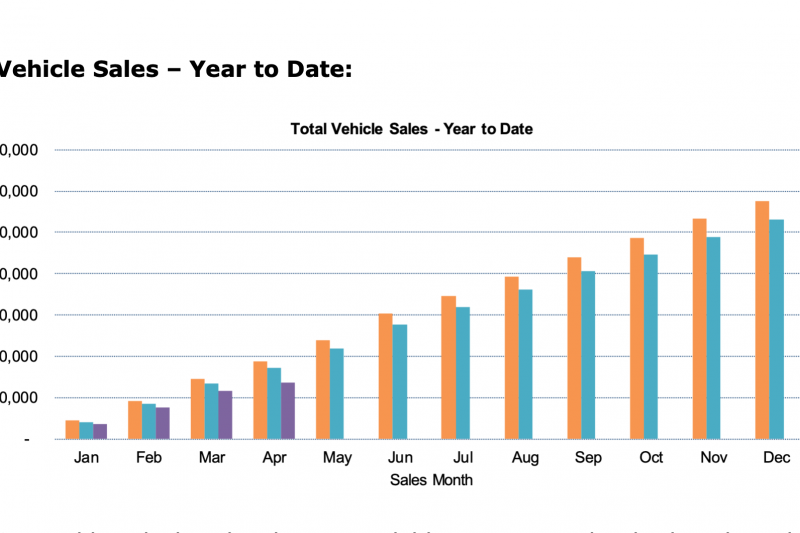

Nationally, year-to-date figures are down 21 per cent over last year’s cumulative tally at 272,287 units. The market has now been contracting for 25 successive months.

Brands

By contracting in sales ‘only’ 32 per cent, Toyota grew its market share to 26.5 per cent and made five of the top-selling six vehicles (HiLux, RAV4, LandCruiser, Corolla and Prado). I believe that’s called domination.

Mazda finished second despite falling 60.5 per cent. Stunningly, Kia finished third and beat out both Ford and its Hyundai big brother – outselling the latter for the second month this year.

Mitsubishi finished sixth while declining 63.2 per cent, and amazingly it was BMW in seventh. The Bavarian brand only declined 5.7 per cent as models such as the 3 Series, X1, X4, X6, X7, and new 2 Series Gran Coupe all grew compared to April 2019.

Holden’s dealers got rid of 1501 cars, more than half of them Colorados. Nissan declined 51.5 per cent, edging out Mercedes-Benz which rounded out the top 10.

Both Chinese brand MG and the Australian importer for Ram Trucks (Ateco, licensing Walkinshaw to do right-hand drive conversions and re-engineering) managed to grow their sales compared to April 2019, which is an impressive achievement.

| April 2020 sales | Change % | |

|---|---|---|

| Toyota | 10,325 | -31.8 |

| Mazda | 3022 | -60.5 |

| Kia | 2492 | -44.9 |

| Ford | 2251 | -53.1 |

| Hyundai | 2247 | -65.3 |

| Mitsubishi | 1734 | -63.2 |

| BMW | 1703 | -5.7 |

| Holden | 1501 | -56.9 |

| Nissan | 1468 | -51.5 |

| Mercedes-Benz | 1350 | -47.5 |

| Volkswagen | 1328 | -62.1 |

| Subaru | 1282 | -57.4 |

| Isuzu Ute | 1099 | -41.2 |

| Honda | 1052 | -60.0 |

| Suzuki | 611 | -42.1 |

| MG | 414 | 1.5 |

| Lexus | 411 | -42.8 |

| Audi | 373 | -63.6 |

| Renault | 311 | -32.4 |

| Volvo Car | 287 | -53.4 |

| Land Rover | 248 | -60.6 |

| Porsche | 227 | -32.8 |

| LDV | 210 | -44.0 |

| Jeep | 179 | -62.6 |

| Ram | 178 | 14.1 |

| Mini | 153 | -38.3 |

| Skoda | 107 | -80.7 |

| Haval | 101 | -15.8 |

| Jaguar | 63 | -57.1 |

| Great Wall | 72 | -28.7 |

April sales: The top 30 manufacturers

Small-volume brands that were not on that list included Fiat and Peugeot (71 apiece), SsangYong (54), Maserati (24), Chrysler (16), Alfa Romeo (13), Ferrari (nine), Lamborghini (nine), Genesis (seven, despite selling online), Citroen (a paltry six), Bentley (four), and Aston Martin, Lotus, and Rolls-Royce (one apiece).

Models

Toyota sold more than a quarter of the top 30 models (eight overall). Mazda had five, Kia, Hyundai and Mitsubishi each had three, both of Isuzu Ute’s models were in there, and Nissan also had two.

Ford, Holden, Subaru and Volkswagen each had one.

| April 2020 sales | |

|---|---|

| Toyota HiLux | 2339 |

| Toyota RAV4 | 1911 |

| Toyota LandCruiser 70 and 200 | 1603 (924 wagons) |

| Ford Ranger | 1540 |

| Toyota Corolla | 1195 |

| Toyota Prado | 947 |

| Kia Cerato | 860 |

| Holden Colorado | 854 |

| Isuzu D-Max | 760 |

| Hyundai i30 | 695 |

| Toyota Camry | 675 |

| Mazda CX-5 | 648 |

| Nissan Navara | 519 |

| Subaru Forester | 510 |

| Hyundai Tucson | 494 |

| Toyota C-HR | 480 |

| Toyota HiAce van and bus | 479 |

| Mitsubishi Triton | 469 |

| Nissan X-Trail | 469 |

| Mazda BT-50 | 466 |

| Mitsubishi Outlander | 459 |

| Mazda3 | 458 |

| Mazda CX-30 | 452 |

| Kia Sportage | 439 |

| Mazda CX-3 | 394 |

| Hyundai Kona | 379 |

| Kia Seltos | 378 |

| Mitsubishi ASX | 348 |

| Volkswagen Golf | 343 |

| Isuzu MU-X | 339 |

April sales: The top 30 models

In terms of segment breakdowns, the most popular type of vehicles were 4×4 Utes (18.2 per cent market share, growing to 21.4 per cent if 4x4s were included), ahead of Medium SUVs (18.1), Small Cars (12.1), Large SUVs (11.4), and Small SUVs (10.9).

