New vehicle sales in October grew 16.9 per cent over the same month last year, to 87,299 units, according to VFACTS industry data released today.

It’s the best October tally since 2018, and indicates that supply chain woes are beginning to ease, given these sales are checked against registrations.

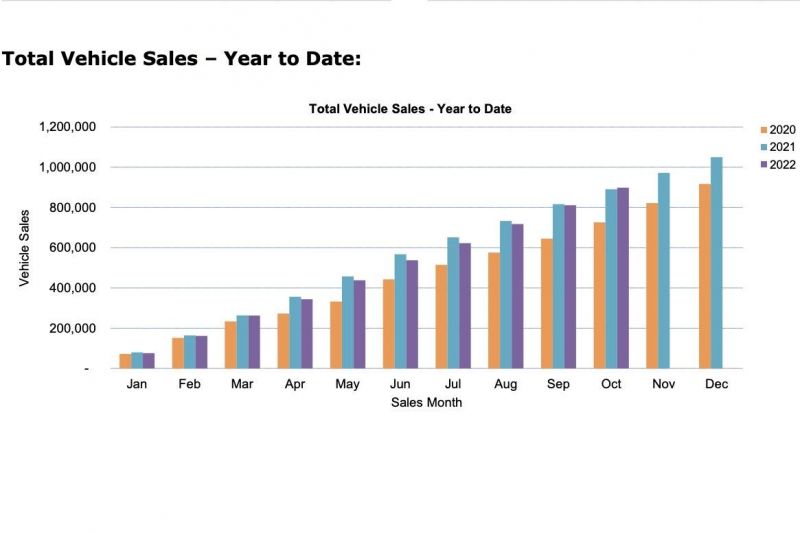

The strong October tally also means the year-to-date figure for 2022 – 898,429 sales – has pulled ahead of 2021’s cumulative tally at the same time, by 0.9 per cent.

Toyota topped the brand charts while Ford finished second, and the Blue Oval brand’s new Ranger took top spot as the overall top-selling model for the month.

Most of the growth last month came from SUVs of all shapes and sizes, up 37.1 per cent overall in volume while capturing 55.5 per cent overall market share.

Light commercial utes and vans took 24.6 per cent share, while traditional passenger cars (sedans, hatchbacks, wagons, people-movers, coupes and convertibles) managed just 15.3 per cent market share.

Electric cars and hybrids also did well, capturing 11.3 per cent market share once heavy commercial trucks are removed from the equation.

Federal Chamber of Automotive Industries chief executive Tony Weber said this monthly result was an indication that car companies were making progress on overcoming logistical challenges.

“This October figure is a positive sign that supply chains are recovering and consistency is returning to the marketplace, but we still have some way to go before it returns to normal,” Mr Weber said.

“It is important to note the continuing, strong preference for SUV and Light Commercial vehicles in Australia. Consumer preference for these vehicles needs to be considered when charting any policy designed to increase the uptake of zero emission vehicles.

“This is particularly critical given the low availability and high price points of zero and low emission models in these segments. We look forward to working with governments to provide practical guidance on how emissions from light vehicles can be reduced within this context.”

Brands

The top five brands all showed strong growth, not least Toyota which was up almost 20 per cent to 18,259 sales with a RAV4 delivery spike and the new Corolla Cross key factors.

Ford was up more than 40 per cent to 7823 and grabbed second spot, with 88 per cent of its volume coming from the new Ranger and its Everest SUV spinoff.

Kia nabbed third growing more than 30 per cent to 6380 sales, in so doing stretching its YTD lead over Hyundai to more than 3000 units with two months to run.

Stronger months from the Outlander and Triton 4×4 saw Mitsubishi grab fourth with 42.3 per cent growth, edging Mazda into fifth spot despite its own solid 11.5 per cent sales hike.

Hyundai in sixth declined 13.5 per cent, though it did finish ahead of budget brand MG (up 60.4 per cent, with the MG 3 light car and ZS small SUV topping their respective segments).

Volkswagen saw 10 per cent growth after a torrid time with supply, to finish eighth ahead of Isuzu Ute (up 21.2 per cent), while MG’s Chinese compatriot GWM (including Haval) grabbed its first top 10 finish with 45.5 per cent growth, edging out Subaru (down 15.3 per cent).

At the premium end Mercedes-Benz did beat BMW, but only once vans were counted. Apples for Apples, the Bavarian brand won out with 1918 monthly sales versus 1719. Audi found 1283 buyers, Tesla 1109 from its Model 3 and Model Y EVs, and Volvo 721.

We’d note that Tesla’s October tally – while equal to more than half of all BEVs sold – was well down on the 5969 deliveries recorded in September. Moving forward though, Elon Musk has promised a more consistent sales cadence rather than a glut of deliveries to end each quarter.

