Ben Zachariah

2026 BYD Sealion 5 Essential review

8 Minutes Ago

While companies like Volkswagen are slowly increasing production in the wake of Russia's invasion, others have been forced to suspend factories.

News Editor

News Editor

Volkswagen is ramping up German production and Skoda has said its Ukrainian wiring harness supplier is operating again, but all is not well in the European automotive industry as war rages in Ukraine.

Reuters reports Ford has paused German production of its Fiesta and Focus until the end of the week due to shortages arising from the supply chain disruption.

It has also suspended orders for the Tourneo Connect, Galaxy and S-Max people movers, which are built in Poland and Spain.

Likewise, Nissan has reportedly halted production at its St Petersburg plant in Russia for three weeks due to parts shortages.

The Russian Government has threatened to nationalise the assets of companies that cease production there. The likes of Ford, Hyundai and Toyota have suspended Russian production, though Renault – owner of Russian automaker AvtoVaz – has pressed on.

While some companies have also been forced to throttle production outside Russia due to the war and associated supply chain crunch, Volkswagen has told Automotive News Europe it’s resuming a second shift of Golf production this week at its Wolfsburg plant and will soon produce it in three shifts.

The company says its Zwickau and Dresden plants, which build electric vehicles, will take longer to get back to normal. Zwickau could return online in April.

The Volkswagen Group has been trying to source additional wiring harnesses from Romania, Hungary, Tunisia, Morocco, Mexico and China, though its Skoda brand said in a 2021 earnings presentation this week its Ukrainian supplier has resumed production.

With no end in sight to the invasion of Ukraine by Russia, automotive supply chains have been hobbled.

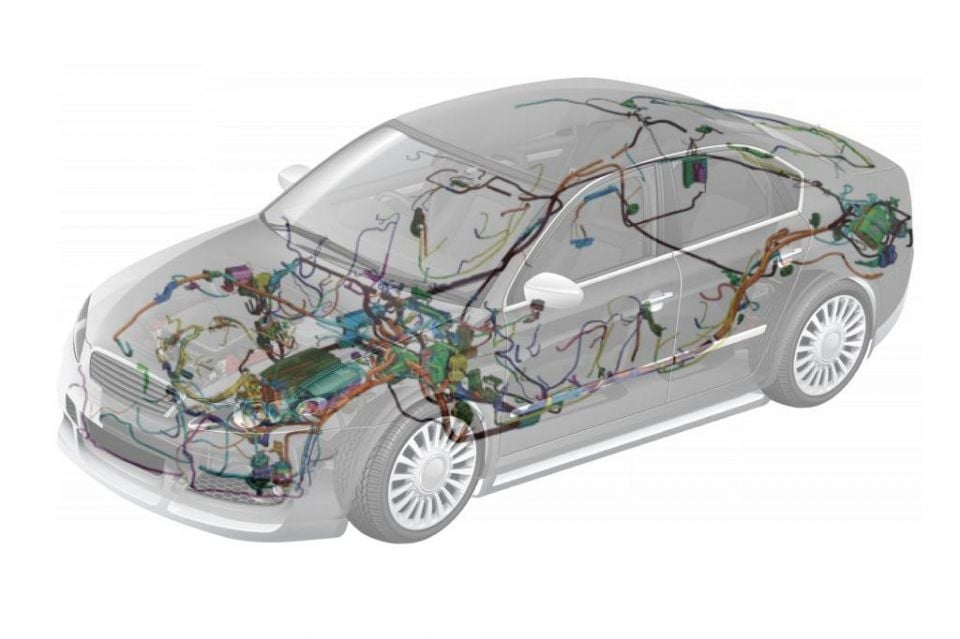

Several carmakers source wiring harnesses from suppliers such as Leoni, Fujikura and Nexans in Ukraine, due to the country’s geographic proximity to their factories, plus its lower labour costs and skilled workforce.

Reuters reports harnesses are the most critical automotive component exported to the European Union from Ukraine, accounting for nearly seven per cent of all imports of this product.

Wiring harnesses bundle up to 5km of cables in the average car, and are unique to a vehicle model. It could take months for suppliers to increase production capacity at other locations.

It’s not just Ukraine that automakers rely on for components. Russia is the world’s third-largest supplier of nickel, used in electric vehicle batteries. The country also produces 40 per cent of the world’s palladium.

The knock-on effect of Russia’s invasion of Ukraine could be pricier electric vehicles.

A report from S&P Global Mobility says raw materials costs for EV batteries could soar, increasing by $8000 per vehicle with the Tesla Model Y and $11,000 per vehicle with the Mercedes-Benz EQS.

Nickel prices have become volatile, reportedly surging from $30,000 per ton on March 7 to $100,000 per ton just a day later.

Automakers had been gravitating towards nickel as a replacement for cobalt, as human rights abuses in Congo – the world’s leading supplier of cobalt – became well-publicised.

S&P Global Mobility has lowered its global vehicle production forecast by 2.6 million units for 2022. It projects next year will also see an identical decline in overall volume.

William Stopford is an automotive journalist with a passion for mainstream cars, automotive history and overseas auto markets.

Ben Zachariah

8 Minutes Ago

Ben Zachariah

8 Minutes Ago

William Stopford

6 Hours Ago

William Stopford

7 Hours Ago

Damion Smy

9 Hours Ago

Damion Smy

11 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.