These five vehicle segments accounted for about three-quarters of all sales.

| 1 | 2 | 3 | |

|---|---|---|---|

| Micro | Kia Picanto 99 | Fiat 500 20 | Mitsubishi Mirage 19 |

| Light | Kia Rio 251 | MG3 222 | Suzuki Swift 182 |

| Light lux | Mini 74 | Audi 17 | Citroen C3 1 |

| Small | Toyota Corolla 1195 | Kia Cerato 860 | Hyundai i30 695 |

| Small lux | Mercedes A-Class 217 | BMW 1 Series 116 | Audi A3 65 |

| Medium | Toyota Camry 675 | Mazda6 71 | Skoda Octavia 39 |

| Medium lux | BMW 3 Series 254 | Mercedes CLA 94 | Mercedes C-Class 87 |

| Large | Kia Stinger 75 | Holden Commodore 30 | Skoda Superb 2 |

| Large lux | Mercedes E-Class 36 | BMW 5 Series 30 | Maserati Ghibli 11 |

| Upper | Chrysler 300 16 | BMW 6 Series GT 15 | BMW 8 Series 5 |

| MPVs | Kia Carnival 220 | Hyundai iMax 30 | Honda Odyssey 26 |

| Sports | Ford Mustang 146 | BMW 2 Series 62 | Mazda MX-5 33 |

| Sports lux | BMW 4 Series 50 | Mercedes C-Class 38 | BMW Z4 14 |

Above: Top three sellers per passenger vehicle segment

| 1 | 2 | 3 | |

|---|---|---|---|

| Light | Mazda CX-3 394 | Volkswagen T-Cross 188 | Holden Trax 178 |

| Small | Toyota C-HR 480 | Mazda CX-30 452 | Hyundai Kona 379 |

| Small lux | BMW X1 222 | Volvo XC40 177 | Audi Q3 151 |

| Medium | Toyota RAV4 1911 | Mazda CX-5 648 | Subaru Forester 510 |

| Medium lux | BMW X3/X4 425 | Mercedes GLC/Coupe 237 | Lexus NX 140 |

| Large | Toyota Prado 947 | Isuzu MU-X 339 | Toyota Kluger 313 |

| Large lux | BMW X5/X6 300 | Mercedes GLE/Coupe 119 | Range Rover Sport 81 |

| Upper | Toyota LandCruiser 924 | Nissan Patrol 150 | BMW X7 60 |

Above: Top three sellers per SUV segment

| 1 | 2 | 3 | |

|---|---|---|---|

| Light vans | Volkswagen Caddy 69 | Renault Kangoo 25 | Peugeot Partner 6 |

| Mid vans | Toyota HiAce 308 | Hyundai iLoad 152 | Ford Transit Cust. 105 |

| 4×2 Ute | Toyota HiLux 456 | Isuzu D-Max 198 | Mazda BT-50 147 |

| 4×4 Ute | Toyota HiLux 1883 | Ford Ranger 1419 | Holden Colorado 780 |

Above: Top three sellers per light commercial segment

Miscellaneous

Private sales fell 47.7 per cent to 17,094 and business fleet sales fell 49.6 per cent to 15,758. Government fleet sales fell a more modest 12.6 per cent to 2543, and rental car sales declined 78.9 per cent to 1221.

There were 131 EVs and PHEVs sold excluding Tesla, equal to just 0.3 per cent market share. Plug-less hybrid vehicles found 2809 buyers, equal to 7.2 per cent share.

The top sources of imports were Japan (13,077), Thailand (9632), Korea (4778), Germany (2533) and the USA (1747).

Quote from FCAI chief Tony Weber

“Clearly, the COVID-19 pandemic has had a major influence on the April sales result, and reflects a downturn in the broader economy right across the country.

“Figures recently released by the Australian Bureau of Statistics show that 31 per cent of Australian citizens have experienced a decrease in income due to the pandemic.

“In addition 72 per cent of Australian businesses reported that reduced cash flow is expected to have an adverse impact on business over the next two months.

“These conditions inevitably impact consumer confidence and purchase decisions.

“Our member brands are working closely with their dealer networks to ensure dealerships are accessible and safe. Enhanced hygiene protocols and contact-less sales and social interactions have been initiated to ensure personal protection for both customers and dealer staff.

“We know that our member brands are doing everything they can to assist both their dealerships and their valued customers during this difficult time.

“But more needs to be done. We are calling on Federal and State Governments to consider the automotive industry, which employs over 65,000 people in Australia, when compiling their recovery plans.

“The JobKeeper and JobSeeker payment programs put in place by the Federal Government are a welcome initiative.

“However, we believe the scope needs to ensure high turnover and low margin businesses, such as new car dealerships, are covered.

“These businesses are often the backbone of local communities and in the current environment, many are facing overwhelming challenges.

“As well as continued business initiatives, support to bolster consumer confidence is imperative to the strength of our economy.

“We have begun to see a slight lift in consumer confidence as the COVID-19 restrictions start to ease. We really need further measures to support this confidence and continue the positive trend.

“Initially, we would ask that the instant asset write off package is extended to further stimulate business purchasing.”

Do you have any questions you’d like to ask? Put them in the comments and we will answer.