Derek Fung

China to ban yoke-style steering wheels - report

19 Minutes Ago

The Australian car market returned its best tally since 2018, with Toyota, Mazda and Kia taking the top three spots and EVs setting a record.

Senior Contributor

Senior Contributor

New vehicle sales grew 3.0 per cent in 2022 despite widely publicised supply issues, finishing up at around 1.08 million units for the calendar year.

Annual sales data (VFACTS) shows that 1,081,429 new cars, SUVs and commercial vehicles were delivered in 2022, making it the best result since 2018 when 1,153,111 vehicles were sold.

Industry-wide sales for December 2022 jumped 12.1 per cent, giving the market some momentum heading into the new calendar year.

Toyota finished on top of the annual charts and recorded its best result in 14 years, showing its wait-list issues are more about demand than supply. Mazda took second place, ahead of Kia with its best-ever result for a third-place finish.

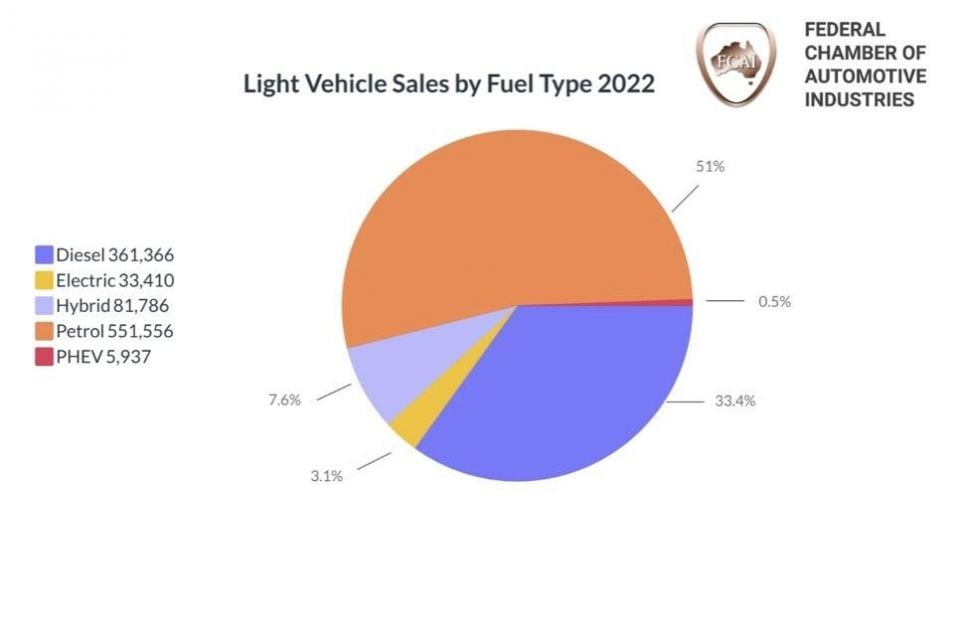

Battery electric vehicles accounted for 3.1 per cent of sales, and show all the signs of spiking in 2023 as a wave of more affordable models from China come on stream.

Federal Chamber of Automotive Industries chief executive Tony Weber said the path through COVID recovery, chip shortages, and bottlenecks due to global shipping snags had created “great challenges for car makers and their dealer networks in 2022”.

“While 2022 has been a year of resilience and recovery, 2023 is shaping up as one of the most significant in recent history, particularly in terms of the development of policies that set the direction for the future decarbonisation of the light vehicle fleet,” he said.

Toyota was dominant. The Japanese carmaker sold a total of 231,050 cars, SUVs and commercial vehicles locally during 2022, lifting sales by 3.3 per cent. One in five new vehicles delivered last year was a Toyota.

Toyotas were the best-selling models in nine market segments last year.

The brand achieved a new record for hybrid vehicles too, selling a total of 72,815 petrol-electric models. This is 31.5 per cent of all Toyota vehicles delivered in 2022, and thus if Toyota Hybrid was a separate franchise, it would rank sixth in the market.

This is all despite widely-reported supply chain issues and production cuts, leading to a huge order bank for vehicles such as RAV4, Camry and LandCruiser. In fact, Toyota claims demand for its cars is at a record high.

Second place finisher was Mazda despite a 5.3 per cent drop in deliveries, ahead of an impressive Kia in third spot (up 15.3 per cent).

The Korean brand edged out Mitsubishi which itself had nearly 14 per cent annual growth, and banished its sibling brand Hyundai into fifth spot.

Rounding out the top 10 were Ford, MG, Subaru, Isuzu Ute and Mercedes-Benz – the graphic above says Volkswagen, but if you combine Mercedes-Benz Cars and Vans (as we do with all other brands) the result is flipped.

Smaller-volume brands that spiked in percentage terms included Ram (up 52.8 per cent), GWM/Haval (up 36.2 per cent and finishing 13th overall), SsangYong (up 32.4 per cent), Porsche (up 26.6 per cent), Renault (up 24.7 per cent), Suzuki (up 23.5 per cent), Chevrolet (up 23.4 per cent), and Volvo (up 18.7 per cent).

A few brands that went backwards in terms of throughput included Nissan (down 35.8 per cent as it was bereft of SUV supply, finishing a disappointing 12th overall), Land Rover (down 32.7 per cent), Peugeot (down 25.6 per cent), Lexus (down 23.7 per cent), Honda (down 19.1 per cent), and Jeep (down 14.2 per cent).

The Volkswagen Group had supply issues across the board, which affected sales thus: Volkswagen (down 24.1 per cent), Audi (down 7.9 per cent), and Skoda (down 29.2 per cent). New brand Cupra did ok though, managing 1111 deliveries.

