Overview

We already know Toyota held on to the number one spot in the 2021 sales race, and even grew its lead over second-placed Volkswagen.

Due to different reporting cycles and other machinations, we haven’t been able to publish the rest of the top 10 until now.

Thanks to a decline at GM, both Hyundai and Stellantis have moved up one place on the charts.

A fall in sales at Daimler – now known as the Mercedes-Benz Group – saw the van and luxury car maker drop out of the top 10 with rival BMW returning to the chart, and Suzuki marching up one spot.

For the second year running, these sales figures are heavily impacted by the COVID-19 pandemic. While in 2020 lockdowns stopped production and prevented sales, in 2021 global supply chain problems, most notably for semiconductors, have led all manufacturers to halt production at various times.

Consumers have seen this play out with low stock at dealerships, and sky high prices for used vehicles.

As with last year, we’ve gone into the numbers for a few manufacturers outside the top 10 which might be of interest to Australians.

In this arena, Tesla was clearly the standout performer, almost doubling its sales and coming with touching distance of a million units.

Unless otherwise mentioned the numbers used in this article come directly from manufacturers. Please note manufacturers have different methodologies for calculating sales or delivery figures.

| Manufacturer | 2021 sales | Position change | Change from 2020 | |

|---|---|---|---|---|

| 1 | Toyota Motor Corp | 10,495,548 | (same) | +11.8% |

| 2 | Volkswagen Group | 8,610,100 | (same) | -5.5% |

| 3 | Renault Nissan Mitsubishi Alliance | 7,680,014 | (same) | -1.3% |

| 4 | Hyundai Motor Group | 6,667,085 | +1 | +5.0% |

| 5 | Stellantis | 6,583,269 | +1 | +5.2% |

| 6 | General Motors | 6,291,000 | -2 | -7.9% |

| 7 | Honda | 4,121,000 | (same) | -6.5% |

| 8 | Ford Motor Company | 3,942,000 | (same) | -5.9% |

| 9 | Suzuki | 2,763,000 | +1 | 12.9% |

| 10 | BMW | 2,521,514 | +1 | +8.5% |

Toyota Motor Corporation: 10.3 million

Toyota sold 10,340,336 vehicles across its Toyota, Lexus and Daihatsu brands in 2021. For easier apples-to-apples comparisons we’ve excluded Hino’s 155,212 trucks from our calculations and numbers unless otherwise stated.

While many other automakers had to drastically cut production due to the global semiconductor shortage, Toyota was able to sail through the first three quarters of the year before it had to implement widespread shutdowns.

The Japanese automaker credits stockpiling and its close relationship with suppliers for its ability ride out the early part of the storm.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Toyota | 8,912,949 | +11.8 per cent |

| Lexus | 702,208 | -2.3 per cent |

| Daihatsu | 725,179 | +4.5 per cent |

Daihatsu was up 4.5 per cent to 725,179 sales, buoyed 50.2 per cent increase in sales outside Japan — primarily in Indonesia. The small car specialist still sells most of its vehicles in its homeland, though, with its 527,739 sales in Japan accounting for almost 73 per cent of its total.

Things didn’t fare so well at Lexus; its 702,208 sales were down 2.3 per cent from 2020.

| Region | Sales | Change from 2020 |

|---|---|---|

| Asia (ex. Japan) | 3,135,228 | +13.2 per cent |

| – China | 1,944,010 | +8.2 per cent |

| – Indonesia | 291,499 | +58.7 per cent |

| – Thailand | 239,732 | -1.9 per cent |

| North America | 2,681,219 | +11.3 per cent |

| – USA | 2,332,262 | +10.4 per cent |

| – Canada | 225,215 | +17.7 per cent |

| – Mexico | 91,145 | +19.0 per cent |

| Japan | 1,476,136 | -1.9 per cent |

| Europe | 1,037,126 | +7.8 per cent |

| – UK | 128,334 | +11.8 per cent |

| – Russia | 119,178 | +4.6 per cent |

| – France | 107,558 | -0.3 per cent |

| – Italy | 87,237 | +4.5 per cent |

| – Germany | 81,061 | -6.7 per cent |

| Middle East | 418,612 | +16.6 per cent |

| Latin America | 385,246 | +37.5 per cent |

| – Brazil | 173,475 | +28.6 per cent |

| – Argentina | 69,913 | +35.3 per cent |

| Oceania | 273,768 | +12.4 per cent |

| – Australia | 232,932 | +9.0 per cent |

| Africa | 205,750 | +24.7 per cent |

| – South Africa | 115,126 | +30.8 per cent |

Breaking down the company’s figures by region, Toyota saw gains in most markets. It was down in Japan by 1.9 per cent to 1,476,136 sales, however.

A jump of 10.2 per cent to 2,332,262 sales saw Toyota overtake GM and become the largest automaker for the first time in the US market.

| 2021 sales | Percentage of total | Change from 2020 | |

|---|---|---|---|

| Hybrid | 2,482,236 | 24.01 per cent | +27.0 per cent |

| PHEV | 111,882 | 1.08 per cent | +131 per cent |

| EV | 14,404 | 0.14 per cent | +331 per cent |

| Mild hybrid | 7482 | 0.07 per cent | (none in 2020) |

| Fuel cell | 5918 | 0.06 per cent | +234 per cent |

Once again Toyota is the dominant hybrid vehicle manufacturer, with the drivetrain type popularised by the Prius and now available in many model lines now accounting for 24 per cent of all sales.

While the company unveiled its first mainstream electric vehicle last year, the bZ4X won’t go on sale globally until later in 2022.

All the Toyota electric cars and mild hybrids sold in 2021 were the from the European ProAce and ProAce City vans, which are badge-engineered versions of the Peugeot Expert/Citroen Dispatch and Peugeot Partner/Citroen Berlingo, respectively.

Volkswagen Group: 8.6 million

Things didn’t pan out so well at the Volkswagen Group, with the German automaker’s passenger car divisions down 5.5 per cent to 8,610,600.