Smaller scale brands that all grew above the monthly average included Suzuki (36.1 per cent), LDV (23.5 per cent), Porsche (187.1 per cent), Renault (20 per cent), Ram Trucks (107.3 per cent), Skoda (35.3 per cent), Land Rover (43 per cent), SsangYong (22.9 per cent), and Chevrolet via GMSV (37.6 per cent).

In a battle of the new brands, Cupra edged out Polestar by the barest of margins with 248 sales versus 246, although the latter brand sells just the one model: the Polestar 2 EV.

The biggest loser for the month was Nissan, down 63.3 per cent, but it has an excuse given the new-generation Qashqai, X-Trail and Pathfinder SUVs are just now rolling into dealers – so expect a bounce of some variety before the year turns.

| Brand | October sales | Change over Oct ’21 |

|---|---|---|

| Toyota | 18,259 | 18.6% |

| Ford | 7823 | 43.2% |

| Kia | 6380 | 31.5% |

| Mitsubishi | 5982 | 42.3% |

| Mazda | 5775 | 11.5% |

| Hyundai | 5289 | -13.5% |

| MG | 5031 | 60.4% |

| Volkswagen | 3199 | 9.9% |

| Isuzu Ute | 2865 | 21.1% |

| GWM | 2462 | 45.5% |

| Subaru | 2318 | -15.3% |

| Mercedes-Benz | 2051 | -17.5% |

| BMW | 1918 | 0.9% |

| Suzuki | 1522 | 36.1% |

| LDV | 1518 | 23.5% |

| Audi | 1283 | 16.4% |

| Nissan | 1247 | -63.3% |

| Honda | 1112 | 1.1% |

| Tesla | 1109 | No data from Oct 2021 |

| Volvo | 721 | 21.6% |

| Porsche | 692 | 187.1% |

| Renault | 667 | 20.0% |

| Ram | 657 | 107.3% |

| Lexus | 618 | -2.4% |

| Skoda | 613 | 35.3% |

| Land Rover | 482 | 43.0% |

| Jeep | 450 | -10.0% |

| SsangYong | 402 | 22.9% |

| Chevrolet | 260 | 37.6% |

| Cupra | 248 | No data from Oct 2021 |

| Polestar | 246 | No data from Oct 2021 |

| Peugeot | 182 | -26.0% |

| Mini | 154 | -20.2% |

| Genesis | 125 | 104.9% |

| Fiat | 115 | -55.3% |

| Jaguar | 50 | -21.9% |

| Maserati | 42 | -12.5% |

| Alfa Romeo | 37 | 12.1% |

| Citroen | 37 | 117.6% |

| Lamborghini | 33 | 266.7% |

| Ferrari | 31 | 158.3% |

| Aston Martin | 11 | 0.0% |

| McLaren | 11 | 37.5% |

| Bentley | 6 | -57.1% |

| Rolls-Royce | 3 | -25.0% |

Models

The top 20 model list included six medium SUVs, five light commercials (four utes and one van/bus), four light/small SUVs, three large/upper large SUVs, one light car and one small car.

- Ford Ranger: 5628

- Toyota HiLux: 4884

- Toyota RAV4: 3222

- Mazda CX-5: 2352

- MG ZS: 2293

- Isuzu D-Max: 1951

- Kia Sportage: 1877

- MG 3: 1823

- Mitsubishi ASX: 1734

- Mitsubishi Triton: 1679

- Hyundai Tucson: 1654

- Mitsubishi Outlander: 1619

- Toyota Prado: 1461

- Hyundai i30: 1441

- Ford Everest: 1271

- Toyota LandCruiser wagon: 1217

- Tesla Model Y: 1076

- Toyota Corolla Cross: 1025

- Toyota Yaris Cross: 1019

- Toyota HiAce: 977

Segments

- Micro Cars: Kia Picanto (424), Fiat 500 (11), Mitsubishi Mirage (1)

- Light Cars under $25,000: MG 3 (1823), Toyota Yaris (348), Suzuki Swift (294)

- Light Cars over $25,000: Mini Hatch (70), Audi A1 (33), Citroen C3 (1)

- Small Cars under $40,000: Hyundai i30 (1441), Toyota Corolla (904), Kia Cerato (788)

- Small Cars over $40,000: Mercedes-Benz A-Class (204), Audi A3 (183), BMW 1 Series (153)

- Medium Cars under $60,000: Toyota Camry (601), Mazda 6 (104), Hyundai Sonata (61)

- Medium Cars over $60,000: Mercedes-Benz C-Class (287), Polestar 2 (246), BMW 3 Series (192)

- Large Cars under $70,000: Kia Stinger (112), Citroen C5 X (34), Skoda Superb (29)