EV-focused brands that lack 2021 sales data to compare with include Tesla (19,594 sales, finishing 16th overall), new entrant BYD (2113 sales late in the year following launch), and Polestar (1524 deliveries across the year).

| BRAND | SALES | % CHANGE YoY |

|---|---|---|

| Toyota | 231,050 | 3.3% |

| Mazda | 95,718 | -5.3% |

| Kia | 78,330 | 15.3% |

| Mitsubishi | 76,991 | 13.7% |

| Hyundai | 73,345 | 0.6% |

| Ford | 66,628 | -6.7% |

| MG | 49,582 | 27.1% |

| Subaru | 36,036 | -2.6% |

| Isuzu Ute | 35,323 | -1.2% |

| Mercedes-Benz | 31,281 | -5.3% |

| Volkswagen | 30,946 | -24.1% |

| Nissan | 26,491 | -35.8% |

| GWM | 25,042 | 36.2% |

| BMW | 22,696 | -8.8% |

| Suzuki | 21,578 | 23.5% |

| Tesla | 19,594 | |

| LDV | 16,269 | 7.1% |

| Audi | 14,732 | -7.9% |

| Honda | 14,215 | -19.1% |

| Volvo Car | 10,715 | 18.7% |

| Renault | 8855 | 24.7% |

| Lexus | 7089 | -23.7% |

| Jeep | 6658 | -14.2% |

| Skoda | 6502 | -29.2% |

| Ram | 6149 | 52.8% |

| Porsche | 5608 | 26.6% |

| Land Rover | 4348 | -32.7% |

| SsangYong | 3943 | 32.4% |

| Mini | 3002 | -16.1% |

| Chevrolet | 2614 | 23.4% |

| BYD | 2113 | |

| Peugeot | 2087 | -25.6% |

| Polestar | 1524 | |

| Fiat | 1161 | -42.4% |

| Cupra | 1111 | |

| Genesis | 1039 | 41.6% |

| Jaguar | 700 | -42.7% |

| Maserati | 594 | 6.1% |

| Alfa Romeo | 571 | -7.6% |

| Citroen | 296 | 69.1% |

| Bentley | 203 | -7.3% |

| Ferrari | 203 | 4.6% |

| Lamborghini | 176 | 34.4% |

| Aston Martin | 132 | -5.7% |

| Chrysler | 79 | -53.5% |

| Lotus | 62 | -12.7% |

| McLaren | 61 | -30.7% |

| Rolls-Royce | 60 | 25.0% |

| Alpine | 4 | -85.7% |

| Caterham | 2 | 100.0% |

Here’s a list of the top 20 vehicles sold across 2022.

The list comprises five utes; five mid-sized SUVs; three light and small SUVs; three small cars; three large or upper large SUVs; and one light car.

From this list, six models are sold by market leader Toyota. Next best was Mazda with four models, while Kia, Hyundai, Mitsubishi and MG each had two of their models in the top 20.

Brands with one top 20 product were Isuzu Ute and Ford.

Sales by region

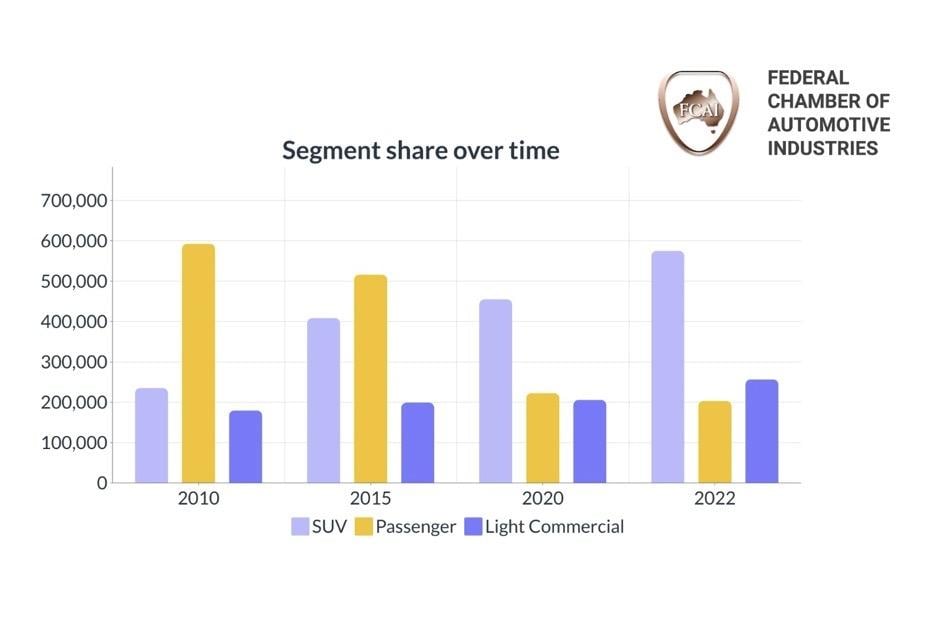

Category breakdown

Top segments by market share

Sales by buyer type

Sales by propulsion or fuel type

Sales by country of origin

Got any questions about car sales? Ask away in the comments and I’ll jump in!

Derek Fung

19 Minutes Ago

Matt Campbell

7 Hours Ago

Ben Zachariah

23 Hours Ago

James Wong

23 Hours Ago

William Stopford

23 Hours Ago

Josh Nevett

1 Day Ago

Add CarExpert as a Preferred Source on Google so your search results prioritise writing by actual experts, not AI.