As with Toyota, we’ve subtracted the sales of the company’s truck brands from the overall figure so the numbers are more comparable from manufacturer to manufacturer.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Volkswagen Cars | 4,896,900 | -8.09 per cent |

| Audi | 1,680,500 | -0.73 per cent |

| Skoda | 878,200 | -12.60 per cent |

| Seat | 470,500 | +10.29 per cent |

| – Cupra | 79,300 | +189.42 per cent |

| Porsche | 301,900 | +10.91 per cent |

| Volkswagen Commercial Vehicles | 359,500 | -3.26 per cent |

| MAN | 151,000 | +27.86 per cent |

| Scania | 90,400 | +25.38 per cent |

| Navistar | 29,900 | (N/A) |

| Other (Bugatti, Bentley, Lambo) | 23,100 | +23.53 per cent |

While the mainstream Volkswagen, Audi and Skoda brands were down, Seat saw sales climb thanks to its Cupra sub-brand. Cupra’s first unique vehicle, the Formentor crossover, enjoyed its first full year on sale and helped grow the marque significantly.

The automaker’s stable of high-profit, low-volume brands also enjoyed notable improvement.

Although the Volkswagen Group had improved sales in many regions, a big dip in China saw the automaker lose significant ground with Toyota in the sales race.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Western Europe | 2,860,400 | -2.69 per cent |

| Central & Eastern Europe | 658,300 | -2.76 per cent |

| North America | 908,400 | +15.60 per cent |

| South America | 514,600 | +5.08 per cent |

| China (incl. Hong Kong) | 3,304,800 | -14.14 per cent |

| Asia Pacific (ex. China) | 305,800 | +11.93 per cent |

| Middle East & Africa | 329,600 | +13.38 per cent |

The automaker is into its second full year of big push into electric vehicles, with all its electric models notching up big gains over 2020.

Overall the group sold 452,900 electric cars around the world, a 221,300 unit or 95.5 per cent increase from the year before.

Unsurprisingly a crossover (the ID.4) holds top spot. Indeed crossovers account for at least 47.1 per cent of EV sales, but the real number should be close to 50 per cent as Porsche doesn’t break out numbers of the Cross Turismo from the rest of the Taycan range.

One car has disappeared off the chart: the Volkswagen e-Golf. While the electric hatch racked up 41,300 sales in 2020, it was discontinued as the Golf entered its eighth generation.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Volkswagen ID.4 | 119,600 | (New model) |

| Volkswagen ID.3 | 75,500 | +33.63 per cent |

| Audi E-Tron | 49,200 | +4.02 per cent |

| Skoda Enyaq | 44,700 | (New model) |

| Volkswagen e-Up | 41,400 | +86.49 per cent |

| Porsche Taycan | 41,300 | +106.50 per cent |

| 2021 sales | Change from 2020 | |

|---|---|---|

| Q5 | 293,069 | +5.3 per cent |

| Q3 | 258,616 | +19.2 per cent |

| A6 | 244,191 | -10.8 per cent |

| A4 | 215,227 | -14.0 per cent |

| A3 | 179,399 | -17.7 per cent |

| Q2 | 110,084 | -8.4 per cent |

| A5 | 71,340 | +8.3 per cent |

| Q7 | 67,452 | +5.3 per cent |

| A1 | 64,178 | +1.1 per cent |

| e-tron | 49,157 | +3.9 per cent |

| Q8 | 41,584 | +7.5 per cent |

| A8 | 23,708 | +6.4 per cent |

| Q4 e-tron | 21,098 | (new model) |

| A7 | 19,169 | +9.2 per cent |

| TT | 8714 | -11.4 per cent |

| e-tron GT | 6896 | (new model) |

| Q2 L e-tron | 4743 | +11.9 per cent |

| R8 | 1887 | +14.3 per cent |

Last year Audi sold 1,680,512 vehicles across the world, a 0.7 per cent decrease from 2020.

The luxury marque’s two most popular models are now crossovers, with the A6 the last remaining sedan/wagon combo with a podium spot.

Sales are now almost evenly split between crossovers and traditional body styles, with the latter now accounting for 49.7 per cent of the brand’s volume.

Audi sold 81,894 electric vehicles in 2021, or 4.9 per cent of its total. EV sales jumped 57.4 per cent thanks to the addition of two new models: the MEB-based Q4 e-tron crossover and the e-tron GT, latter of which is the Porsche Taycan’s twin in a sharp business suit.

The company’s largest markets were China (701,289), Europe (617,048), and the USA (196,038). In Europe, Audi broke six figures in Germany (180,883) and the UK (117,993).

| 2021 sales | Change from 2020 | |

|---|---|---|

| Octavia | 200,771 | -21.99 per cent |

| Kamiq | 120,742 | -6.07 per cent |

| Karoq | 119,156 | -13.17 per cent |

| Fabia | 99,104 | -6.03 per cent |

| Kodiaq | 98,566 | -25.10 per cent |

| Superb | 66,146 | -23.22 per cent |

| Rapid | 63,657 | -20.13 per cent |

| Scala | 48,154 | -23.78 per cent |

| Enyaq iV | 44,718 | (new model) |

| Kushaq | 12,815 | (new model) |

| Citigo iV | 4373 | -70.79 per cent |

Skoda saw its sales fall 12.6 per cent to 878,202. Every model line was down, with the exception of the Enyaq iV and Kushaq, both of which were essentially new models for 2021.

A sharp 58.8 per cent fall in sales to 71,200 saw China lose its place as its Skoda’s largest market. In 2021, it was relegated to fourth place behind Germany (136,781), Russia (90,443) and the Czech Republic (79,928).

Despite Skoda’s development of models specific to the Chinese and Indian markets, greater Europe accounts for 79.6 per cent of all sales. Although the brand lost some ground in Central Europe, it still has an impressive 17.2 per cent market share there.

Fun fact: wagons account for 54 per cent of Superb and 56 per cent of Octavia sales, but just 34 per cent of the Fabia range.

The Seat SA group saw collective sales improve 10.3 per cent to 470,500. While there was small 2.0 per cent fall for the main Seat marque to 391,200, the Cupra brand grew 189.4 per cent to 79,300, primarily on the back of Formentor.

During the Formentor’s first full year on sale, it accounted for roughly 70 per cent of the sub-brand’s numbers.

