Ben Zachariah

2026 KGM Musso EV review

4 Hours Ago

Rimac Group has raised almost $750 million in its latest investment round which it'll primarily use to further the Rimac Technology business.

Contributor

Contributor

Croatian electric vehicle (EV) start-up Rimac Group says it has raised €500 million ($A743 million) as part of its Series D investment round.

This latest splash of extra cash brings the claimed valuation of the business to over €2 billion ($A2.97 billion).

This fundraising round was lead by venture capital fund SoftBack Vision Fund 2 and private equity business Goldman Sachs Asset Management, with the participation of existing Rimac shareholders including Porsche and InvestIndustrial.

Series D investment rounds rarely occur in start-up companies but they typically give the company an increase in value before going public.

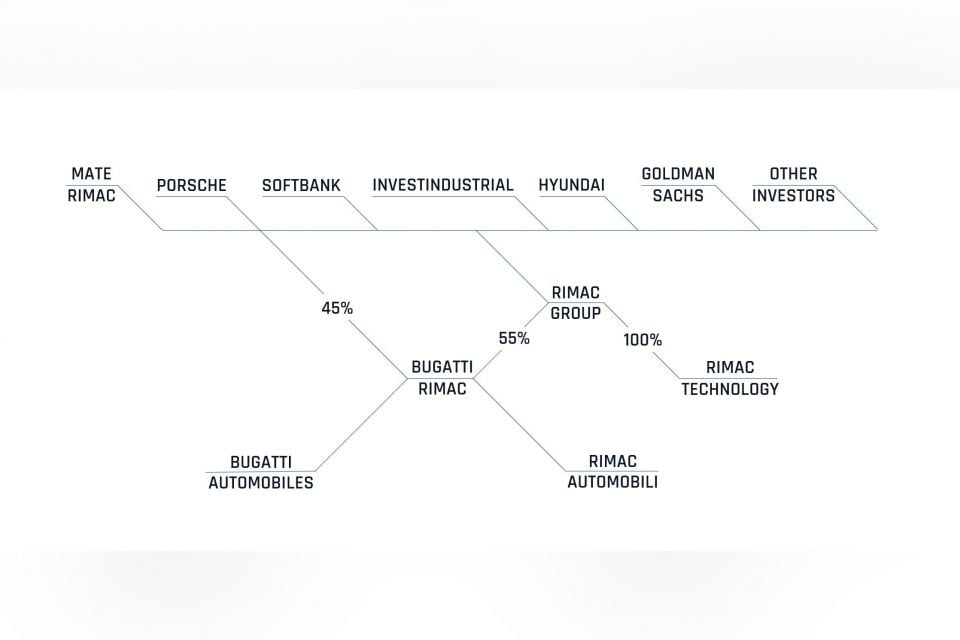

Mate Rimac remains the largest shareholder of Rimac Group.

As previously detailed, Rimac recently launched the standalone Rimac Technology business which will continue to expand the engineering, development and supply of high-performance EV battery systems, electric drive units, electronic systems, and user interface components.

This latest funding will be primarily used to further Rimac Technology as it starts “large-volume” mass-production for global manufacturers.

Mr Rimac also noted the raise will allow for the company to recruit 700 new team members in 2022, open new offices across Europe and expand new production facilities.

Rimac Technology is ramping up its production capacity and completing work on the new €200 million ($A297 million) headquarters in Zagreb, Croatia.

Titled as ‘Rimac Campus‘, it’ll serve as the company’s international research and development (R&D) and production base for all future Rimac products, including the Rimac Nevera, and their key components.

This campus will also become the home of R&D for future Bugatti models due to the new joint venture, though these vehicles will be built at Bugatti’s Molsheim plant in France.

Rimac recently joined forces with Bugatti to form a new joint venture company known as Bugatti Rimac, with Rimac founder Mate Rimac becoming CEO of both brands.

The joint venture saw Bugatti step out from under the Volkswagen Group umbrella, though Porsche holds a 45 per cent stake in Bugatti Rimac.

For now the individual brands will continue to operate separately, retaining their existing production facilities and distribution channels.

“We’re witnessing a rapid demand for electrification in an industry facing significant challenges adapting to this technological shift,” said SoftBank Investment Advisors investor Jimi MacDonald.

“Rimac has quickly established itself as a leading EV technology partner to global OEMs supporting their transition to an electric future.”

“We are pleased to support Mate and his team in building on this success and taking Rimac to the next level.”

MORE: Rimac Technology begins operating as independent company MORE: Bugatti Rimac $297 million Croatian headquarters under construction MORE: Bugatti and Rimac form joint venture

Jack Quick is an automotive journalist based in Melbourne. Jack studied journalism and photography at Deakin University in Burwood, and previously represented the university in dance nationally. In his spare time, he loves to pump Charli XCX and play a bit of Grand Theft Auto. He’s also the proud owner of a blue, manual 2020 Suzuki Jimny.

Ben Zachariah

4 Hours Ago

James Wong

4 Hours Ago

James Wong

4 Hours Ago

James Wong

4 Hours Ago

Damion Smy

11 Hours Ago

William Stopford

12 Hours Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.