- Large Cars over $70,000: BMW 5 Series (37), Mercedes-Benz E-Class (29), Audi A6 (21)

- Upper Large Cars: Mercedes-Benz S-Class (8), BMW 8 Series Gran Coupe (6), Mercedes-Benz EQS (5)

- People Movers: Kia Carnival (757), Hyundai Staria (68), Volkswagen Multivan (60)

- Sports Cars under $80,000: Ford Mustang (135), Subaru BRZ (116), BMW 2 Series (50)

- Sports Cars over $80,000: BMW 4 Series (135), Mercedes-Benz C-Class (35), Chevrolet Corvette (12)

- Sports Cars over $200,000: Porsche 911 (53), Ferrari (31), Lamborghini (21)

- Light SUVs: Toyota Yaris Cross (1019), Mazda CX-3 (852), Suzuki Jimny (567)

- Small SUVs under $40,000: MG ZS (2293), Mitsubishi ASX (1734), Toyota Corolla Cross (1025)

- Small SUVs over $40,000: Audi Q3 (625), Volvo XC40 (373), Mercedes-Benz GLA (168)

- Medium SUVs under $60,000: Toyota RAV4 (3222), Mazda CX-5 (2352), Kia Sportage (1877)

- Medium SUVs over $60,000: Tesla Model Y (1076), BMW X3 (447), Porsche Macan (368)

- Large SUVs under $70,000: Toyota Prado (1461), Ford Everest (1271), Isuzu MU-X (914)

- Large SUVs over $70,000: Land Rover Defender (297), BMW X5 (247), Mercedes-Benz GLE (239)

- Upper Large SUVs under $100,000: Toyota LandCruiser Wagon (1217), Nissan Patrol (230)

- Upper Large SUVs over $100,000: Mercedes-Benz GLS (62), Audi Q8 (31), Range Rover (25)

- Light Vans: Volkswagen Caddy (31), Peugeot Partner (29), Renault Kangoo (6)

- Medium Vans: Toyota HiAce (781), LDV G10 (239), Ford Transit Custom (215)

- Large Vans: LDV Deliver 9 (255), Mercedes-Benz Sprinter (189), Volkswagen Crafter (165)

- Light Buses: Toyota HiAce (196), Toyota Coaster (50), LDV Deliver 9 (9)

- 4×2 Utes: Toyota HiLux (1392), Ford Ranger (481), Mitsubishi Triton (233)

- 4×4 Utes: Ford Ranger (5147), Toyota HiLux (3492), Isuzu D-Max (1834)

Miscellaneous

Sales by region

- New South Wales: 26,869, up 10.2 per cent

- Victoria: 23,283, up 24.5 per cent

- Queensland: 18,850, up 16.7 per cent

- Western Australia: 9050, up 22.5 per cent

- South Australia: 5564, up 12.4 per cent

- Tasmania: 1652, up 25.1 per cent

- Australian Capital Territory: 1305, up 17.3 per cent

- Northern Territory: 726, up 13.1 per cent

Category breakdown

- SUV: 48,463 sales, 55.5 per cent market share

- Light commercials: 21,447 sales, 24.6 per cent market share

- Passenger cars: 13,321 sales, 15.3 per cent market share

- Heavy commercials: 4068 sales, 4.7 per cent market share

Top segments by market share

- Medium SUV: 21.2 per cent

- 4×4 Utes: 19.1 per cent

- Small SUV: 14.8 per cent

- Large SUV: 12.8 per cent

- Small Car: 6.0 per cent

Sales by buyer type

- Private buyers: 47,005, up 27.5 per cent

- Business fleets: 29,373, up 8.2 per cent

- Rental fleets: 4982, up 15.3 per cent

- Government fleets: 1871, down 19.4 per cent

Sales by propulsion or fuel type

- Petrol: 45,099

- Diesel: 28,707

- Hybrid: 6860

- Electric: 2098

- PHEV: 464

- Hydrogen FCEV: 3

Sales by country of origin

- Japan: 24,504

- Thailand: 20,341

- Korea: 12,413

- China: 11,113

- Germany: 3600

Some previous monthly reports

- September 2022 Australian new vehicle sales (VFACTS)

- August 2022 Australian new vehicle sales (VFACTS)

- July 2022 Australian new vehicle sales (VFACTS)

- June 2022 Australian new vehicle sales (VFACTS)

- May 2022 Australian new vehicle sales (VFACTS)

- April 2022 Australian new vehicle sales (VFACTS)

- March 2022 Australian new vehicle sales (VFACTS)

- February 2022 Australian new vehicle sales (VFACTS)

- January 2022 Australian new vehicle sales (VFACTS)

- December 2021 Australian new vehicle sales (VFACTS)

Got any questions about car sales? Ask away in the comments and I’ll jump in!