According to the Spanish firm, plug-in hybrid and full EV sales grew by 312 per cent to 60,600.

| Select models | 2021 sales |

|---|---|

| Seat Arona | 106,900 |

| Seat Ibiza | 95,800 |

| Seat Leon | 87,700 |

| Cupra Formentor | 54,600 |

All major markets except Germany saw improved sales. The group’s top three were Germany (104,100), Spain (81,800) and the UK (50,700).

| Model | 2021 sales |

|---|---|

| Macan | 88,362 |

| Cayenne | 83,071 |

| Taycan | 41,296 |

| 911 | 38,464 |

| Panamera | 30,220 |

| 718 | 20,502 |

Porsche sold a record 301,915 vehicles in 2021. Purists look away now: 56.8 per cent of these were crossovers, and 23.7 per cent were sedans.

The all-electric Taycan doubled its sales, while the 911 notched up its biggest ever number.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Urus | 5,240 | +20.1 per cent |

| Huracán | 2,435 | +21.1 per cent |

| Aventador | 628 | -28.3 per cent |

Lamborghini saw its volume jump 14.5 per cent to 8303 cars in 2021. There hefty increases for both the “entry-level” Huracan, and the family-friendly Urus.

Although it is the youngest member of the family, the Urus accounted for 63.1 per cent of the company’s sales.

Renualt-Nissan-Mitsubishi Alliance: 7.7 million

The Alliance saw sales increase by 0.14 per cent to 7,680,014. A drop in sales by the Renault Group were largely offset by a strong performance from Mitsubishi Motors.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Renault Group | 2,696,000 | -4.46 per cent |

| Nissan | 4,065,014 | +0.89 per cent |

| Mitsubishi | 919,000 | +12.07 per cent |

| 2021 sales | Change from 2020 | |

|---|---|---|

| Renault | 1,694,000 | -5.31 per cent |

| Dacia | 537,000 | +3.07 per cent |

| Lada | 385,000 | +0.26 per cent |

| Other | 80,000 | -37.98 per cent |

The Renault Group saw slight gains at both of its budget brands, Dacia and Lada, which help to offset a decline at its namesake marque. We’re likely to see a steep fall in Renault’s 2022 numbers as it is reportedly planning to sell its controlling stake in Lada after Russia’s invasion of Ukraine.

Sales in the “Other” category include vehicles from Jinbei, Huasong, Alpine, and Renault Samsung Motors.

According to Automotive News Renault Samsung sold just 57,480 cars last year, a drop of 36 per cent from 2020.

In order to shore up its South Korean operation, the company will begin producing Geely designed and engineered models from 2024.

| Nissan Regions | 2021 sales | Change from 2020 |

|---|---|---|

| China | 1,381,494 | -5.17 per cent |

| North America | 1,281,663 | +8.27 per cent |

| – USA | 977,639 | +8.72 per cent |

| – Canada | 98,405 | +11.25 per cent |

| – Mexico | 204,569 | +4.79 per cent |

| Japan | 451,646 | -3.60 per cent |

| – Kei cars | 177,379 | -12.30 per cent |

| Europe | 372,338 | -8.34 per cent |

| – Russia | 53,377 | -26.90 per cent |

| Rest of the world | 577,873 | +12.44 per cent |

A strong improvement in North America helped Nissan increase sales marginally globally despite seeing falls in every other market.

While there were declines in China, Japan and Europe, North America helped to pull the automaker into the black on the back on new generations of popular models.

| Nissan USA models | 2021 sales | Change from 2020 |

|---|---|---|

| Rogue | 285,601 | +25.3 per cent |

| Sentra | 127,862 | +35.1 per cent |

| Altima | 103,776 | -24.8 per cent |

| Kicks | 82,960 | +40.9 per cent |

| Versa | 60,913 | +26.2 per cent |

| Frontier | 60,697 | +10.7 per cent |

| Murano | 46,115 | -20.8 per cent |

| Pathfinder | 41,324 | -14.9 per cent |

| Titan | 27,406 | +3.6 per cent |

| Armada | 22,815 | +16.2 per cent |

| NV200 | 17,359 | +1.4 per cent |

| Maxima | 16,386 | -9.7 per cent |

| Leaf | 14,237 | +48.9 per cent |

| NV | 11,374 | -25.4 per cent |

| GT-R | 228 | -24.8 per cent |

| 370Z | 37 | -98.1 per cent |

These figures from Good Car Bar Car show the impact of vastly improved product in the American range. Most important is the third-generation Rogue — known as the X-Trail in the rest of the world — which had its first full year on sale.

The mid-size Frontier pickup (60,697) easily outsold the full-size Titan (27,406). Just 14,237 Leaf hatchbacks moved out the door. For context, Tesla sold 14,452 Model Y crossovers in April alone.

Over at Infiniti, sales dived 26.3 per cent to a mere 58,555. Every model in the lineup dropped, but the QX60 — a more luxurious take on the Nissan Pathfinder — fell 74.5 per cent ahead of the launch of a new generation model.

| Mitsubishi Region | 2021 sales | Change from 2020 |

|---|---|---|

| Japan | 79,000 | +12.86 per cent |

| – Regular cars | 36,000 | +33.33 per cent |

| – Kei cars | 43,000 | (unchanged) |

| North America | 154,000 | +28.33 per cent |

| – USA | 102,000 | +15.91 per cent |

| Europe | 135,000 | -17.68 per cent |

| – Western Europe | 102,000 | -23.31 per cent |

| – Russia+ | 33,000 | +6.45 per cent |

| Asia | 325,000 | +11.68 per cent |

| – China | 70,000 | -12.50 per cent |

| – Thailand | 48,000 | -15.79 per cent |

| – Indonesia | 104,000 | +89.09 per cent |

| – Philippines | 38,000 | (unchanged) |

| Australia/NZ | 88,000 | +27.54 per cent |

| – Australia | 68,000 | +17.24 per cent |

| – New Zealand | 20,000 | +81.82 per cent |

| Latin America | 54,000 | +28.57 per cent |

| Middle East and Africa | 84,000 | +31.25 per cent |

Mitsubishi was the bright star in the Alliance in 2021 with big improvements in most markets.

There was a big fall, however, in Europe. As part of the leader-follower plan unveiled in mid-2020, Mitsubishi had initially planned to leave the Continent in order to focus on developing markets.

In 2021 the company reversed course and decided to sell to stay in some European countries with redesigned Renault models, including a successor to the ASX based on the Renault Captur.

Hyundai Motor Group: 6.7 million

Last year the Hyundai Motor Group sold 6,667,085 vehicles across its three brands, an increase of 5.0 per cent over 2020.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Hyundai | 3,689,311 | +2.13 per cent |

| Genesis | 201,415 | +52.07 per cent |

| Kia | 2,776,359 | +6.48 per cent |

Both the mainstream Hyundai and Kia brands had sales and production rebounds from 2020.

Genesis increased its numbers by almost 70,000 units, helped in large part by the launch of the GV70 crossover.

| South Korean model | 2021 sales |

|---|---|

| Hyundai light commercial vehicles | 125,650 |

| Kia Niro | 119,424 |

| Kia Morning (Picanto) | 114,451 |

| Kia Sportage | 109,799 |

| Kia Soul | 96,121 |

| Hyundai Grandeur | 89,084 |

| Kia Stonic | 76,576 |

| Kia Seltos | 74,588 |

| Hyundai Avante (Elantra) | 71,036 |

| Hyundai Sonata | 63,109 |

| Genesis G80 | 59,464 |

| Kia Sorento | 56,278 |

| Hyundai Palisade | 52,338 |

| Kia Pride (Rio) | 49,157 |

| Hyundai Tucson | 48,376 |

| Kia Carnival | 46,284 |

| Hyundai Santa Fe | 41,600 |

| Genesis GV70 | 40,994 |

| Kia Bongo Ⅲ (Truck) | 34,408 |

| Kia K3 | 33,774 |

| Kia K5 / Optima | 29,678 |

| Hyundai HCV | 28,658 |

| Genesis GV80 | 24,591 |

| Hyundai Ioniq 5 | 22,671 |

| Kia EV6 | 18,459 |

| Kia Stinger | 17,007 |

| Hyundai Venue | 13,496 |

| Hyundai Kona | 12,244 |

| Hyundai Casper | 10,806 |

| Hyundai Nexo | 8,502 |

| Genesis G70 | 7,429 |

| Genesis G90 | 5,089 |

| Kia Mohave / Borrego | 1,404 |

| Kia K7 / Cadenza | 1,193 |

| Genesis GV60 | 1,190 |

| Hyundai Veloster | 510 |

| Kia Military | 442 |

| Kia K9 | 227 |

| Kia Bus | 6 |

| Hyundai Ioniq | 1 |

| Hyundai i30 | 1 |

While its neighbour across the sea of Japan skews towards kei and city cars — thanks largely to taxation rates, geography, and city planning — South Korean sales are more evenly distributed.

Although the top four spots (Niro, Morning, Sportage, and Soul) are held by Kia, the brand’s best-selling models tend to be at the smaller-end of scale.

Hyundai on the other hand has an easier time selling larger vehicles, such as the Grandeur (fifth) and Sonata (ninth). Indeed the Genesis G80 managed to squeak into the final top 10 position.

Overall Hyundai (726,838) outsold its sibling (535,016) in their home market.

Stellantis: 6.5 million

The Franco-Italian-American automaker saw sales rebound by 3.9 per cent to 6,583,269 vehicles in 2022. While any upward progression is good, the company is a long way from the 8.1 million cars it sold in 2019 when it was separate under the Fiat Chrysler and Groupe PSA umbrellas.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Europe | 3,102,000 | +0.71 per cent |

| North America | 2,004,000 | -2.67 per cent |

| South America | 812,000 | +36.93 per cent |

| Middle East and Africa | 411,000 | +3.79 per cent |

| Asia Pacific | 230,000 | +19.17 per cent |

| Maserati (global) | 24,269 | +41.38 per cent |

As we noted when the two companies merged in 2021, Stellantis is still very heavily reliant on sales in Europe and North America.

Both regions are down significantly from the 2019 numbers, when the FCA and PSA sold a total of 4.21 million vehicles in Europe, and 2.5 million vehicles in North America.

Stellantis is following FCA’s practice of largely not breaking down global sales by individual brands, but it did provide details about Peugeot, Citroen and Maserati sales.

Peugeot sold 1,214,851 vehicles across the world in 2021, a claimed increased of around 5 per cent from 2020.

The Peugeot brand derives 77.7 per cent of its sales from Europe. Naturally its biggest market is France, which accounts for 29.9 per cent of the global total.

| 2021 sales | Change from 2021 | |

|---|---|---|

| Europe | 943,805 | |

| – France | 362,762 | -2.63 per cent |

| – Italy | 97,965 | +5.12 per cent |

| – UK | 91,006 | +7.68 per cent |

| – Spain | 88,453 | -2.30 per cent |

| – Germany | 63,161 | -4.94 per cent |

| – Belgium & Luxembourg | 41,433 | -9.78 per cent |

| Middle East and Africa | 109,876 | |

| Latin America | 83,429 | |

| China | 37,815 | |

| India and Asia Pacific | 28,637 | |

| Mexico | 11,289 |

As far as models go, the brand dished out some selective figures. The 208 light hatch was up 22.3 per cent to 270,700 sales, the 2008 crossover increased 20.4 per cent to 247,600, and the 3008 improved 14.8 per cent to 180,000.

Its vans were also popular with the Partner up 7.5 per cent to 90,600, the Expert gaining 5.4 per cent to 65,900, and the Boxer up 5.5 per cent to 66,600 sales.

No figures were supplied for the 308, which likely saw a dip thanks to a generational changeover.

Citroen sold a total of 796,868 cars last year, an increase of 7.0 per cent over 2020.

Like Peugeot, Citroen still generates the vast majority (78.3 per cent) of its sales from Europe, with France accounting for 28.1 per cent of its total sales.

| 2021 sales | Percentage change | |

|---|---|---|

| Europe | 624,140 | +1.2 per cent |

| – France | 223,625 | -2.12 per cent |

| – Italy | 76,488 | -3.60 per cent |

| – Spain | 70,919 | +1.40 per cent |

| – UK | 50,913 | -8.28 per cent |

| – Germany | 58,479 | +11.65 per cent |

| Middle East and Africa | 61,695 | +11.7 per cent |

| South America | 48,615 | +39 per cent |

| China | 41,391 | +101.7 per cent |

| India and Asia Pacific | 8665 | +14.2 per cent |

| Other | 12,362 |

The double chevron brand provided a breakdown of its global sales by model.

While every model available in Europe is listed separately, Citroen didn’t break down numbers for China-specific models, such as the C3L sedan, C6 range-topping sedan, and C3-XR crossover.

These vehicles, as well as the C-Elysee, which is sold in some developing markets, are lumped together in the Other category.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Ami | 9183 | +237.73 per cent |

| C1 | 36,559 | -9.95 per cent |

| C3 | 199,295 | +8.89 per cent |

| C3 Aircross | 76,986 | -9.22 per cent |

| C4 | 72,962 | +1148 per cent |

| C4 Spacetourer | 18,078 | -36.97 per cent |

| C5 Aircross | 76,362 | -21.48 per cent |

| C5 X | 12,000 | (new model) |

| Berlingo people mover | 33,313 | -23.83 per cent |

| Berlingo van | 79,124 | -11.81 per cent |

| Jumper | 71,203 | +23.72 per cent |

| Jumpy / Dispatch | 45,857 | +13.83 per cent |

| Spacetourer | 9657 | +14.28 per cent |

| Other | 56,289 |

The C3 small hatch is easily Citroen’s model popular model, accounting for 25.0 per cent of all sales.

As the brand is blurring the lines between traditional and crossover body styles with many of its models, there are only two dedicated Aircross SUVs in the range, which account for 19.2 per cent of its total volume.

Van-based vehicles make a large proportion (30.0 per cent) of Citroen’s sales, with the Berlingo range (both people mover and van) being the the marque’s second most popular model overall.

| 2021 US sales | Change from 2020 | |

|---|---|---|

| Jeep | 778,711 | -2.09 per cent |

| Ram | 647,331 | +3.63 per cent |

| Dodge | 215,724 | -19.30 per cent |

| Chrysler | 115,004 | +4.11 per cent |

| Fiat | 2,374 | -44.83 per cent |

| Alfa Romeo | 18,250 | -1.81 per cent |

Growth at Ram was led largely by its Fiat-built vans, as sales of its signature pickup truck held steady at 569,388.

Spurred by the launch of a new generation, the Grand Cherokee was up 26 per cent to 264,444. This wasn’t enough to offset large drops by Jeep’s smaller models: the Renegade (down 25 per cent), Compass (off 30 per cent), and Cherokee (down 34 per cent).

There was a fall of 19.3 per cent at Dodge. While sales of the Challenger (54,314) and Charger (78,389) improved a bit, and the Durango jumped 14 per cent to 65,935, the discontinuation of the Journey crossover and Grand Caravan people mover that had the biggest impact on the brand’s numbers.

Despite production ending in 2020, Dodge still managed to sell 14,035 Journeys in 2021, down 65 per cent.

The discontinued Grand Caravan plummeted 92 per cent to 3037. Despite this, sales of the more modern Chrysler Pacifica only climbed 4500 units to 98,232.

General Motors: 6.3 million

The General saw sales slip 7.9 per cent to 6,291,000.

After the sale of Opel/Vauxhall in 2017, the subsequent closure of Holden, and its withdrawal from all right-hand drive markets, GM focuses on four main regions: the US and North America, China, the Middle East, and Latin America.

| 2021 sales | Change from 2020 | |

|---|---|---|

| USA | 2,218,000 | -12.92 per cent |

| – Chevrolet cars | 121,000 | -42.65 per cent |

| – Chevrolet trucks | 807,000 | -7.88 per cent |

| – Chevrolet crossovers | 509,000 | -21.93 per cent |

| – Cadillac | 118,000 | -8.53 per cent |

| – Buick | 180,000 | +10.43 per cent |

| – GMC | 483,000 | -6.40 per cent |

| Canada and Mexico | 356,000 | -5.57 per cent |

| Asia Pacific, Middle East, Africa | 3,323,000 | -3.15 per cent |

| – Chevrolet | 609,000 | -20.29 per cent |

| – Wuling | 1,426,000 | +29.75 per cent |

| – Buick | 816,000 | -7.80 per cent |

| – Baojun | 211,000 | -47.51 per cent |

| – Cadillac | 240,000 | +1.27 per cent |

| – Other brands | 21,000 | -52.27 per cent |

| South America | 393,000 | -16.38 per cent |

| Europe | 1000 | (unchanged) |

Except for Buick, every US brand in the GM stable went backwards.

In the numbers below from Good Car Bad Car we can see the combined figures from the largely-identical Chevrolet Silverado and GMC Sierra (778,688) make GM’s full-size pickup range the most popular in the US ahead of the Ford F-Series (726,003), and the Ram 1500 (569,388).

GM is slowly phasing out sedans from its mainstream US range, with the Chevrolet Malibu (39,376) the company’s top-ranking three-box model.

Down 61.6 per cent from 2020, the Malibu was outsold by the big-bucks Cadillac Escalade (39,376) and sat not too far ahead of the Corvette (33,042).

The Camaro was down 26.5 per cent to 21,893.

| US model | 2021 sales | Change from 2020 |

|---|---|---|

| Chevrolet Silverado | 529,765 | -10.7 per cent |

| GMC Sierra | 248,923 | -1.6 per cent |

| Chevrolet Equinox | 165,325 | -39.0 per cent |

| Chevrolet Traverse | 116,251 | -7.4 per cent |

| Chevrolet Tahoe | 106,019 | +20.2 per cent |

| Chevrolet TrailBlazer | 90,163 | +162.9 per cent |

| Chevrolet Suburban | 85,159 | +153.1 per cent |

| GMC Yukon | 84,243 | +32.8 per cent |

| Chevrolet Colorado | 73,008 | -24.1 per cent |

| Buick Encore GX | 72,401 | +71.4 per cent |

Honda: 4.1 million

Honda sold 4,121,000 vehicles across the globe in 2021, a drop of 6.5 per cent from 2020.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Asia (ex. Japan) | 1,971,000 | -3.29 per cent |

| North America | 1,360,000 | -10.59 per cent |

| Japan | 559,000 | -6.99 per cent |

| Europe | 100,000 | -6.54 per cent |

| Other | 131,000 | -5.76 per cent |

The company suffered declines in every region, especially North America.

It should be noted, the sales figures reported by American Honda differ from those compiled by Honda headquarters back in Japan.

According to the American branch, Honda sold 1,466,630 vehicles in the US in 2021, which is actually an increase of 8.9 per cent over the year before.

| US model | US 2021 sales | Change from 2020 |

|---|---|---|

| CR-V | 361,271 | +8.33 per cent |

| Civic | 263,787 | +0.98 per cent |

| Accord | 202,676 | +1.61 per cent |

| Pilot | 143,062 | +15.55 per cent |

| HR-V | 137,090 | +63.15 per cent |

| Odyssey | 76,125 | -8.73 per cent |

| Passport | 53,133 | +34.29 per cent |

| Ridgeline | 41,355 | +28.56 per cent |

| Insight | 19,431 | +21.96 per cent |

| Fit | 8,695 | -73.24 per cent |

| Clarity | 2,597 | -38.39 per cent |

The vast majority of US sales (1,309,222) were for Honda-branded vehicles, with Acura accounting for 157,408 vehicles or 10.7 per cent of the total.

According to the firm, 107,060 of its 2021 sales were of electrified vehicles, primarily the Accord and CR-V hybrids, as well as the Insight hybrid sedan. The Clarity range features plug-in hybrid, pure electric, and hydrogen fuel-cell models.

Crossovers sales were up 19.6 per cent to 694,556, and accounted for 53.1 per cent of the Honda brand’s total.

| 2021 sales | Change from 2020 | |

|---|---|---|

| MDX | 60,057 | +25.60 per cent |

| RDX | 57,013 | +8.01 per cent |

| TLX | 26,100 | +19.81 per cent |

| ILX | 13,900 | +3.62 per cent |

| RLX | 214 | -79.72 per cent |

| NSX | 124 | -3.13 per cent |

Over at Acura, crossovers took 74.4 per cent of the sales pie. This might shift back slightly towards sedans this year if the recently-revealed Integra is well received.

Ford Motor Corporation: 3.9 million

Ford and Lincoln saw combined sales slip 5.9 per cent to 3,942,000 in 2021.

| 2021 | Change from 2020 | |

|---|---|---|

| North America | 2,006,000 | -3.60 per cent |

| Europe | 891,000 | -12.65 per cent |

| China | 649,000 | +5.19 per cent |

| South America | 81,000 | -56.22 per cent |

| Rest of the World | 315,000 | +10.92 per cent |

As with every other car company, Ford had to deal with a shortage of computer chips last year.

In addition to this, it closed its factories in Brazil and significantly shrank its dealership network in the country. Without any locally-produced models, the company now relies on a fully-imported range which is subject to high tariffs.

Lincoln is following in the footsteps of compatriot Cadillac, and aggressively targeting the Chinese market. Although the automaker didn’t provide exact figures, last year Lincoln sold more vehicles in China than in the US.

According to Good Car Bad Car, Lincoln sales in the US slipped 16.6 per cent to 87,929. The disparity is likely to grow in 2022 with the company planning to launch the Zephyr sedan as a China-only model.

| US Top 7 | 2021 US sales | Change from 2020 |

|---|---|---|

| F-Series | 726,003 | -7.8 per cent |

| Explorer | 219,871 | -2.8 per cent |

| Escape | 145,415 | -18.5 per cent |

| Bronco Sport | 108,169 | +2012 per cent |

| Transit | 99,745 | -24.2 per cent |

| Ranger | 94,755 | -6.6 per cent |

In its home market, Ford sold 1,804,793 vehicles in 2021, a drop of 6.5 per cent. (Again, these are figures from Good Car Bad Car.)

The Bronco Sport took some sales from the similarly-sized Escape, but grew Ford’s presence in the small crossover segment.

Elsewhere, the Mustang Mach-E managed 27,140 sales in its first full year on sale, making it the brand’s 13th most popular model out of 17. It was wedged between the Bronco (35,023), deliveries of which only began in June, and Transit Connect (26,112).

| EU model | 2021 European sales | Change from 2020 |

|---|---|---|

| Puma | 132,455 | +11.97% |

| Transit Custom | 131,028 | +13.02% |

| Kuga | 106,294 | +34.73% |

| Transit | 102,520 | +17.65% |

| Focus | 94,707 | -45.11% |

| Fiesta | 81,618 | -47.42% |

| Ranger | 54,308 | +25.92% |

| Transit Connect | 34,729 | -6.92% |

| EcoSport | 30,874 | -34.42% |

| Tourneo Custom | 24,703 | -3.12% |

| Mustang Mach-E | 23,424 | (new model) |

| Transit Courier | 15,348 | +0.64% |

| Mondeo | 12,584 | -40.09% |

| S-Max | 7,430 | -43.98% |

| Tourneo Connect | 6,711 | -31.42% |

| Explorer | 5,413 | +115.92% |

| Galaxy | 4,700 | -42.13% |

| Mustang | 3,700 | -47.78% |

| Tourneo Courier | 2,527 | -64.86% |

| Edge | 246 | -93.39% |

| C-Max | 3 | -97.41% |

| Other | 3,326 | -42.75% |

Sales fell sharply in Europe. The numbers for the Fiesta and Focus almost halved from 2020. This was partially offset by increases in their crossover siblings, the Puma and Kuga.

Interestingly, Ford sold almost as many Mustang Mach-E electric crossovers in Europe as it did in the USA. Such a generous allocation of EVs to Europe was probably a result of the EU’s CO2 limit of 95g/km for a brand’s average new vehicle sales mix.

The days of the car-based people mover are well and truly over, with the Tourneo Custom doubling the combined figure for the Galaxy and S-Max.

Suzuki: 2.8 million

Like compatriot Toyota, Suzuki was one of the few automakers which was able to grow sales significantly last year. The small car specialist sold 2,763,000 vehicles last year, an increase of 12.9 per cent.

The small car specialist saw improvement in its primary market, India, where its joint venture Maruti Suzuki still enjoys roughly 50 per cent market share.

Although it mightn’t be the first name western minds think of when it comes to Japanese manufacturers, Suzuki (609,000) once again outsold Honda (559,000), Nissan (468,518), Mazda (155,000), Subaru (101,312) and Mitsubishi (79,000)

| 2021 sales | Change from 2020 | |

|---|---|---|

| Japan | 609,000 | -3.49 per cent |

| – kei car | 509,000 | -2.68 per cent |

| – regular cars | 99,000 | -6.60 per cent |

| Europe | 236,000 | +19.80 per cent |

| Asia (ex. Japan) | 1,688,000 | +14.91 per cent |

| – India | 1,398,000 | +13.11 per cent |

| – Pakistan | 122,000 | +103.33 per cent |

| – Indonesia | 90,000 | +26.76 per cent |

| – Thailand | 22,000 | -15.38 per cent |

| Others | 231,000 | +54.00 per cent |

BMW Group: 2.5 million

With its own sales rising, and chief rival Daimler — now just the Mercedes-Benz Group — falling, the BMW Group re-entered the global top 10 in 2021.

| 2021 sales | Change from 2020 | |

|---|---|---|

| BMW | 2,213,795 | +9.13 per cent |

| Mini | 302,144 | +3.33 per cent |

| Rolls-Royce | 5586 | +48.72 per cent |

Thanks largely to the launch of i-branded EV variants of existing model lines, sales of electrified vehicles (plug-in hybrid and pure electric) grew to 328,316 in 2021.

That’s increase of 70.4 per cent over 2020, meaning electrified cars are now responsible for 14.8 per cent of all the company’s sales.

Sales in most major markets grew with the exception of Germany, which fell 6.7 per cent despite European sales (948,087) improving 3.9 per cent.

The company’s most important countries are China (846,237), the USA (366,574), and Germany (267,917).

| 2021 sales | Change from 2020 | |

|---|---|---|

| 3 Series & 4 Series | 490,969 | 16.82 per cent |

| X3 & X4 | 414,671 | 19.31 per cent |

| 5 Series & 6 Series | 326,212 | 1.16 per cent |

| X1 & X2 | 311,928 | 2.52 per cent |

| 1 Series & 2 Series | 265,964 | -1.10 per cent |

| X5 & X6 | 240,504 | 16.31 per cent |

| 7 Sereis & 8 Series | 62,628 | -6.14 per cent |

| X7 | 54,957 | 12.86 per cent |

| iX, i3 & i8 | 31,179 | 10.71 per cent |

| Z4 | 14,778 | -1.36 per cent |

The core BMW brand saw sales improve by 9.1 per cent to 2,213,790. Crossovers made up at least 46.2 per cent of all BMWs sold, up from 44.7 per cent the year before.

The high-performance BMW M division also saw a 13.4 per cent spike in sales with 163,542 cars sold in 2021.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Hatch | 164,270 | 4.60 per cent |

| Countryman | 82,363 | 5.99 per cent |

| Clubman | 30,385 | -7.81 per cent |

| Convertible | 25,120 | 0.98 per cent |

Mini sales improved 3.3 per cent to 302,138, with the Clubman wagon the only model go backwards.

The electric Mini Cooper SE three-door hatch found 34,851 homes in 2021, an increase of 98.2 per cent.

Adding in the Countryman plug-in hybrid, electrified models accounted for about 18 per cent of the marque’s sales.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Cullinan | 2,422 | 10.14 per cent |

| Ghost | 1,909 | 489.20 per cent |

| Wraith & Dawn | 828 | -5.15 per cent |

| Phantom | 427 | 18.61 per cent |

On the back of the new Ghost, Rolls-Royce sales soared 48.7 per cent to 5586. While the Cullinan was still the brand’s top-selling model, traditional body styles once again accounted for the majority of sales.

Daimler: 2.3 million

With its own sales falling by 5.4 per cent to 2,330,169, and BMW’s numbers rising, Daimler fell out of the global top 10 in 2021.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Crossovers & SUVs | 946,600 | +6.6 per cent |

| A-Class, B-Class, CLA | 322,800 | -28.1 per cent |

| E-Class | 295,100 | -11.1 per cent |

| C-Class | 239,000 | -22.7 per cent |

| S-Class | 91,100 | +62.7 per cent |

| Smart | 38,400 | +9.1 per cent |

| SL, SLC, AMG GT | 10,900 | -39.4 per cent |

Sales for the passenger car division, including Mercedes-Benz, Mercedes-AMG, Mercedes-Maybach, and Smart, were down 6.9 per cent to 1,943,930, while Mercedes-Benz Vans was up 3.1 per cent to 386,239.

Sales of coupes, convertibles, hatches, sedans and wagons fell across all model lines, except for the S-Class which was up dramatically as the seventh-generation W223 range enjoyed its first full year on sale.

Unfortunately Mercedes-Benz doesn’t break out the numbers for its extensive crossover range. Hopefully this will change next year.

| 2021 sales | Change from 2021 | |

|---|---|---|

| Europe | 662,288 | -15.5 per cent |

| – Germany | 218,366 | -22.7 per cent |

| North America | 290,627 | +1.3 per cent |

| – USA | 251,444 | +1.1 per cent |

| Asia | 931,596 | -2.4 per cent |

| – China | 734,658 | -3.1 per cent |

| ROW | 59,419 | -4.5 per cent |

There was a slight uptick in North America, big falls in Europe, and smaller declines elsewhere.

Geely/Volvo: 2.2 million

The Zhejiang Geely Group sold at least 2,172,411 vehicles in 2021, an increase of 3.8 per cent over 2020. The Chinese automaker is made up of several business units, including Geely, Volvo, Proton, Lotus, and LEVC.

The company also owns 50 per cent of the Smart brand. We’ve rolled those numbers into Daimler’s for the time being as all of the 2021 range was developed by Daimler. That will change in 2022 and 2023 when the Smart #1 EV crossover is launched.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Geely* | 1,328,329 | +0.6 per cent |

| Volvo | 698,700 | +5.6 per cent |

| Proton | 114,672 | +4.5 per cent |

| Polestar | 29,000 | +185 per cent |

| Lotus | 1,710 | +24.1 per cent |

Geely’s numbers include sales from the Lynk & Co, Geometry and Zeekr brands.

Most of the vehicles (1,213,021) from these four brands were sold in China, but Geely and Lynk & Co are improving their presence overseas, with exports growing by 58 per cent to 115,008.

According to the company, 100,126 — or about 7.5 per cent — of Geely’s sales were of “new energy vehicles”, which includes mild hybrid, hybrid, plug-in hybrid, and pure electric vehicles.

These four brands’ sales were skewed towards crossovers (805,327), with sedans (510,524) and people movers (12,178) making up the rest.

| Volvo model | 2021 sales | Change from 2021 |

|---|---|---|

| XC40 | 201,000 | +8.41 per cent |

| XC60 | 215,600 | +12.47 per cent |

| XC90 | 108,200 | +16.97 per cent |

| V60 | 56,100 | -13.56 per cent |

| S60 | 49,300 | -5.74 per cent |

| S90 | 46,600 | +1.30 per cent |

| V90 | 20,700 | -19.14 per cent |

| C40 BEV | 1200 | (new) |

Volvo saw its sales figures rise by 5.6 per cent to 698,700.

The brand plans on becoming fully electric by 2030, but at present there are just two EV models in its range: the electric-only C40 crossover coupe, and the electric variant of the XC40 crossover.

The XC40 EV (24,500) accounted for 12.2 per cent of all XC40 sales. Together with the C40, electric cars made up 3.7 per cent of Volvo’s 2021 numbers.

Crossovers made up 75 per cent of Volvo’s volume in 2021, and that’s without counting the Cross Country versions of the V60 and V90 wagons. Given these figures it’s no surprise the company has promised to continue offering sedans and wagons in the future, but spread across fewer models.

The brand’s top five markets were China (171,700), the USA (122,200), the UK (48,300), Sweden (47,800), and Germany (43,800).

| Proton model | 2021 sales |

|---|---|

| Saga | 42,627 |

| X50 | 28,774 |

| X70 | 16,375 |

| Persona | 16,153 |

| Iriz | 6,708 |

| Exora | 4,035 |

Proton saw its total global sales rise by 4.5 per cent to 114,708, the highest since 2014.

Thanks to its full year in production, the X50 crossover — essentially a right-hand drive version of the Geely Coolray/Binyue — helped Proton to increase its share in Malaysia to 22.7 per cent in a shrinking overall market.

Proton still plays second fiddle to Perodua.

While the company is happy to tout the fact its exports more than doubled in 2021, these vehicles only accounted for 3018 of the brand’s total, which is a far cry from its halcyon days in the 1990s when Proton was pressing into developed markets, such as Australia and Europe.

Mazda: 1.2 million

Overall sales were down by 5.2 per cent to 1,178,000.

| 2021 sales | Change from 2020 | |

|---|---|---|

| Japan | 155,000 | -12.92 per cent |

| North America | 387,000 | 0.78 per cent |

| – USA | 289,000 | +3.58 per cent |

| Europe | 162,000 | -10.00 per cent |

| China | 198,000 | -7.48 per cent |

| Others | 275,000 | -4.18 per cent |

| – Australia | 87,000 | +2.35 per cent |

| – ASEAN | 70,000 | -17.65 per cent |

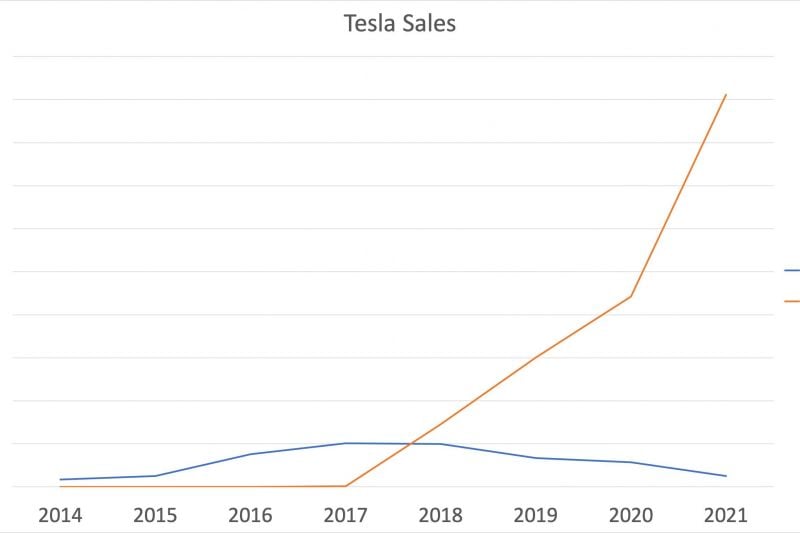

Tesla: 936,172

In a year when everyone manufacturer struggled with chip shortages, Toyota and Suzuki managed to post double-digit growth, but they were both outdone by Tesla which almost doubled its sales to blow past Subaru.

On the back of strong demand for the Model 3 sedan, and improving supply of the related Model Y crossover, Tesla’s sales grew 87.4 per cent to 936,172.

| 2021 global sales | Change from 2020 | |

|---|---|---|

| Model S/X | 24,964 | -56.23% |

| Model 3/Y | 911,208 | +105.92% |

When sales of the Model S/X peaked in 2015, it seemed unlikely to many Tesla would see sales grow eight-fold in the following five years with a million in sight.

These numbers are likely to grow significantly thanks to the recent opening of the company’s factory in Berlin, Germany, and a plant in Austin, Texas, due to open in 2022.

From the figures below, which we obtained from Good Car Bad Car, we know sales in the US grew just 3.1 per cent in 2021 to 301,998.

Last year US sales accounted for 32.3 per cent of the company’s total, down from 58.6 per cent from 2020.

Just as Tesla deprioritised sales of the Model S and Model X when Model 3 production hit its stride in the States, a similar situation is playing out now with the Model Y.

| 2021 US sales | Change from 2020 | |

|---|---|---|

| Tesla Model 3 | 121,610 | -41.1 per cent |

| Tesla Model S | 11,556 | -43.1 per cent |

| Tesla Model X | 7,305 | -72.0 per cent |

| Tesla Model Y | 161,527 | 303.8 per cent |

Subaru: 860,311

The all-wheel drive brand sold 860,311 across the world in 2021, a drop of 2.2 per cent from 2020.

Despite being a Japanese company, Subaru is more reliant on the US than any of the Big Three, with 67.9 per cent of the automaker’s sales coming from the Land of the Free.

By comparison, Ford derived 45.8 per cent of its volume from the US, GM 35.5 per cent, and Stellantis just 27.0 per cent.

| 2021 sales | Change from 2020 | |

|---|---|---|

| US | 583,810 | -4.60 per cent |

| Japan | 101,312 | -4.01 per cent |

| – Regular | 83,114 | -1.96 per cent |

| – Kei | 18,198 | -12.37 per cent |

| Canada | 56,870 | +9.09 per cent |

| Australia | 37,015 | +17.50 per cent |

| Europe | 22,153 | +10.95 per cent |

| China | 16,768 | -25.00 per cent |

| Russia | 5,704 | -9.56 per cent |

| Other | 36,679 | +23.54 per cent |